Economic essence and main forms of mortgage lending. The essence of the concept and classification of mortgage lending

Mortgage (pledge of real estate as a means of ensuring the fulfillment of various civil obligations) traditionally serves in countries with a developed market economy as one of the most important factors in stabilizing civil turnover, an effective tool for maintaining financial and payment discipline at the proper level, and a reliable guarantor of the rights and legitimate interests of creditors.

Mortgage has two components in its content - economic and legal.

In economic terms, a mortgage is a market instrument for the turnover of property rights to real estate in cases where other forms of alienation (purchase and sale, exchange) are legally and commercially impractical, and allows you to attract additional financial resources for the implementation of various projects.

In legal terms, a mortgage is a pledge of real estate for the purpose of obtaining a mortgage loan, when the property remains in the hands of the debtor.

A mortgage loan is a loan (loan) granted for the purchase of real estate secured by this real estate as security for an obligation. The rights of claim on the loan can be certified and transferred through a mortgage - a registered security of a promissory note type.

Considering mortgage as an economic category, it must be emphasized that it consists of three terms and at the same time expresses:

Property relations;

Credit relations;

Financial relations.

Ownership relations are expressed in the transfer of title and property, but not the right to possession, until the end of payments on the debt or the implementation of obligations in case of refusal to pay. Mortgage stimulates the turnover and redistribution of real estate, ensuring the realization of property rights to objects, when other forms of alienation are inappropriate in these specific cases.

Credit relations are expressed in the provision of mortgage loans secured by real estate. Real estate pledge acts as a tool to attract the necessary financial resources for the development of production. At the same time, the features of mortgage loans are as follows:

1. Mandatory security.

2. The duration of the loan.

3. Target character.

4. A mortgage loan is a relatively low-risk banking operation.

5. Notarization and state registration.

Financial relations are expressed in the refinancing of mortgage loans, including also a mortgage that certifies the mortgagee's right to real estate and is a security with all its inherent features - the isolation of property rights, documentation and negotiability. Financial relations based on a security create a multi-level fictitious capital, so when the owner of a real estate object issues primary, secondary mortgages, derivative mortgage-backed securities, there is an increase in working capital or the amount of fictitious capital.

The system of mortgage lending is a system of relations regarding the formation of primary and secondary markets for mortgage loans and relationships with the real estate, insurance and mortgage securities markets that arise from the active interaction of entities operating in the mortgage market.

The system of mortgage lending should consist of the following segments:

A real estate market that has the necessary characteristics to participate in mortgage lending;

The primary market for mortgage loans, covering the entire set of activities of creditors and debtors entering into relevant obligations between themselves, in which the debtor (mortgagor) provides, and the creditor (mortgagor) accepts real estate as a pledge;

The secondary market for mortgage loans, which ensures the transfer of rights on mortgages and mortgage loans (the sale of already issued mortgage loans), as well as the reinvestment of already issued mortgage loans. The secondary market is a link between lenders in the primary mortgage market and investors in the mortgage securities market, ensuring the accumulation of investors' funds and directing financial flows into mortgage loans;

The mortgage-backed securities market, which ensures the transformation of personified rights under credit obligations and mortgage agreements (mortgage bonds) into impersonal income-generating securities (bonds), and their placement among long-term investors. In other words, in the mortgage-backed securities market, individuals and legal entities acquire, accumulate and place mortgage-backed securities offered by intermediaries in order to receive income on them;

The insurance market that provides risk insurance in the system of mortgage lending.

Participants of the mortgage credit relationship:

1. Borrowers - individuals who have entered into loan agreements with banks (credit organizations), under the terms of which the funds received in the form of a loan are used to purchase housing. The execution of such contracts is secured by the mortgage of the acquired housing. The maximum loan amount for each borrower is determined on the basis of an assessment of its solvency and the provided loan repayment security, as well as taking into account its reliability and the balance of debt on previously received loans;

2. Home sellers - individuals and legal entities selling real estate owned by them or owned by other individuals or legal entities and sold on their behalf, incl. construction organizations;

3. Lenders - the main creditors, of course, are banks, which can be specialized (mortgage) or universal. Other legal entities that provide targeted long-term loans to citizens for the purchase of housing can also act as creditors;

Table 1. Legal framework for banking regulation.

| Name | Content |

| Composition of the banking system | |

| Credit organisation | A legal entity that, in order to make a profit as the main goal of its activities, on the basis of a special permit (license) of the Central Bank of the Russian Federation, has the right to carry out banking operations provided for by the Federal Law “On Banks and Banking Activity”. A credit organization is formed on the basis of any form of ownership as a business entity |

| Bank | A credit institution that has the exclusive right to carry out the following banking operations in aggregate: attraction of funds from individuals and legal entities to deposits, placement of these funds on its own behalf and at its own expense on the terms of payment, repayment, urgency, opening and maintaining accounts of individuals and legal entities |

| Non-bank credit organization | A credit institution that has the right to carry out certain banking activities provided for by the Federal Law. Permissible combinations of banking operations for non-bank credit institutions are established by the Bank of Russia |

| foreign bank | A bank recognized as such under the laws of a foreign state in whose territory it is registered |

4. Operators of the secondary market of mortgage loans (agencies for housing mortgage lending) - specialized organizations that refinance creditors that issue long-term mortgage loans. Secondary market operators, in addition to refinancing lenders, issue equity mortgage-backed securities, raise funds from investors in the field of housing lending, and assist lenders in implementing a rational mortgage lending policy. If agencies redeem mortgages from creditors, their activities do not require a license from the Bank of Russia. If agencies will operate with mortgage claims, they must be licensed as a non-bank lending institution;

5. Bodies of state registration of rights to real estate and transactions with it, which register transactions for the purchase and sale of residential premises, formalize the transfer of ownership to a new owner, register mortgage agreements and mortgage rights, store and provide information on ownership rights and encumbrances of residential mortgages premises;

6. Insurance companies providing insurance of mortgaged housing, personal insurance of borrowers and civil liability insurance of mortgage market participants;

7. Appraisers - legal entities and individuals entitled to professional real estate appraisal, whose activities are regulated by the Federal Law "On Appraisal Activities in the Russian Federation". The activities of professional appraisers are licensed, and the license issuing authority must exercise control over the compliance of appraisers with the law.

In mortgage lending, in the event of a dispute over the value of the subject of mortgage, an assessment is mandatory.

Appraisal activity is one of the few types of activity for which compulsory insurance of civil liability of appraisers is provided. In particular, the appraiser is not entitled to engage in appraisal activities without concluding an insurance contract. The insured event will be the infliction of losses to third parties in connection with the implementation by the appraiser of his activities, established by the decision of the arbitration or arbitral tribunal that has entered into legal force.

8. Real estate company - a professional intermediary in the real estate market, providing services for finding objects, drawing up contracts and preparing a package of documents necessary for submission to the bank. Real estate activity is licensed. In particular, it is mentioned in the Law on Licensing Certain Types of Activities. In addition to state bodies exercising control over the activities of real estate firms, it is also exercised by public organizations. Among them is the Russian Guild of Realtors.

Real estate, acting as a commodity of a special kind, has a certain monetary value. Usually this assessment is formed spontaneously, under the influence of subjective factors (primarily under the influence of supply and demand). At the same time, when evaluating any real estate, there are certain objective factors that the parties must take into account when concluding a specific contract.

A number of professional participants work on the mortgage market. At the same time, only highly qualified specialists, using modern concepts of financial management, production activities and enterprise resources, can successfully adapt advanced management techniques to the existing economic conditions. World experience shows that an essential backbone element of mortgage lending is the activity of credit institutions, in particular commercial banks, which are one of the most important subjects of the mortgage lending market.

More on the topic 1.1. The concept and essence of mortgages and mortgage loans:

- The concept and characteristic features of writ proceedings; grounds for issuing a court order; the concept and essence of a court order; stages of order production

- The concept and essence of enforcement proceedings; participants in enforcement proceedings; general rules of enforcement proceedings; the procedure for carrying out enforcement proceedings; protection of the rights of the recoverer, debtor and other persons in the performance of enforcement actions

- CHAPTER 1. THE CONCEPT AND ESSENCE OF THE LEGAL MECHANISM OF INCREASING THE EFFICIENCY OF ACTIVITIES OF THE MEMBERS OF THE MANAGEMENT BODIES OF ECONOMIC COMPANIES.

- § 1. The concept and essence of the means and methods of protecting private law

- THE CONCEPT AND ESSENCE OF "PENETRATING RESPONSIBILITY" IN LEGAL ORDERS OF THE CONTINENTAL EUROPEAN AND ANGLO-AMERICAN TYPE

- THE CONCEPT AND ESSENCE OF "PENETRATING LIABILITY" IN RUSSIAN CORPORATE LAW

- § 1. The concept and essence of justice in criminal proceedings

- § 1.1 The concept and essence of information support for passport and visa activities of the Ministry of Internal Affairs of Russia in the field of migration

- Copyright - Advocacy - Administrative law - Administrative process - Antimonopoly and competition law - Arbitration (economic) process - Audit - Banking system - Banking law - Business - Accounting - Property law - State law and management - Civil law and procedure - Monetary circulation, finance and credit - Money - Diplomatic and consular law -

But lending is impossible without serious security of the interests of the creditor. The evolution of credit development has shown that best interests of the creditor can be secured through the use of real estate collateral, because the:

- real estate is relatively little at risk of destruction or sudden disappearance;

- the value of real estate tends to constantly increase;

- the high cost of real estate and the risk of its loss are a powerful incentive that encourages the debtor to fulfill its obligations to the creditor accurately and in a timely manner.

One of the tools to protect the interests of creditors through the use of real estate pledge was a mortgage.

Mortgage - concept and essence

The term "mortgage" in legal circulation usually covers two concepts:

Mortgage as a legal relationship is a pledge of real estate (land, fixed assets, buildings, housing) in order to obtain a loan.

Mortgage as a security- implies: a debt instrument certifying the rights of the pledgee to real estate.

Mortgage credit lending- this is lending secured by real estate, that is, lending using a mortgage as a security for the repayment of credit funds.

If the loan is not repaid, the creditor becomes the owner of the property. Thus, a mortgage is a special form of collateral for a loan.

Features of mortgage lending:- a mortgage is a pledge of property;

- long-term nature of the mortgage loan (20 - 30 years);

- the pledged property for the period of the mortgage remains, as a rule, with the debtor;

- Only property that belongs to the pledgor on the right of ownership or on the right of economic management can be pledged;

- the legal basis for mortgage lending is the pledge right, on the basis of which a mortgage agreement is drawn up and the sale of property transferred to the creditor is carried out;

- the development of mortgage lending presupposes the existence of a developed institution for its assessment;

- Mortgage lending is carried out, as a rule, by specialized mortgage banks.

- Pledgor - physical. or a legal entity that provided real estate as collateral to secure its debt.

- A mortgagee (mortgage lender) is a legal entity that issues loans secured by real estate.

Legal basis for mortgage lending in Russia:

- Federal Law of the Russian Federation "On Mortgage (Pledge of Real Estate)" dated July 16, 1998;

- Federal Law of the Russian Federation "On valuation activities in the Russian Federation" dated 29.07.98.

The mortgage is subject to state registration by the institutions of justice in the Unified State Register of Rights to Real Estate.

Mortgages and banks

Mortgage banks - specialized banks providing long-term lending secured by real estate.

Advantages of mortgage lending for banks:

- relatively low risk when issuing loans, as they are secured by real estate;

- long-term lending frees banks from private negotiations with customers;

- mortgage loans provide the bank with a quite stable clientele;

- mortgages can be actively traded in the secondary market, which allows the bank to diversify its risk by selling the mortgage after the loan is issued.

Disadvantages of mortgage lending for banks:

- the need to keep narrow professional specialists in the staff - appraisers of real estate, which is presented as collateral, which increases the costs of the bank;

- long-term diversion of funds;

- a long term for which a loan is granted is a big threat to the bank's future profits, since it is very difficult to predict the dynamics of market interest rates for decades to come.

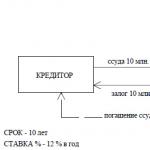

Mortgage lending mechanism

A mortgage is a loan secured by real estate.

The main documents for obtaining a loan that determine the relationship between the lender and the borrower are a loan agreement and a pledge agreement.

Loan agreement determines the purpose of obtaining a loan, the term and size of the loan, the procedure for issuing and repaying a loan, lending instruments (interest rate, conditions and frequency of its change), loan insurance conditions, method and form of checking the security and intended use of the loan, sanctions for misuse and untimely repayment loans, the amount and procedure for paying fines, the procedure for terminating the contract, additional conditions by agreement of the lender and the borrower.

Mortgage agreement determines the form, size and procedure for collateral for the loan.

Mortgage deposit

The development of mortgages presupposes the existence of specific types of securities—mortgages and mortgage bonds.

Mortgage— this is a legal document on the pledge (pledge) of a real estate object, which certifies the return of the object to secure obligations under a loan.

The object of collateral is real estate that serves as collateral for the obligations of the borrower. The object of lending is a specific goal. for which the loan is provided.

Thus, various combinations of the collateral object and the lending object are possible. For example: a loan for the construction of housing secured by a land plot.

Mortgage lending mechanism differs significantly from the mechanism of formation of credit resources in a commercial bank. In developed countries, the bank generates funds for granting a loan, mainly by selling bonds and own capital.

Mortgage sheets - these are long-term collateral obligations of the bank, providing reliable (or aggregate) mortgage loans, on which a fixed interest is paid.

Mortgage bonds are sold by mortgage banks in the secondary market to investors - other credit institutions (in some countries - to any investor).

The secondary market is the process of buying and selling mortgage securities issued in the primary market. To provide primary lenders with the opportunity to sell the primary mortgage, and to provide another loan on the income received in the same market - this is the main task of mortgage capital.

Investments in mortgage bonds are considered a reliable investment of capital, because, in addition to a stable interest income, the investor is guaranteed against risk by mortgage. Of course, the market value of the pledged property may fall over time, but here banks can offer various hedging options (risk reduction) when realizing mortgages.

Having sold mortgages, the lender uses the proceeds to provide new mortgage loans.

Mortgage loan repayment associated with the term and interest on realizable mortgages. If the validity of mortgages is 10 years, and the fixed interest rate is 6.5%, then the loan must be issued at a rate of at least 7% per annum to cover the costs of issuing mortgages and paying interest to investors. A change in the % rate, depending on market conditions, will occur after 10 years, if the mortgage term is longer. Repayment is carried out with installment payment, the interval (month, quarter, six months, annually) is established by the loan agreement.

Mortgage Loan Scheme

The role of mortgages in the economy

Mortgage lending is an essential element. Reflecting the patterns of development of the global banking industry, it is one of the priority development tools.

Mortgages and crises

World experience shows that mortgage lending has contributed to revival, recovery, overcoming unemployment and, ultimately, out of the crisis United States of America - in the 30s, Canada and Germany - in the 40s-50s, Argentina and Chile - in the 70s-80s, as well as the acceleration of economic reforms in a number of countries. Certain hopes are placed on mortgages as a tool for solving the housing problem in Russia as well.

Mortgage and the real sector of the economy

The development of the mortgage business has a positive impact on the functioning of industry, construction, agriculture, etc. As world practice shows, the spread of mortgage lending as effective way to finance capital investments can contribute to overcoming the investment crisis.

Mortgage and banking system

Mortgage lending is of great importance directly for development of the banking system countries. Mortgage is the most important instrument that ensures the repayment of the loan. A mortgage lending institution operating within the framework of the mortgage lending system is a relatively stable and profitable economic entity. Therefore, the more such credit institutions in the banking system, the more stable and efficient its activity in the economic system of the country as a whole.

Mortgage and social welfare

Mortgage lending, diverting funds from the current turnover into internal savings, to some extent contributes to the reductioninflation.

In modern conditions, the importance of mortgages for. Housing mortgage lending contributes to the provision of citizens with affordable private residential property, being a powerful factor in the class of society.

The relevance of a housing mortgage loan is due to the fact that its use allows you to resolve contradictions:

- between high real estate prices and current incomes of the population;

- between the savings of money in one group of economic entities and the need to use them in another.

The absence in our country for 70 years of the institution for real estate and the institution of mortgage has led to negative consequences - the experience of organizing mortgage lending has been largely lost both at the level of a credit institution and at the level of the state as a whole.

If earlier the only way to improve living conditions was to obtain public housing, today this problem is mainly solved by citizens through the purchase or construction of housing at the expense of their own savings. The limited budgetary resources have focused the state's attention on solving the housing problems of only certain groups of the population. However, most of them are currently unable to improve their living conditions due to lack of necessary savings.

Creation of a mortgage lending system will make the purchase of housing affordable for the main part of the population; will ensure the relationship between the monetary resources of the population, banks, financial, construction companies and construction industry enterprises, directing financial resources to the real sector of the economy.

Mortgage lending infrastructure

The effective functioning of the system of mortgage lending institutions is impossible without the availability of appropriate supporting elements (infrastructure). The specificity of mortgage lending is its closest connection with the valuation, insurance and registration of the turnover of real estate, as well as with the secondary mortgage market. In this regard, the functioning of the system of mortgage institutions is impossible without the presence in the country of:

- real estate turnover registration systems;

- insurance organizations (companies);

- organizations professionally engaged in real estate valuation.

The developed infrastructure of the mortgage lending system ensures the efficiency of mortgage operations, increasing the protection of the rights of mortgage lending entities.

The word mortgage is of Greek origin. For the first time it was used in the legislation of Solon (7th century BC), according to which a pillar burst into the land of the debtor so that everyone knew that this land served as a security for the rights of the creditor. According to historical evidence, the mortgaging of land and the sale of land allotments began to be widely practiced in Egypt during the first millennium BC.

There are two types of mortgages. In the narrow sense of the word "mortgage" is a pledge of immovable property, and in the broad sense it is one of the forms of property security of the debtor's obligation, in which the immovable property remains in the ownership of the latter, and the creditor, in the event that the debtor fails to fulfill his obligation, acquires the right to receive satisfaction at the expense of sale of this property. Accordingly, a mortgage loan is a loan secured by a pledge of real estate. The salient features of mortgages are as follows.

Firstly, a mortgage, like any pledge, is a way to ensure the proper performance of another (main) obligation - a loan or credit agreement, a lease agreement, a contract, compensation for damage, etc. Therefore, the mortgage depends on this basic obligation, since without this dependence it loses its meaning.

Secondly, the subject of mortgage is always real estate. Real estate includes land plots and everything that is firmly connected with them - enterprises, residential buildings, other buildings and structures.

Thirdly, the subject of mortgage remains in the possession of the debtor. The latter remains the owner, user and actual owner of this property.

Fourthly, the agreement between the creditor and the debtor on the establishment of a mortgage is drawn up in a special document - a mortgage bond, which is subject to notarization and state registration. Mortgage - a registered security that certifies the following rights of its owner: the right to receive performance on a monetary obligation secured by a mortgage, without presenting other evidence of the existence of this obligation; the right to pledge property encumbered with a mortgage. Under certain conditions, a mortgage bond may acquire the properties of a security that can pass from one owner to another and be sufficiently “torn off” from the original claim.

Finally, in case of non-performance of an obligation secured by a mortgage, the creditor has the right to demand the sale of the pledged property at public auction. When selling property pledged under a mortgage agreement, the mortgage lender has advantages over other creditors in the amount specified in the mortgage.

A mortgage loan is a special type of economic relations regarding the provision of long-term loans secured by real estate. Participants in a credit transaction may be a creditor bank, a borrower, a seller of property in a financial transaction of sale and purchase, and the owner of a mortgage on property, if any.

There are four main actors in the mortgage market: the borrower, the lender, the investor, and the government.

Mortgage lenders are mortgage banks or special mortgage companies, associations, credit companies, as well as ordinary commercial banks specializing in providing long-term loans secured by real estate. Credit resources of mortgage lending institutions can be deposits (deposits) of clients, issue and sale of mortgage bonds, resale of mortgage certificates, etc.

Borrowers are individuals and legal entities that own the object of mortgage. The features of the pledge are, firstly, that the borrower has property, and secondly, so that this property brings income to its owner, and thirdly, it is in demand in the market. When pledging immovable property, the debtor nominally retains his right of ownership.

Lenders - banks (credit organizations) and other legal entities that provide mortgage loans to borrowers in the manner prescribed by law.

Investors - legal entities and individuals who purchase mortgage-backed securities imitated by lenders or secondary market operators. These include investment funds, insurance companies, mutual funds.

The government creates conditions for the reliable functioning of the mortgage lending system, supervises the activities of creditors, and assists certain groups of the population in purchasing housing.

There are also many minor participants in the mortgage market, such as home sellers, operators of the secondary mortgage market (housing mortgage lending agencies), state registration authorities for real estate rights and transactions with it, insurance companies, appraisers, real estate firms.

Home sellers are individuals and legal entities that sell residential premises owned by them or owned by other individuals or legal entities. Secondary market operators are specialized organizations that refinance loans.

Insurance companies carry out property insurance (insurance of mortgaged housing), personal insurance of borrowers and civil liability insurance of mortgage market participants.

Appraisers - legal entities and individuals who have the right to carry out a professional assessment of residential premises that are the subject of collateral for mortgage lending.

Real estate firms are legal entities, professional intermediaries in the real estate market.

Infrastructural links of the mortgage lending system - notaries, passport services, guardianship and guardianship authorities, legal advice, etc.

Mortgage lending is lending secured by real estate, that is, lending using a mortgage as a security for the repayment of loan funds.

When considering a mortgage as an element of the economic system, it is necessary to highlight its three most characteristic features:

- 1. Pledge of real estate acts as a tool to attract the necessary financial resources for the development of production.

- 2. A mortgage is able to ensure the realization of property rights to objects when other forms (for example, purchase and sale) are inappropriate under these specific conditions.

- 3. Creation of fictitious capital on the basis of a security with the help of a mortgage (when the owner of a real estate object issues primary, secondary, etc. mortgages, working capital increases by the amount of fictitious capital formed).

In economic terms, a mortgage is a market instrument for the turnover of property rights to real estate in cases where other forms of alienation (purchase and sale, exchange) are legally or commercially impractical, and allows you to attract additional financial resources for the implementation of various projects.

It is especially necessary to highlight the functions of mortgage lending and the features of this kind of loan, which give it an advantage over other methods of lending.

The functions performed by mortgage lending can be formulated as follows:

the function of the financial mechanism for attracting investments in the sphere of material production;

the function of ensuring the return of borrowed funds;

the function of stimulating the turnover and redistribution of real estate, when other methods (purchase and sale, etc.) are not economically feasible or legally impossible;

the function of forming a multi-level fictitious capital in the form of mortgages, derivatives of mortgage-backed securities, etc.

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Hosted at http://www.allbest.ru/

Introduction

Under mortgage lending In global practice, a system is understood that includes loans issued against the security of real estate (mortgage), registration of pledge in the state register of real estate rights, as well as elements of refinancing of creditors who issued mortgage loans. As a result of the mass application of the mechanism of mortgage lending in economically developed countries, a market for mortgage loans is emerging.

Under the mortgage market refers to a market where only debt securities are circulated with mortgage guarantees provided to facilitate the refinancing of secured loans.

Before the transition to market relations, the main sources of replenishment of the housing stock of the Russian Federation were state housing construction and housing construction by enterprises and organizations, while cooperative and individual housing construction played a supporting role. However, in the early 1990s there has been a sharp curtailment of the pace of housing construction by the state, enterprises and organizations, which led to the almost complete disappearance of any support for the population in the housing sector. In addition, as a result of the financial crises in Russia, the income differentiation of the population has greatly increased. For these reasons, one of the social problems today is providing the population with housing. In Russia, housing is an expensive object and the purchase of this product with a one-time income (wage) for many Russians is almost impossible.

Creating conditions for long-term mortgage lending is an attractive alternative for the population, since it allows you to get housing for use at the initial stage.

In addition, mortgages contain a huge potential for the economic development of the credit system. It allows real estate to turn into working capital, enabling lenders to receive a guaranteed income, and for the population to finance the purchase of housing.

Mortgage lending is one of the world's most proven and reliable ways to attract private investment in the housing sector. In foreign practice, mortgage lending brings banks a stable income with relatively low risks, allowing the most beneficial combination of the interests of the population in improving housing conditions, commercial banks and other lenders - in efficient and profitable work, the construction industry - in the rhythmic loading of production and, of course, the state interested in overall economic growth.

Thus, we can conclude that the problem of developing the mortgage lending system in Russia is relevant in socio-economic terms.

The purpose of this course work is to identify the concept and functions of mortgages, analyze the state of mortgage lending in the Russian Federation at the present time, highlight the most significant problems and development prospects in the functioning of mortgage lending in the Russian Federation.

To achieve this goal, it is necessary to perform the following tasks:

1. Expand the concept and essence of mortgage lending.

2. Consider the main instruments of mortgage lending.

3. Conduct an analysis of the development of the mortgage lending market, analyze the current state of the mortgage market.

4. Consider the problems and prospects for the development of mortgages in the Russian Federation.

The object of study of this course work is mortgage lending in the Russian Federation.

The subject of the study is the organizational and economic relations that arise in the process of mortgage lending and the mechanisms for their implementation in the financial market.

The information and methodological basis of the study was the provisions and conclusions made in the works of leading domestic and foreign experts in the field of the housing market and mortgage lending.

In the process of work, general scientific methods were used: species classification, comparisons, a systematic approach, historical, economic and mathematical modeling and statistical analysis. The totality of the methodological base used made it possible to ultimately ensure the reliability and validity of the conclusions and practical solutions.

This work consists of three chapters. The first chapter deals with the theoretical aspects of the existence of credit. The second chapter is devoted to the consideration of a mortgage loan in the Russian Federation and mortgage development trends. In the third chapter, the most significant problems in the functioning of mortgage lending will be identified and forecasts and prospects for the development of mortgages in the Russian Federation will be considered.

1. Theoretical foundations for the existence of credit

economic mortgage loan

A loan is an economic relationship that arises between a lender and borrowers regarding the loaned value, transferred for temporary use on terms of urgency, payment and repayment.

Credit can act in commodity and monetary forms. In commodity form, it involves the transfer for temporary use of value in the form of a specific thing, defined by generic characteristics. In cash, credit is granted and repaid in the form of money. In a credit transaction there is no equivalent commodity-money exchange, but there is a transfer of value for temporary use with the condition of return after a certain time and payment of interest for the use of this value. The repayment of the loaned value, which cannot be canceled by the will of one of the subjects of the credit transaction, is an integral feature of the loan as an economic category.

Credit as a special form of value relations arises when the value released from one economic entity cannot for some time enter a new reproduction cycle and be used in business transactions. Thanks to the loan, this value is transferred to another entity experiencing a temporary need for additional funds, and thus continues to function within the reproduction process.

Credit represents the movement of the loan fund through the banking system and special financial and credit institutions. Banks accumulate free funds of enterprises and the population and transfer them on the basis of security, repayment, payment and urgency to enterprises that need them.

Unlike finance, which expresses a unilateral and gratuitous movement of value, a loan must be returned to the lender within a specified period with the payment of predetermined interest on it.

There is another point of view on the definition of credit as an economic category: credit is the movement of loan capital. Loan capital is money capital provided on loan by the owner on a repayment basis for a fee in the form of interest. This is a special historical form of capital. Its qualitative difference from money capital is that loan capital is one of the forms of self-increasing value, while money itself does not give growth.

Loan capital resources are:

Cash reserves (temporarily free cash) released in the process of circulation of enterprise funds;

Cash reserves in the form of special funds (amortization fund);

State cash reserves;

Monetary resources of the population;

Issue of banknotes in accordance with the needs of trade.

The possibility of the emergence and development of credit is associated with the circulation and circulation of capital. In the process of movement of fixed and circulating capital, there is a release of resources or money capital, released in the process of circulation of industrial and commercial capital.

The emergence of temporarily free funds is an objective necessity. But temporarily free funds come into conflict with the need for efficient use of funds in a market economy. This contradiction is resolved by means of a loan, i.e. temporarily released money capital is transferred to a loan. The possibility of resolving this contradiction is due to the fact that at the other pole there is a need for means of labor and fairly large one-time investments. Some subjects have a temporary excess of funds, while others feel their shortage.

In order for the possibility of a loan to become a reality, certain conditions are necessary:

Participants in a credit transaction should act as entities materially guaranteeing the fulfillment of obligations arising from their economic ties;

A loan becomes necessary and possible if the interests of the lender and the borrower coincide.

Thus, the need for a loan is caused by:

The need to overcome the contradictions between the constant formation of reserves in individual economic entities and their effective use for the needs of reproduction;

In the conditions of macroeconomics - the need to ensure the continuity of the circulation of capital in the conditions of the functioning of industries with different durations of the circulation;

The need to create a means of circulation and develop payments based on the credit nature of the issue of signs and non-cash funds (what money is in your pocket);

The need to manage firms on a commercial basis, in the course of which there is either a temporary need for additional resources, or, conversely, temporarily frees up cash resources.

Also, an element of the structure of credit relations is the object of transfer - something that is transferred from the lender to the borrower and that makes its way back from the borrower to the lender.

The object of transfer is the loaned value as a special part of the value. First of all, it represents a kind of unrealized value. It has specific features that characterize it as an object of credit relations.

The returnable nature of the movement of the loaned value presupposes its preservation at all stages of this movement. Indeed, the credit relation, being a value one, necessitates the observance of equivalence in the relationship between the lender and the borrower. This means that, having used the loan in its reproduction process, the borrower must return to the lender a value equivalent to that received on credit.

1 .2 Forms and types of credit

Forms of credit are varieties of credit arising from the essence of credit relations.

Classification of a loan is carried out according to such basic features as the nature of the loaned value, the categories of lenders and borrowers, the form of provision, and the directions of borrowers' needs.

By the nature of the loaned value:

1) The commodity form of credit historically precedes the monetary form. In this form of credit, goods are loaned. Goods become the property of the borrower only after repayment of the loan and payment of interest.

2) Monetary form of credit - the classic form of credit, which means that temporarily free cash is provided on loan. This form of credit is used by both the state and individuals both within the country and in foreign economic turnover.

3) Mixed (commodity-money) form of credit. In this case, the loan is provided in the form of goods, and returned in cash or vice versa.

According to the status of the lender and the borrower:

1) Bank loan - provided exclusively by financial and credit institutions licensed by the Central Bank of the Russian Federation to conduct such types of operations.

2) Commercial loan - the lender is not a credit institution, but a loan is provided in the course of a trade transaction, therefore it is also called a trade. The main purpose of this form - acceleration of the process of selling goods and, consequently, extracting the profit embedded in them.

3) State credit is provided at the expense of budgetary funds.

4) International credit - a set of credit relations operating at the international level, the direct participants of which are the state and international financial institutions.

5) Civil form of credit - is implemented by issuing loans to individuals, as well as business entities that do not have an appropriate license from the central bank.

According to the target needs of the borrower:

1) Production form of credit - provided for entrepreneurial purposes: expansion of production volume, works, services, assets. Production credit directly affects the increase in the supply of goods, works, services, assets, factors of production, and the increase in the standard of living of the population.

2) consumer credit- a feature is the relationship of both monetary and commodity capital, and individuals are potential borrowers.

Unlike the production form, this credit is used by the population for the purpose of consumption; it is not aimed at creating new value.

For other types of loans:

1) The direct form of credit reflects the direct issuance of a loan to a specific user without intermediaries.

2) An indirect form of credit involves taking a loan for lending to other entities. It is usually used when lending for the purchase of agricultural products.

3) An explicit form of credit means a loan with a predetermined purpose.

4) Developed and undeveloped forms of credit characterize the degree of its development. Lombard credit can be attributed to an undeveloped form of credit.

Having considered the forms of credit, it is possible to analyze their types according to some criteria (table 1).

Table 1 - Types of credit

|

signs |

||

|

By groups of borrowers |

Business entities Loans to individuals For financial and credit organizations To public authorities |

|

|

Purpose |

Consumer Industrial Trade Agricultural Investment |

|

|

By area of operation |

For the reproduction and expansion of fixed assets Credits of participants in the organization of revolving funds |

|

|

By period of use |

Short long term Poste restante |

|

|

Security |

Secured Unsecured |

|

|

By way of issuance |

Compensatory loans Payment loans |

|

|

By repayment method |

One-time In parts |

Consider some of the types of loans.

Secured loans - a form of commodity credit, which consists in the fact that the goods purchased by the borrower remain the property of the creditor - the seller of the goods until the goods are fully paid. A secured loan provides for the payment of the cost of goods and interest on the loan in installments. The product is collateral for the loan.

An investment loan is one of the types of bank loans for legal entities aimed at modernizing an enterprise and production processes.

The need for an investment loan is experienced by manufacturing companies, individual entrepreneurs, trading firms - in a word, everyone who needs to equip a new production facility or modernize an existing one.

A back-to-back loan is a financial concept that has two main meanings:

1) mutual credit provided to each other by firms of different countries in their national currency for equivalent amounts;

2) a loan provided by one company to another company (both companies in different countries), often lending is made in different currencies, using a bank or other financial institution as an intermediary in providing a loan (in normal practice, funds in this case come from a third party) .

A one-time consumer loan is a type of universal consumer loan. Like a loan for urgent needs, this type of loan can be provided to almost any capable citizen, but within the amount established by the bank, calculated on the basis of an assessment of the borrower's solvency.

Long-term type of loan and its features:

A long repayment period makes it possible to return a large amount in small installments;

Enterprises have the opportunity to repay their debts with money that they have earned as a result of buying new equipment or expanding production at the expense of credit money.

High interest on loans. With a long-term loan, a large amount overpays, which may be equal to the amount of the loan;

This loan is a long process.

Long-term lending for citizens, that is, individuals is a mortgage.

2. Mortgage loan and its application in modern conditions of Russia

2.1 The concept and essence of mortgage lending

The term "mortgage" is used in the following cases:

1) when talking about the pledge of immovable property owned by the pledgor (for example, land plots, buildings and structures), in order to obtain a mortgage loan;

2) when an interested person receives funds from a credit institution for the further acquisition of a real estate object (apartment). At the same time, the loan is targeted, which is significant in terms of further legal regulation of emerging legal relations, and the specified property is pledged to a credit institution.

Common in both cases is a pledge of real estate (land plots, enterprises, buildings, structures, apartments, etc.) to receive funds (loans, credit).

Thus, a mortgage is a type of pledge in which the pledged property (they are real estate objects, as a rule, this is land and buildings on it) remains in the possession of the mortgagor until the maturity date.

In the first case, this formal legal definition implies the following: you enter into a mortgage lending agreement with the bank of your choice, and on the basis of this agreement, he gives you the money you need to buy an apartment (or other real estate).

The second form of collateral for mortgage lending is when, under the same agreement, you pledge not a new, purchased apartment, but an old one that you already owned before concluding a loan agreement.

For the use of the issued loan, you pay the bank the interest specified in the loan agreement and return the borrowed funds in the form of monthly payments to the bank, also established by the loan agreement. Real estate, for example, an apartment purchased on credit, remains pledged (mortgage) with the bank until the loan is fully repaid, although formally you will be the owner of the housing.

However, if your financial situation changes, which, for example, will make it impossible for you to fulfill your loan obligations, the bank will sell the apartment and return its money.

This right is provided for in Art. 334 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), according to which the bank that issued the loan, as a creditor under a secured obligation, has the right, if the debtor fails to fulfill this obligation, to receive satisfaction from the value of the pledged property preferentially over other creditors of this person.

Since as a result of registration of a mortgage, new legal relations arise, it is necessary to pay attention to a number of legal issues. This must be done before signing the relevant agreement with the bank in order to be aware of all the possible consequences of certain actions.

Pledge is - a way to secure an obligation (along with a penalty, a surety, a bank guarantee and a deposit, which are not discussed in this case) [Civil Code of the Russian Federation], i.e. a mortgage as a collateral option can be established to secure the main obligation:

1) under a loan agreement;

2) under a loan agreement;

3) another obligation, including one based on the sale, lease, contract, other contract, causing harm, unless otherwise provided by federal law.

Land plots, with the exception of land plots that are state or municipal property, as well as land plots, the size of which is less than the minimum size established by the regulations of the constituent entities of the Russian Federation or local governments for land of one or another designated purpose and permitted use;

Enterprises, buildings, structures and other real estate used in business activities;

Residential houses, apartments, isolated parts of residential buildings and apartments;

Dachas, garden houses, garages and other consumer buildings;

Air and sea vessels, inland navigation vessels and space objects.

Under an agreement on pledge of real estate (mortgage agreement), one party - the pledgee, who is a creditor under an obligation secured by a mortgage, has the right to receive satisfaction of his monetary claims against the debtor under this obligation from the value of the pledged real estate of the other party - the pledgor, predominantly over other creditors of the pledgor .

The mortgage agreement may be independent (i.e., separate from the agreement under which the secured obligation arises) or conditions on the pledge may be included in the agreement under which the secured obligation arises (for example, a provision on ensuring the timely repayment of a home loan housing mortgage).

The essential terms of the mortgage agreement are:

1. The Subject of the Agreement;

2) its evaluation;

3) secured obligation;

4) the amount and term of fulfillment of the obligation.

Mortgage promotes the sale of built houses, while the growth of construction causes a revival in the production of building materials and structures, construction and road engineering, woodworking and furniture production, etc. Industrial mortgage lending makes it possible to modernize production, which leads to an increase in the quality and competitiveness of products - all this leads to an increase in the economic potential of the country.

The development of mortgage lending has a positive impact on overcoming social instability.

Mortgage affects the problem of employment (additional jobs in construction and other industries) and helps to meet the population's need for housing.

Mortgage is also of great importance for increasing the stability and efficiency of the country's banking system. Real estate-backed loans are safer for banks, since if the loan is not repaid, the bank will sell the collateral and return its funds. Of course, in the case of mortgages, this requires a proper assessment of real estate, as well as a developed real estate market. The target nature of loans also contributes to the reduction of risk in mortgage lending. Real estate transactions are often less risky than the current lending operations of commercial banks.

Thus, a mortgage loan is a loan secured by certain real estate, and mortgage lending is a loan secured by real estate. Mortgage lending is a promising area of banking activity.

2.2 Mortgage lending instruments

In mortgage lending, a significant role is played by the choice of financial instruments and technologies used at various stages of the financial process. Their choice is determined by the general economic situation, the development of mortgage operations in the country, the financial capabilities and desires of the participants in the transactions, as well as the type of operation.

The correct choice and application of mortgage lending instruments largely determine the effectiveness of mortgage operations, risk reduction, increased availability of mortgage loans, and their liquidity.

Mortgage lending instrument is a way to repay debt (loan amortization). The amortization schedule shows the balances of the debt on the loan in each period of time. It also reflects the part of the payment that goes to the payment of interest, and what part - to pay the principal amount of the debt.

Depending on the method of amortization, mortgage loans are divided into permanent mortgage loans and mortgages with variable payments. The latter, in turn, is divided into balloon payment mortgages, fixed payment mortgages, and incremental payment mortgages. There are also alternative mortgage lending instruments.

Permanent mortgage payments provide periodic equal payments. The borrower pays an equal amount every month, part of which goes to repay the loan and part - to pay the interest accrued for the month. Interest is charged on the balance of the outstanding loan amount.

Accordingly, this loan repayment procedure gives stability to the borrower in the amount of his expenses on this loan.

In addition, since there is no gradual repayment of the principal, the risk of non-repayment of the issued loan at the end of the loan period increases.

Mortgage loans with a "ball" payment can be structured as follows:

Failure to make interest payments until the expiration of the loan;

Payments of only interest, and then - a "ball" payment;

Partial depreciation with a final "ball" payment.

Some mortgages have equal payments of principal and interest on the outstanding balance. Interest amounts are subject to change. The monthly fixed payment of the borrower will decrease, which reduces the burden on him. The total amount of interest paid will be less than with constant payments.

Mortgages with incremental payments (hereinafter referred to as IIP) provide for variable payments. During, for example, the first three years, payments on them remain low, but over the next years they reach a level that allows full amortization of the loan.

In the early years, the IIR gives negative amortization (mortgage constant below the interest rate). In this case, the balance of the principal amount of the debt increases. For full amortization, payments on the IIR of recent years must exceed the level of payments on a standard mortgage. Lending instruments of this kind make it possible to take into account changing lending conditions, reduce interest rate risk and liquidity risk, and ensure the efficiency of long-term lending operations.

Payments with indexation of the outstanding amount of the debt allow repaying the loan in equal payments in real amounts when the nominal payments change. The outstanding debt is adjusted based on a selected index such as: consumer prices; US dollar exchange rate; the cost of the consumer basket; the minimum wage (abbreviated minimum wage); and other financial indices reflecting inflation dynamics. As a result, the interest rate will reflect the real price of the loan at the time of issuance. Payments are calculated based on the true value of the outstanding amount of the debt.

The capitalization of unreceived amounts of payments on the loan at the initial stage of repayment of the loan provides banks with a higher yield on housing loans compared to other lending operations. Reducing the amount of payments at the initial stage of loan repayment increases the availability of credit. At the same time, an increase in payments in nominal terms increases the risk of a “payment shock”, which occurs if the growth rate of household incomes lags significantly behind the inflation rate, which increases the risk of default on previously granted loans.

3. Problems and prospects of mortgage lending in Russia at the present stage

In the Russian Federation, mortgage lending has been developing at a rapid pace over the past ten years.

Today in the Russian Federation there is a formed demand among the population for mortgage lending, an established legislative framework and an infrastructural basis. The cost of liquid real estate in Russia, according to experts, is about 500 billion dollars, which, with a sufficient level of mortgage lending, will provide housing for a significant part of the population with a demand for real estate.

Consider the benefits of mortgage housing lending. The borrower in a short time acquires an apartment, paid with a long-term installment plan, and has income tax benefits. So it is possible to solve the housing problem of a large group of the population. However, in practice, not everything is as smooth as in theory. The borrower incurs significant costs and actually pays double the price for the apartment, also at the moment in the Russian Federation, interest rates are quite high. Instability in wages increases the risks that arise when applying for a mortgage loan. According to statistics, housing mortgages are available to those citizens whose monthly income is 40-50 thousand rubles. To date, mortgages are not available for 70% of the population of the Russian Federation.

It is necessary to use the experience of foreign countries and understand that mortgages are a solution to both economic and social problems. Banks have a desire to engage in mortgage lending, and have knowledge of technology, but there is clearly not enough money to solve the problem of providing housing to the population throughout the country.

In order for the mortgage lending system to develop at a rapid pace, it is necessary to use such state programs as mortgages, for example, with maternity capital, military mortgages, and mortgages for state employees.

The big problem in the mortgage lending market is still high interest rates. Currently, the rates vary from 10 to 17%. Also, not all citizens can afford to pay a significant down payment on real estate, not everyone has a clean credit history and an official salary. As a result, mortgage lending is developing, but not as a mass product, since lending is available only to borrowers with above-average incomes.

There is a problem with monopolies in the housing market. The primary housing market is still opaque. Often, a narrow circle of companies has the opportunity to build new residential buildings. The lack of competition keeps the cost of square meters too high to be affordable for ordinary consumers. When the share construction market ceases to be monopolized, this will automatically lead to the solution of a number of mortgage lending problems - the price of real estate will decrease in accordance with market conditions. In addition, there is an acute shortage of economy-class housing in the real estate market.

Lack of economic stability, low wages, problems of the formation of the middle class, relatively high interest rates on mortgage lending, all this stands in the way of the stable development of the mortgage lending system in the Russian Federation.

Consider the prospects for the development of the mortgage lending market in the Russian Federation. In the absence of sharp fluctuations in global financial markets, the sector will maintain a steady growth rate. In the next 1-1.5 years, the demand for mortgages will be supported by the positive dynamics emerging in housing construction. The key constraint on the growth of mortgage lending is the upward trend in interest rates on loans, including those under government-supported programs. In particular, at the beginning of the second half of 2013, most market leaders exceeded the rates for the most popular programs by 1-3 percentage points on average (this mainly affected loans with an initial payment of less than 50%). Since September 3, 2013, the terms of lending under the standard program of the Agency for Housing Mortgage Lending (hereinafter AHML) have been revised: the minimum rates, when they are fixed for the entire loan term, increased by an average of 2% points. According to forecasts, the affordability of mortgages will decrease: inflation is accelerating, and the Bank of Russia has already raised key interest rates in the fight against it. As a result, by the end of 2013, the increase in mortgage rates was realized. According to experts' forecasts, annual growth rates will be at the level of 50-60%. As a result, by the end of 2013, the volume of mortgage lending will cross the bar of 1 trillion. rubles and will amount to 1.1 trillion. rubles.

In 2014, the impact of interest rates may be more noticeable: some borrowers will postpone the purchase of an apartment "until better times" or try to save up funds for a higher down payment, thereby ensuring a lower rate. In connection with this, a further slowdown in market growth is expected - given its scale, they will not exceed 40% on an annualized basis.

According to forecasts, the share of large banks in the mortgage market will grow steadily. As a rule, large banks operating according to their own programs are distinguished by efficiency in decision-making and more interesting product offers. The drop in the interests of medium and small banks in the most popular AHML program will also have an effect. It's not just about increasing the cost of loans under such programs. The current activities of AHML increasingly testify to the desire of the institute to limit its presence in the classic market and concentrate on innovative products. In particular, in January-June 2013, AHML purchased mortgages for 26.1 billion rubles, which is 17% more than the same period last year. At the same time, the share of AHML in the total lending volume decreased from 8% to 6%.

Banks working with AHML have significant difficulties and numerous formalities that accompany the mortgage refinancing process. The new conditions for the repurchase of mortgages suggest that partner banks will have to decide in advance on the volume of issuance and pay the option to the agency. It is obvious that medium and small banks, which will switch to their own programs, will offer higher rates than according to AHML standards, and will lose in competition with large banks.

In order to stimulate demand for mortgage lending, the following measures should be taken:

1) ensure that interest rates are maintained at an acceptable level for the borrower;

2) increase the affordability of economy-class housing;

3) provide reliable borrowers with the opportunity to reduce the down payment through the development of mortgage insurance;

4) stimulate the development of social mortgage lending programs targeted at certain categories of borrowers (young families, recipients of maternity capital).

Conclusion

A mortgage loan is a loan secured by certain real estate, and mortgage lending is a loan secured by real estate.

At present, there is a stable demand for real estate in the Russian Federation, but not everyone has the opportunity to purchase housing. Mortgage is the best option for solving housing problems. Moreover, interest in mortgages is growing every year, which indicates the prospects for growth in the mortgage lending market in the future.

The presence in the country of a developed system of mortgage lending indicates the development of the economy, the prospects for growth, and the high level of development of society as a whole.

Mortgage is that link of the national economic system that has the ability to ensure the relationship between the monetary resources of the population, banks, construction companies and construction industry enterprises, directing financial resources to the real sector of the economy. To date, with the help of mortgage lending, the problem of providing the population with housing should be solved. With the help of the mortgage mechanism, the flow of funds to the housing market will increase, construction and related sectors of industry will be activated, which means that jobs will expand, incomes of the population and budgets of all levels will increase, and the economy as a whole will grow. Therefore, it is necessary to use the real conditions and opportunities that the regions have, to create the necessary organizational, legal and financial prerequisites for the development of mass housing construction using market and state mechanisms for regulating processes in this socially important sector of the economy.

Only with state support, lower interest rates on mortgage lending, the introduction of social programs, and the intensification of economy-class housing construction, a stable and sustainable system of mortgage lending can emerge.

In this course work, the main issues in the field of mortgage lending were studied, the market situation was analyzed, the most significant problems in the functioning of mortgage lending were identified, and forecasts and prospects for the development of mortgages in the current conditions of the Russian Federation were considered.

List of usedsources

Civil Code of the Russian Federation (part one): Federal Law of the Russian Federation

dated November 30, 1994, No. 51-FZ. [Electronic resource]. - Access from the legal reference system "Consultant Plus". - Access mode: http://www.consultant.ru

Federal Law No. 102-FZ of July 16, 1998 "On Mortgage (Pledge of Real Estate)" (as amended on July 17, 2009 No. 166-FZ). [Electronic resource]. - Access from the legal reference system "Consultant Plus". - Access mode: http://www.consultant.ru

Federal Law No. 152-FZ dated November 11, 2003 "On Mortgage Securities". [Electronic resource]. - Access from the legal reference system "Consultant Plus". - Access mode: http://www.consultant.ru

Federal Law No. 188-FZ of December 29, 2004 "Housing Code of the Russian Federation". [Electronic resource]. - Access from the legal reference system "Consultant Plus". - Access mode: http://www.consultant.ru

Federal Law No. 214-FZ of December 30, 2004 "On Participation in Shared Construction of Apartment Buildings and Other Real Estate and on Amendments to Certain Legislative Acts of the Russian Federation". [Electronic resource]. - Access from the legal reference system "Consultant Plus". - Access mode: http://www.consultant.ru

Banking [Text]: textbook / ed. E.F. Zhukova, N.D. Eriashvili. - M.: UNITI-DANA: Unity, 2009. - 575 p.

Banking [Text]: textbook / ed. Lavrushina O.I., Mamonova I.D., Valentseva N.I. - M.: KNORUS, 2009. - 768 p.

Banking [Text]: textbook / Beloglazova G.N., Krolivetskaya L.P. - St. Petersburg: Piter, 2009. - 400 p.

Banking operations [Text]: textbook / Pechnikova A.V., Markova O.M., Starodubtseva E.B. - M.: FORUM: INFRA-M, 2009. - 352 p.

All about mortgages [Text]: textbook / Afonina A.V. - Omega-L, 2008. - 210 p.

Goremykin, V.A. Mortgage lending: [Text] Textbook. - M.: MGIU, 2009. - 368 p.

Money, credit, banks [Text]: textbook / Ed. Zhukova E.F., Zelenkova N.M., Litvinenko L.T. - M.: UNITI, 2011. - 783 p.

Mortgage. Credit. Commentary on housing legislation [Text]: textbook / L.Yu. Grudtsyna, M.N. Kozlov. - M.: Eksmo, 2006. - 368 p.

Mortgage: just about the complex [Text]: textbook / Shevchuk D.A. - Grossmedia, 2008. - 160 p.

Organization of the activities of a commercial bank [Teks] / Textbook / M.S. Maramygin, E.G. Shatkovskaya, 2013. - 182 p.

Lukyanov, A.V. Analysis of the mortgage lending market [Text] / A.V. Lukyanov // Journal of Money and Credit. - 2010. - No. 8. - With. 10-15.

The development of mortgage lending in the Russian Federation [Text]: textbook / Ed. Kopeikina A.B., Rogozhina N.N., Kosareva N.B. - M.: Delo, 2010. - 256 p.

Razumova, I.A. Mortgage credit lending. [Text] / 2nd ed. - St. Petersburg: Piter, 2009. - 304 p.

Mortgage lending market and socio-economic indicators in Russia (2005-2010) // Research of the analytical center of the company "Rusipoteka" LLC, Moscow. - 2010. - No. 11. - With. 34-37.

Rusipoteka: lending and securitization [Text] // Analytical review of Rusipoteka LLC. - 2011. - No. 1.

Doronkin, M, Volkov, S, Samiev, P. Mortgage lending in the 1st half of 2011: from renaissance to obscurity [Text] // Banking services. 2011. - No. 11. - With. 38-49.

Central Bank of the Russian Federation: [Electronic resource]. - Access mode: http://www.cbr.ru

Mortgage lending in Russia [Electronic resource]. - Access mode: http://www.ipocredit.ru

Sberbank of Russia [Electronic resource]. - Access mode: http://www. sbrf.ru

Russian mortgage [Electronic resource]. - Access mode: http://www.russianipoteka.ru

Agency for Housing Mortgage Lending [Electronic resource]. - Access mode: http://www.ahml.ru

Portal "All about the mortgage" [Electronic resource]. - Access mode: http://www.vse-obipoteke.ru

"RosBusinessConsulting" [Electronic resource]. - Access mode: http://www.rbc.ru

Hosted on Allbest.ru

Similar Documents

Theoretical foundations and essence of mortgage lending. Brief description and economic analysis of the joint-stock commercial Savings Bank of the Russian Federation. The main problems and ways to improve the conditions of mortgage lending in the Russian Federation.

thesis, added 05/09/2011

The essence of mortgage lending, its history, role in the economy. Mortgage lending instruments, loan payment calculation schemes. Attracting investments in the housing and communal sector. Market of housing mortgage lending in the Kursk region.

thesis, added 05/06/2012

The concept of a mortgage loan as a special form of lending. Models of mortgage lending, features of its development in Russia. Analysis of the system of mortgage lending in JSC "SKB-Bank". The main problems and ways of developing the system of mortgage lending.

thesis, added 07/01/2013

The essence and significance of mortgage lending in the economy. Analysis and evaluation of mortgage lending in the banking sector of the Republic of Belarus. Organizational and economic characteristics of the bank under study. Composition and structure of mortgage loans in the branch.

term paper, added 03/12/2012

The essence of mortgage lending and its role in the economy. The concept of the mortgage lending market and its elements. The state of the Russian mortgage lending market at the present stage, its problems. The main programs of mortgage lending in Russia.

term paper, added 12/08/2014

The essence and history of the development of mortgage lending, its main types and forms, assessment of the role and importance in a market economy. Analysis of this type of lending in the pre-crisis, crisis and post-crisis periods, comparison of the behavior of market participants.

term paper, added 11/24/2014

The essence of mortgage lending and its role in the Russian economy, stages and directions of this market, refinancing models. Analysis of the mortgage lending market in modern Russia: dynamics, government programs, problems and prospects.

thesis, added 10/17/2013

Characteristics of the system of mortgage lending in JSC "Temirbank". Analysis of the loan portfolio of Temirbank JSC. The essence and role of mortgage lending in the activities of the bank. Mortgage lending system in the Republic of Kazakhstan, development prospects.

term paper, added 03/17/2010

Distinctive features of a mortgage loan. Fundamentals of mortgages. Functions of mortgage lending. Analysis of the system of mortgage lending in the Russian Federation. The procedure for granting a mortgage loan for the purchase of housing, mortgage problems.

abstract, added 10/30/2014

General provisions, history of development, state support of mortgage lending. Experience of foreign countries in the field of mortgage lending. The main problems of modern mortgage lending and ways to improve mortgage lending.

We can talk about the existence of a mortgage lending market since 1998, when the Federal Law of July 16, 1998 N 102-FZ "On Mortgage (Pledge of Real Estate)" was adopted. From that moment on, constant work is underway to improve the mortgage lending system and ensure its functioning.

The definition of the concept of a mortgage loan is logically preceded by the disclosure of the essence of the mortgage.

Mortgage is a pledge of real estate2Dovdienko I.V. Mortgage. M., 2003. S. 3. Mortgage, or pledge of real estate, is as a legal relationship, by virtue of which the pledgee has the right to satisfy his monetary claim to the debtor under the secured obligation from the value of the mortgaged real estate predominantly over other creditors.

As can be seen from the above, a mortgage is a means of securing an obligation, in which the debtor retains the right to own and use the pledged property, regardless of whether it is movable or immovable. But it has received the greatest distribution when pledging real estate, and, above all, land plots, for the following reasons. Land and other immovable property cannot be transferred to another place, unlike movable property. In addition, real estate is the main means of production, having lost it, the debtor will practically not be able to fulfill his obligations to the creditor. Therefore, mortgages began to be widely used precisely when pledging real estate and interpreted as a property right.

At the same time, there is no definition of mortgage lending in federal legislation, and one can only find a definition of a mortgage agreement as an agreement under which a pledgee who is a creditor under an obligation secured by a mortgage has the right to receive satisfaction of his monetary claims against the debtor under this obligation from the value of the pledged immovable property of another the parties - the mortgagor, predominantly over other creditors of the mortgagor, with exceptions established by federal law (clause 1, article 1 of the Federal Law of July 16, 1998 N 102-FZ "On Mortgage (Pledge of Real Estate)" .

Article 2 of the Federal Law “On Mortgage” establishes which obligations can be secured by mortgages, as well as the need for legal entities (creditors-debtors) to record obligations secured by mortgages in the accounting records in the manner prescribed by the accounting legislation of the Russian Federation3.

According to this article, a mortgage may be established to secure an obligation under a loan agreement, under a loan agreement or other obligation, including an obligation based on the purchase and sale, lease, contract, other agreement, causing harm, unless otherwise provided by federal law. The current legislation makes it possible to secure any legal requirements with a mortgage, which is in line with international practice. For example, there are no restrictions on the type of claims to be secured, in particular, in the legislation of Belgium, Germany, Spain13 Gerasin S.I. Actual problems of the mortgage of agricultural land // Law. 2007. No. 1. S. 58..

A mortgage may be established, unless otherwise provided by federal law, to secure:

- - obligations under the loan agreement,

- - obligations under the loan agreement,

- - other obligation, including an obligation based on the sale, purchase, lease, contract, other agreement,

- - liability based on causing harm.

Thus, with mortgage lending, the borrower receives a loan to purchase real estate. His obligation to the creditor is the repayment of the loan, and the pledge of real estate ensures the fulfillment of this obligation. At the same time, you can buy and mortgage not only housing, but also other real estate objects - land, a car, a yacht, etc. Real estate purchased under the mortgage program is the property of the borrower of the loan from the moment of purchase.

Under a loan agreement, a bank or other credit organization (creditor) undertakes to provide funds (credit) to the borrower in the amount and on the terms stipulated by the agreement, and the borrower undertakes to return the amount of money received and pay interest on it Civil Code of the Russian Federation: Part 2 of November 30 1994 No. 51-FZ (as amended on December 30, 2004) // Collection of Legislation of the Russian Federation. 2006. No. 1. Art. 819.. The loan agreement must be concluded in writing. Failure to comply with the written form entails the invalidity of the loan agreement. Such an agreement is considered null and void. Art. 820..

Under a loan agreement, one party (the lender) transfers money or other things defined by generic characteristics to the ownership of the other party (the borrower), and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal amount of other things received by him of the same kind and quality . The loan agreement is considered concluded from the moment of transfer of money or other things. Foreign currency and currency values may be the subject of a loan agreement on the territory of the Russian Federation in compliance with the rules of Articles 140, 141 and 317 of the Civil Code of the Russian Federation Ibid Art. 807.