The concept of the intensity of competition. Main factors for assessing the intensity of market competition

Plan.

Introduction…………………………………………………………………

1.1. The concept and essence of competition ……………………………...

1.2. Characteristics of types of competition …………………………….

2.2. Competitive positions

2.3. Assessing the strengths and weaknesses of competitors

Conclusion

Glossary

List of used literature

The marketing environment of a firm is made up of a microenvironment and a macroenvironment. The microenvironment is represented by forces that are directly related to the firm itself and its ability to serve the clientele, i.e. suppliers, marketing intermediaries, customers, competitors and contact audiences. The macroenvironment is represented by forces of a broader social plan that influence the microenvironment (demographic, economic, natural, technical, political and cultural factors).

In this way, competitors are an important component of the marketing microenvironment of the company, without taking into account and studying which it is impossible to develop an acceptable strategy and tactics for the functioning of the company in the market.

There are many definitions of competitors, we will give the most common of them. As noted above, competitors- these are the subjects of the marketing system that, by their actions, influence the choice of markets, suppliers, intermediaries, the formation of a range of goods and the entire range of marketing activities (which entails the need to study them). Considering competitors as subjects of the marketing system in more detail, we can give the following definition. Competing firms are firms that have a completely or partially coinciding fundamental niche. The fundamental market niche here is understood as

The presence of competing firms gives rise to such a phenomenon in the economy as competition. From an economic point of view, competition- the economic process of interaction, the relationship between the struggle of producers and suppliers in the sale of products, the rivalry between individual manufacturers or suppliers of goods and / or services for the most favorable production conditions. Thus, competition in a general sense can be defined as rivalry between individuals and economic units interested in achieving the same goal. If this goal is concretized from the point of view of the concept of marketing, then market competition is the struggle of firms for a limited amount of effective demand of consumers, conducted by firms in the market segments accessible to them.

From a marketing point of view, the following aspects are important in this definition:

First, we are talking about market competition, that is, the direct interaction of firms in the market. It refers only to the struggle that firms wage in promoting their products and/or services to the market.

Secondly, competition is conducted for a limited amount of effective demand. It is the limited demand that makes firms compete with each other. After all, if the demand is satisfied by the product and / or service of one company, then all the others automatically lose the opportunity to sell their products. And in those rare cases where demand is virtually unlimited, relationships between firms offering the same type of product are often more like collaboration than competition. Such a situation, for example, was observed at the very beginning of reforms in Russia, when a small number of goods that began to arrive from the West faced an almost insatiable domestic demand.

Thirdly, market competition develops only in accessible market segments. Therefore, one of the common techniques that firms resort to to ease the pressure on themselves from the competitive pressure is to move into market segments that are inaccessible to others.

Chapter 1: Fundamentals of the concept and types of competition

1.1. The concept and essence of competition

It is almost universally accepted, both among economists and in society at large, that if producers are constantly in danger of dying because of higher costs, or too low revenue, then society as a whole wins.

Since only those punishments are frightening which are applied from time to time, competition is effective only when it ruins and destroys those who lag behind. How often do those who lag behind die in a competitive economy? They often die. The composition of manufacturers of any product is updated quite significantly, and this applies not only to progressive industries, such as software companies. Banks and insurance companies are also going bankrupt, although this business is hundreds of years old. The scale of this phenomenon is even greater than it can be seen at first glance - many bankrupt firms that sold popular products (it happens) also sell the brand to others, so the consumer does not notice this. So, the owners of some Hollywood film companies are now Japanese.

Obviously, those who spend more than their products bring in revenue are the fastest to go bankrupt. If there are no reserves, and if such "scissors" are not a one-time occurrence, then everything ends soon. But it has always been so, even before our era, in any social system. But what happens if the company makes a profit, but the competitor is simply more profitable? Once upon a time, such a situation only led to the fact that someone got rich, and someone also got rich, but more slowly. As long as the enterprise brought in at least some income, its owner could live without much worry, although he had to cut his own consumption. If the enterprise was owned by a company of owners, then it was not easy for one of the partners, dissatisfied with low profits, to withdraw his part of the capital or even his share of the profits and invest in the enterprise of a more successful competitor. The difficulties were both legal and moral.

The situation changed when it became possible to move capital relatively freely and almost anonymously from enterprise to enterprise, from industry to industry, that is, when the stock exchange appeared. A more profitable enterprise has a greater investment attractiveness, and the owners of capitals try to take them away from the less profitable one in order to buy a share in a more profitable one. This is not too easy - the sale of a significant part of the company's shares reduces their price. However, an outflow of capital from a lagging company is inevitable, and none of the shareholders wants to be the last one on a sinking ship.

Therefore, the free movement of capital contributes to the strengthening of "natural selection" among competing enterprises, competing industries. In this, the modern economy differs from the economy even of the last century. And the ease of movement of capital is becoming more and more wonderful - there are almost no national borders for capital, and modern means of communication in a matter of minutes transport billions of dollars of capital to a new place of their application. This is what is written in popular articles about the economy, but some important details are omitted. A shareholder, in order to save his money from a sinking enterprise, needs to find someone to whom he can sell his shares - this is not easy and involves monetary losses. You can't just "give" the shares back to the company that issued them. After all, the money has already been spent - a plant has been built on it, equipment and raw materials have been bought.

Therefore, the dream of any investor- find a way to invest money so that you can return it at any time, or even better, at a guaranteed percentage. And it's not easy.

That is, in fact, such a sharp disappearance of capital on one continent and its appearance on another does not happen, everything happens gradually. You can invest free capital quickly, but it is not so easy to "pull out" it.

Thus, a real investor must be very careful when investing money - it is physically impossible to cancel a deal if the money is invested in an uncompetitive enterprise. Naturally, when planning your investments, it is necessary to calculate the chances of a particular enterprise for survival. The most stupid method is to look at the shares of which company is in demand (the price of such shares is growing), and invest in it. But in this case, you won't win much - the "cream" is taken off by the one who first recognized the profitability of the enterprise - and you can make a mistake: fall for the bait of stock speculators. Yes, some "make" billions on speculation - but let's leave this topic aside. Real investors do not play games - we are talking about serious investments in real production, and not about speculation on the stock exchange.

Of course, intuition can help a lot - what kind of business can be profitable. You can invest in a successful venture if you know something important about it - for example, that there will be a large government order for some product, or that a new technology will reduce the cost of some popular product by ten times. But the emergence of revolutionary new industries or inventions is a rarity, an ordinary investor may never invest his money in an unknown product in his life.

The main tool in the valuation of the enterprise is the method of estimating production costs. This is routine, petty work, but free funds are usually invested on the basis of such an analysis. If we manage to estimate the level of costs in the production of a unit of product at a particular enterprise, then we can reliably assume what its fate will be.

It is with the help of this method that the investment attractiveness of enterprises in a perfectly competitive economy is determined. It is only necessary to correctly analyze the costs of production, not forgetting one little thing, and the picture will be clear. If one farm consumes two kilograms of feed per liter of milk, and the second - three kilograms, then to which farmer will you lend money to expand the farm?

But one should not think that competition acts like natural selection in a stable population of any animals, eliminating only "freaks" and losers. The world economy has not yet reached a steady state, so in some countries entire industries sometimes die out, temporarily or permanently.

The system of free movement of capital in a competitive environment not only promotes growth, but can create problems even in the most powerful and richest country in the world. And can this system bleed not just one industry, but the economy of the whole country? Maybe. It is this system of moving capital to more profitable industries that literally bled our economy. If an enterprise participates in a system of free movement of capital, then it can succeed dramatically, but it can also die, being not unprofitable, even, but simply less profitable than others. The owners of capital vigilantly monitor the profits of enterprises, paying attention to the difference in fractions of a percent.

Yes, competition is one of the most popular words in the economic lexicon. Many books have been written about her. I repeat: when it comes to competition between firms, the main, almost the only method of identifying the advantages of one firm over another is to compare the amount of costs per unit of finished product. The one who is lessshe spends - comes out the winner in the competition. Such a firm is more attractive for investment.

But here's the paradox - when it comes to comparing the economies of entire countries, the criteria are completely different. It is recommended to take into account some strange things - the level of civil liberties, the existence of freedom of the press, the development of legislation, etc. Based on these indicators, it is not clear how they are calculated, the investment attractiveness of countries is ranked.

From this it is concluded that it is enough to adopt the right laws, abolish the death penalty, finally free the press from any responsibility, cancel registration, develop civil liberties (for example, freedom of conscience) - and the investment attractiveness of our country will grow.

1.2. General characteristics of the types of competition

Depending on the ratio between the number of producers and the number of consumers, the following are distinguished: types of competitive structures:

1. A large number of independent producers of some homogeneous product and a mass of isolated consumers of this product. The structure of relations is such that each consumer, in principle, can buy a product from any manufacturer, in accordance with his own assessment of the usefulness of the product, its price and its own possibilities for acquiring this product. Each producer can sell goods to any consumer, according to his own benefit. None of the consumers acquires any significant share of the total demand. This market structure is called polypoly and gives rise to the so-called perfect competition.

2. A huge number of isolated consumers and a small number of producers, each of which can satisfy a significant share of the total demand. Such a structure is called oligopoly, and gives rise to the so-called imperfect competition . The limiting case of this structure, when a mass of consumers is opposed by a single producer capable of satisfying the total demand of all consumers, is monopoly. In the case when the market is represented by a relatively large number of manufacturers offering heterogeneous (dissimilar) products, then one speaks of monopolistic competition.

3. The only consumer of the goods and many independent producers. At the same time, a single consumer acquires the entire supply of a product that is supplied by the entire set of producers. This structure gives rise to a special type of imperfect competition called monopsony (monopoly of demand).

4. A relationship structure where a single consumer is opposed to a single producer ( bilateral monopoly ) is not competitive at all, but it is also not a market one.

According to Smith, the essence of the competitive behavior of producers was "fair" (without collusion) rivalry of producers through, as a rule, price pressure on competitors. Not rivalry in setting the price, but the lack of the ability to influence the price, is the key point in the modern interpretation of the concept of competition.

Let us consider in more detail the main of the above market structures.

Polypoly (perfect competition)

A large number of sellers and buyers of the same product. Changes in the price of any seller cause a corresponding reaction only among buyers, but not among other sellers.

The market is open to everyone. Advertising companies are not so important and mandatory, since only homogeneous (homogeneous) products are offered for sale, the market is transparent and there are no preferences. In a market with such a structure, price is a given value. Based on the foregoing, the following options for the behavior of market participants can be deduced:

Price acceptor. Although the price is formed in the process of competition among all market participants, but at the same time, a single seller does not have any direct influence on the price. If the seller asks for a higher price, all buyers immediately go to his competitors, since in conditions of perfect competition, each seller and buyer has complete and correct information about the price, quantities of the product, costs and demand in the market

If the seller requests a lower price, then he will not be able to satisfy all the demand that will be directed to him, due to his insignificant market share, while there is no direct influence on the price from this particular seller.

If buyers and sellers act in the same way, they influence the price.

Quantity regulator. If the seller is forced to accept prevailing market prices, he can adjust to the market by adjusting the volume of his sales. In this case, he determines the quantity he intends to sell at a given price. The buyer also has only to choose how much he wants to receive at a given price.

The conditions for perfect competition are determined by the following premises:

A large number of sellers and buyers, none of which has a noticeable influence on the market price and quantity of goods;

Each seller produces a homogeneous product which is in no way different from that of other sellers;

Barriers to entry into the market in the long term are either minimal or non-existent;

There are no artificial restrictions on demand, supply or price, and resources - variable factors of production - are mobile;

Each seller and buyer has complete and correct information about the price, product quantities, costs and market demand.

It is easy to see that no real market satisfies all the above conditions. Therefore, the scheme of perfect competition is mainly of theoretical importance. However, it is the key to understanding more realistic market structures. And therein lies its value.

For market participants in conditions of perfect competition, the price is a given value. Therefore, the seller can only decide how much he wants to offer at a given price. This means that he is both a price acceptor and a quantity regulator.

Monopoly

One seller confronts many buyers, and this seller is the only producer of a product that does not have, moreover, close substitutes. This model has the following features:

a) the seller is the only manufacturer of this commodity (product);

b) the product being sold is unique in the sense that there are no substitutes for it;

c) the monopolist has market power, controls prices and supplies to the market. The monopolist is the price-setter, that is, the monopolist sets the price and the buyer, at a given monopoly price, can decide how much of the product he can buy, but in most cases the monopolist cannot set an arbitrarily high price, since, as prices rise, demand decreases, and with falling prices - increases;

d) on the way to enter the market, the monopolist establishes insurmountable barriers for competitors - both natural and artificial origin, examples of natural monopolies can be public utilities - electric and gas companies, water supply companies, communication lines and transport companies. Artificial barriers include patents and licenses granted to some firms for the exclusive right to operate in a given market.

Monopolistic competition

A relatively large number of manufacturers offer similar but not identical products, i.e. There are heterogeneous products on the market. In conditions of perfect competition, firms produce standardized (homogeneous) products, in conditions of monopolistic competition, differentiated products are produced. Differentiation affects primarily the quality of a product or service, due to which the consumer develops price preferences. Products can also be differentiated by terms of after-sales service (for durable goods), proximity to customers, advertising intensity, etc.

Thus, firms in the market of monopolistic competition compete not only (and even not so much) through prices, but also through worldwide differentiation of products and services. Monopoly in such a model lies in the fact that each firm, in terms of product differentiation, has, to some extent, monopoly power over its product; it can raise and lower the price of it regardless of the actions of competitors, although this power is limited by the presence of manufacturers of similar goods. In addition, in monopolistic markets, along with small and medium-sized firms, there are quite large ones.

In this market model, firms tend to expand their area of preference by individualizing their products. This happens, first of all, with the help of trademarks, names and advertising campaigns, which clearly highlight the differences in goods.

Monopolistic competition differs from perfect polypoly in the following ways:

In a perfect market, not homogeneous, but heterogeneous goods are sold;

There is no full market transparency for market participants, and they do not always act in accordance with economic principles;

Enterprises seek to expand their area of preference by individualizing their products;

Access to the market for new sellers under monopolistic competition is difficult due to the presence of preferences.

Oligopoly

A small number of participants in competition is understood as a relatively small (within a dozen) number of firms dominating the market of goods or services. Examples of classic oligopolies: the "big three" in the United States - General Motors, Ford, Chrysler.

Oligopolies can produce both homogeneous and differentiated goods. Homogeneity most often prevails in the markets of raw materials and semi-finished products: ores, oil, steel, cement, etc.; differentiation - in consumer goods markets.

The small number of firms contributes to their monopolistic agreements: to set prices, divide or allocate markets, or otherwise limit competition between them. It has been proved that competition in an oligopolistic market is the more intense, the lower the level of concentration of production (a greater number of firms), and vice versa.

An important role in the nature of competitive relations in such a market is played by the volume and structure of the information about competitors and about the conditions of demand that firms have: the less such information, the more competitive the firm's behavior will be. The main difference between an oligopolistic market and a perfectly competitive market is related to price dynamics. If in a perfect market they pulsate continuously and unsystematically depending on fluctuations in supply and demand, then in an oligopoly they tend to be stable and change less often. Typically, the so-called leadership in prices, when they are mainly dictated by one leading firm, while the rest of the oligopolists follow the leader. Market access for new sellers is difficult. When oligopolists agree on prices, competition shifts more and more in the direction of quality, advertising and individualization.

In the economic literature, it is accepted divide competition according to its methods into:

price (competition based on price);

non-price (competition based on the quality of use value).

Price competition dates back to the days of free market competition, when even homogeneous goods were offered on the market at a wide variety of prices.

Price reduction was the basis by which the manufacturer (merchant) distinguished his product, attracted attention and, ultimately, won the desired market share.

In the modern world, price competition has lost such importance in favor of non-price methods of competition. This does not mean, of course, that the “price war” is not used in the modern market, it exists, but not always in an explicit form. The fact is that an open “price war” is possible only until the firm exhausts its reserves to reduce the cost of goods. In general, competition in an open form leads to a decrease in the rate of profit, a deterioration in the financial condition of firms and, as a result, to ruin. Therefore, firms avoid open price competition. It is currently used usually in the following cases:

F outsider firms in their fight against monopolies, for competition with which, in the field of non-price competition, outsiders have neither the strength nor the opportunity;

F to enter markets with new products;

F to strengthen positions in the event of a sudden aggravation of the sales problem.

With hidden price competition, firms introduce a new product with significantly improved consumer properties, but raise the price disproportionately little.

Non-price competition highlights the use value of the product, which is higher than that of competitors (firms produce goods of higher quality, reliable, provide a lower consumption price, more modern design). Non-price methods include all marketing methods of company management.

Illegal methods of non-price competition include:

ü industrial espionage;

ü enticement of specialists who own trade secrets;

ü release of counterfeit goods, outwardly no different from original products, but significantly worse in quality, and therefore usually 50% cheaper;

ü Purchase of samples for the purpose of their copying.

The following main areas of competitive activity of the company can be distinguished:

1. Competition in the field of raw materials markets for gaining positions in the resource markets in order to provide production with the necessary material resources, promising materials, highly qualified specialists, modern equipment and technology in order to ensure higher labor productivity than competitors. As competitors of the enterprise in the commodity markets, there are mainly firms manufacturing analogue products that use similar material resources, technology, and labor resources in their production;

2. Competition in the sale of goods and/or services on the market;

3. Competition between buyers in sales markets.

Depending on the intensity of competition in this environment, the firm predicts prices for certain goods, organizes its marketing activities.

In a saturated market, buyer competition gives way to seller competition. In this regard, among these three areas of competitive activity of the company, the greatest interest, from the point of view of marketing, is the competition of sellers in the field of selling goods and / or services on the market. The two remaining areas are competition buyers.

Since competition in marketing is usually considered in relation to the consumer, different types of competition correspond to certain stages of consumer choice.

In accordance with the stages of the consumer's decision to purchase, the following types of competition can be distinguished:

1) Desires-competitors. This type of competition is due to the fact that there are many alternative ways for the consumer to invest money;

2) Functional competition. This type of competition is due to the fact that the same need can be satisfied in different ways (there are alternative ways to satisfy the need). This is the basic level of studying competition in marketing.

3) Interfirm competition. This is a competition of alternatives to the dominant and most effective ways to satisfy a need.

4) Intercommodity competition. This is the competition between the firm's products. It is, in fact, not a competition, but is a special case of an assortment range, the purpose of which is to create an imitation of consumer choice.

Chapter 2. Assessment of the intensity of competition

2.1. Ways to compete

Competition, translated from Latin, means "to collide" and means the struggle between commodity producers for the most favorable conditions for the production and marketing of products. Competition plays the role of a regulator of the pace and volume of production, while prompting the manufacturer to introduce scientific and technological achievements, increase labor productivity, improve technology, work organization, etc.

Competition is a determining factor in price regulation, a stimulus for innovation processes (introduction of innovations into production: new ideas, inventions). It contributes to the displacement of inefficient enterprises from production, the rational use of resources, and prevents the dictate of producers (monopolists) in relation to the consumer.

Competition can be conditionally divided into fair competition and unfair competition.

fair competition

Improving product quality

Development of pre- and after-sales service

Creation of new goods and services using the achievements of scientific and technological revolution, etc.

One of the traditional forms of competition, as already mentioned, is price manipulation, the so-called. "price war", used mainly to push weaker competitors out of the market or penetrate an already developed market.

A more effective and more modern form of competition is the struggle for the quality of the goods offered to the market. The entry into the market of higher quality products or new use value makes it more difficult for a competitor to respond. The "formation" of quality goes through a long cycle, starting with the accumulation of economic, scientific and technical information. As an example, we can cite the fact that the well-known Japanese company SONY carried out the development of a video recorder simultaneously in 10 competing areas.

At present, various kinds of marketing research have received a lot of development, the purpose of which is to study the needs of the consumer, his attitude to certain goods, because. knowledge of this kind of information by the manufacturer allows him to more accurately represent future buyers of his products, more accurately represent and predict the situation on the market as a result of his actions, reduce the risk of failure, etc.

An important role is played by pre- and after-sales customer service, as the constant presence of manufacturers in the consumer service sector is necessary. Pre-sales service includes meeting the requirements of consumers in terms of supply: reduction, regularity, rhythm of deliveries (for example, components and assemblies). After-sales service - the creation of various service centers for servicing purchased products, including the provision of spare parts, repairs, etc.

Due to the great influence on the public of the media, the press advertising is the most important method of conducting competition, because. with the help of advertising, it is possible in a certain way to form the opinion of consumers about a particular product, both for the better and for the worse, the following example can be cited as evidence:

During the existence of the FRG, French beer was in great demand among West German consumers. West German producers did everything to prevent French beer from entering the German domestic market. Neither the advertising of German beer, nor the patriotic appeals "Germans, drink German beer", nor the manipulation of prices led to anything. Then the German press began to emphasize that French beer contains various chemicals that are harmful to health, while German beer is allegedly an exceptionally pure product. Various actions in the press, arbitration courts, medical examinations began. As a result of all this, the demand for French beer still fell - just in case, the Germans stopped buying French beer.

But along with the methods of fair competition, there are other, less legal methods of competition:

Unfair competition, the main methods of which are:

Economic (industrial espionage)

Counterfeit products of competitors

Bribery and blackmail

Consumer fraud

Fraud with business reporting

Currency fraud

Hiding defects, etc.

To this we can also add scientific and technical espionage, because. any scientific and technical development is only a source of profit when it finds application in practice, i.e. when scientific and technical ideas are embodied in production in the form of specific goods or new technologies.

The terms "industrial" and "economic" espionage are often used interchangeably. But there is a certain difference between them, because. in principle, industrial espionage is part of economic espionage. Economic espionage beyond industrial also covers areas characterized by such indicators as:

1) the market value of all final products and services produced in the company for the year;

2) the sum of incomes of enterprises, organizations and the population in material and non-material production and depreciation deductions), its distribution by sectors of the economy, interest rates, reserves of natural resources, possible changes in technical policy, projects for the creation of large state facilities - factories, landfills, highways and etc.

The answer to the question why economic espionage is interested in the above indicators of the state is that many countries provide generalized data from which it is difficult to establish the formation of income and expenses of a particular industry or the entire state. This especially applies to such areas as financing various kinds of research work in the field of nuclear physics and electronics, the space industry, etc. The same applies to the maintenance of various kinds of special services.

In principle, in our time, any government of a well-developed country has large funds that are not controlled by parliament. These amounts may be hidden in various government spending items or not included in the published state budget. In this way, hidden funding was created, for example, the atomic bomb in the United States. Its creation cost the government $2 billion.

The main targets of industrial espionage are patents, blueprints, trade secrets, technologies, cost structure; economic espionage, in addition to industrial secrets, also covers macroeconomic indicators and includes the exploration of natural resources, the identification of industrial reserves; in connection with the development of marketing, the collection of information about the tastes and incomes of various social groups in society is of great value.

2.2. Competitive positions

After identifying and evaluating its main competitors, the company must develop competitive marketing strategies.

There is no universal strategy. Each company must determine which strategy is best for it, given its position in the industry, as well as its goals, capabilities, and resources. Even within the same company, different activities or products may require different strategies. For example, a company Johnson & Johnson uses one marketing strategy for its leading brands in stable foreign markets, and another for its activities in the creation of new high-tech products intended for the healthcare sector.

So, let's look at the main competitive international marketing strategies that companies can use in their activities in foreign markets.

Competing companies always differ in their goals and resources. Some companies have large resources, while others lack funds. Some companies are old and stable, others are new and inexperienced. Some are fighting for rapid market share growth, while others are fighting for long-term profits. All these companies will occupy different competitive positions in the markets.

Here are three main competitive positioning strategies that companies can follow:

1. Absolute cost superiority . In this case, the company works hard to achieve the lowest cost of production and distribution in order to set a price lower than competitors and capture a significant market share.

2.Specialization . In this case, the company focuses its main efforts on creating a highly specialized product range and an international marketing program, thus acting as the leader of the external market in this category of goods. Most consumers would prefer to own such a brand if its price is not too high.

3.Concentration . In this case, the company is focusing on providing quality service to a few market segments rather than serving the entire market.

Companies that follow a clear strategy (one of the ones above) are more likely to succeed. The companies that execute this strategy in the best way will reap the most profits. But if companies do not adhere to any clear strategy, they try to stick to the golden mean, they can get lost in the global market among other companies in the industry.

Recently, two marketing consultants, Michelle Tracy and Fred Virzema, proposed a new classification of international competitive marketing strategies. Their starting point is that companies achieve market leadership by delivering the highest value to consumers. To deliver superior customer value, companies can follow any of three strategies called value disciplines. Here are those strategies.

1. Functional Superiority . The company delivers superior value by leading the industry in price and convenience. It works to reduce costs and create an efficient system for delivering customer value. It serves consumers who require reliable, good quality goods or services, but who want them cheaply and effortlessly.

2.Close relationship with the consumer . A company delivers superior value by accurately segmenting "its" external markets and then fine-tuning its products or services to meet the needs of its target customers. It specializes in meeting unique consumer needs by establishing close relationships with consumers and gathering detailed information about their personal preferences and habits. It caters to consumers who are willing to pay a high price to get exactly what they want.

3. Leading position by goods . A company delivers superior customer value by offering a continuous stream of the latest products or services, making both its own legacy products and services and competitors' products and services obsolete quickly.

Some companies successfully follow more than one value discipline, applying them simultaneously. However, such companies are rare. Few companies can achieve excellence in more than one of these disciplines.

Leading companies focus on one of the value disciplines, achieving excellence in it, and try to adhere to the level of industry standards in the other two.

2.3. Assessing the strengths and weaknesses of competitors

As a first step, a company must collect data on each competitor's global business activity over the past few years. It must know everything about the goals, strategies and performance of the competitor. It's no secret that some of the above data will be difficult to obtain. For example, industrial goods companies have difficulty in determining the market share of competing companies because they do not have information services that serve a consortium of enterprises similar to the services that consumer goods companies have access to. However, any information they can get will enable them to form a more accurate assessment of the strengths and weaknesses of their competitors.

The study of the strengths and weaknesses of a company's competitors is usually based on secondary data, personal experience and unverified rumors. In addition, companies can obtain additional information by conducting primary market research of consumers, suppliers and dealers. In recent years, a growing number of companies have been using baseline analysis. They compare their products and business processes with those of competitors or leading companies in other markets to find ways to improve quality and efficiency.

In the process of finding the weaknesses of competitors, the company should seek to reconsider all assumptions about its business and market that are not true. Some companies continue to believe that they produce the highest quality products in the industry, even though this is no longer the case. Many companies fall victim to slogans such as:

"Consumers prefer companies that produce the entire range of products in this group" or "Consumers care about the level of service, not price." If a competitor bases its activities on assumptions that are fundamentally wrong, the company can beat it.

Evaluation of the spectrum of possible reactions of competitors

Knowing the goals, strategies, strengths and weaknesses of competitors can not only explain much of their likely actions, but also anticipate their possible reactions to such company actions as lowering prices, increasing sales promotion or launching a new product on the world market. In addition, each competitor has its own views on entrepreneurial activity, has a certain internal culture and beliefs. International marketing executives need a deep understanding of the "mindset" of a given competitor if they are to anticipate its likely actions or reactions.

Each competitor reacts to the actions of another company in its own way. Some react slowly or weakly. They can feel the loyalty of their consumers; not immediately notice shifts in the competitor's way of doing things; lack resources to organize resistance. Other competitors react only to certain types of attacking actions, ignoring the rest. They can, for example, almost always take some action in response to a competitor's price cut to make him understand the futility of such a promotion. At the same time, they may not react in any way to increased advertising, considering it as a less significant threat. Some competitors react quickly and decisively to any offensive action. Most companies, knowing about such reactions, avoid direct competition with it and look for an easier way. And finally, there are competitors who show completely unpredictable reactions. There is no guarantee that they will react to this or that circumstance, just as it is impossible to predict their actions based on their economic situation, background or any other assumptions.

In some sectors of the world markets, competitors coexist in relative harmony, while in others they are in constant struggle. Knowing the possible reactions of major competitors gives a company the key to understanding how best to attack competitors or how to protect the company's existing position.

Choosing competitors to attack and avoid

Let us assume that the company's management has already largely chosen its main competitors by making a priori strategic decisions regarding target customers, distribution channels, and international marketing mix. These decisions define the strategic group to which the company belongs. Now the management of the company must choose the competitors with whom it will compete most vigorously. A company can focus its offensive actions on one of several competitors.

Strong and weak competitors

Most companies prefer weak competitors as targets. It requires less resources and time. But this tactic may not bring significant results to the company. On the contrary, the company needs to compete with strong competitors in order to show its abilities. Moreover, even strong competitors have some weaknesses, and successfully going up against them often pays off. A useful tool for determining the strengths and weaknesses of competitors is customer value analysis. It allows you to identify those areas in which the company is most vulnerable to the actions of competitors.

Competitors near and far

Most companies will compete with competitors that are most similar to them. At the same time, a company's attempt to destroy a nearby competitor may lead to the fact that it will be forced to avoid it, because. in the case of a successful fight with the nearest rival, stronger competitors sometimes appear.

"Good-natured" competitors and competitors - "destroyers"

The company really needs competitors and even benefits from them. The existence of competitors results in some strategic advantages. Competitors can contribute to the growth of overall demand in world markets. They can bear the overall burden of the costs associated with market and product development and contribute to the emergence of new technologies. Competing companies may serve less attractive segments or promote greater product specialization. Ultimately, when united, they can come out in a much stronger position when concluding various kinds of agreements with trade unions or government agencies that regulate market activity.

However, a company cannot view all of its competitors as beneficial. There are often both "good" competitors and "destroyer" competitors in an industry. "Good-natured" competitors play by the rules defined by the industry. They prefer an industry that is stable and prosperous, set reasonable prices in line with costs, encourage others to cut costs or increase specialization, and are content with modest levels of external market share and profits. Competitors-"destroyers", on the contrary, break the rules.

They try to buy market share, not earn it, often take unnecessary risks, and generally shake the industry.

Conclusion

Companies can no longer afford to focus only on their home market, no matter how big it may be. Many industries are global industries, and those firms that operate globally manage to achieve lower costs and greater visibility.

Given the potential benefits and risks of international markets, companies feel the need for a systematic approach to making international marketing decisions. One of the main factors influencing the decision to enter a foreign market is the level of competition in this market and the competitiveness of one's own goods and/or services.

In developing an effective international marketing strategy, a company must take into account both its competitors and its existing and potential customers. It must constantly engage in competitor analysis and develop international competition marketing strategies that position it effectively against competitors and give it the greatest possible competitive advantage.

Competitive analysis includes, firstly, the identification of the main competitors of the company based on the analysis of competition, both within the industry and in foreign markets. Second, it involves gathering information about the strategies, goals, strengths, weaknesses, and range of possible reactions of competitors by the company. With this information, a company can determine which competitors to attack and which to avoid. Competitive information must be constantly collected, interpreted and distributed using an appropriate information system to support decisions in the field of competition in foreign markets. The heads of international marketing departments and services of the company must receive comprehensive and reliable information about the actions and decisions of a competitor.

The preference for one or another international marketing strategy of competition is given depending on the position of the company in the foreign market and its goals, capabilities and resources. A competitive marketing strategy depends on what type of company the company is, whether it is a market leader, a challenger company, a follower company, or a company serving niche markets.

Competitor orientation is certainly an important aspect of a company's performance in today's global markets, but companies should not overdo it in this direction. Companies are more likely to be vulnerable to growing consumer needs and new competitors than to existing competitors in the industry.

Companies that pay equal attention to the actions of consumers and competitors - have chosen the right international marketing strategy, and are likely to succeed in both domestic and foreign markets.

Glossary

The firm's marketing environment - a set of active actors and forces operating outside the firm and affecting the ability of the management of the marketing service to establish and maintain relationships of successful cooperation with target customers.

Competitor - an important component of the company's marketing microenvironment, without taking into account and studying which it is impossible to develop an acceptable strategy and tactics for the company's functioning in the market.

Competition - the economic process of interaction, the relationship between the struggle of producers and suppliers in the sale of products, the rivalry between individual manufacturers or suppliers of goods and / or services for the most favorable production conditions.

Fundamental market niche- the set of market segments for which the product and/or service produced by the firm is suitable.

Polypoly (perfect competition) - a large number of sellers and buyers of the same product.

Monopoly - one seller confronts many buyers, and this seller is the only producer of a product that, moreover, does not have close substitutes.

- a relatively large number of manufacturers offer similar but not identical products, i.e. There are heterogeneous products on the market.

Oligopoly(small number of participants in competition) - a relatively small (within a dozen) number of firms dominating the market of goods or services.

Price competition - free market rivalry, when even homogeneous goods are offered on the market at a wide variety of prices.

Non-price competition - higher than competitors, the use value of the goods, when firms produce goods of higher quality, reliable, provide a lower consumption price, more modern design.

List of used literature

1. Kotler F. Fundamentals of Marketing. - M.: Economics, 1990

2. Pakhomov S.B. International marketing: work experience of foreign firms. – M.: “Ankil”, 1993

3. Garkavenko S.S. Marketing. – K.: “Libra”, 2002

4. Didenko N.I., Samokhvalov V.V. Fundamentals of international marketing. - St. Petersburg: "Polytechnic", 2000

5. Moiseeva N.K., Aniskin Yu.P. Modern enterprise: competitiveness, marketing, renewal. - M: Vneshtorgizdat, 1993. - 304 p.

6. Orekhov N.A., Lavrukhina N.V. Assessment of the competitiveness of industrial products. - Kaluga: MSTU, 1997. - 38 p.

7. Feoktistova E. M., Krasyuk I. N. Marketing: theory and practice. - M: Higher School, 1993.

8. Lipsits I.V. A business plan is the basis for success. M: Mashinostroenie, 1993. - 80 p.

9. Meskon M. Kh., Albert M. Fundamentals of management. - M: Higher School, 1988.

10. Meskon M.Kh., Albert M., Hedouri F. Fundamentals of management: Per. from English. – M.: Delo, 1999. – 800 p.

Application No. 1

Comparison of consumer properties and competitiveness

Application No. 2

Characteristics of the main types of competition.

| Types of competition | Features and Price Control | Sphere of greatest distribution |

| Perfect (pure) competition | A large number of enterprises that sell standard products; there is no price control; elastic demand; non-price methods of competition are not practiced; there are no barriers to business organization. | Production of agricultural products by farms |

| Monopolistic competition | A large number of enterprises that sell differentiated products; price control range is narrow; demand is elastic; non-price methods of competition are used; Barriers to market entry are low. | Retail |

| Oligopolistic competition | A small number of enterprises; the range of price control depends on the level of coordination between enterprises; predominantly non-price competition; significant obstacles to business organization. | Metallurgical, chemical, automotive, computer manufacturing |

| Pure monopoly | One company that produces unique products that have no effective substitutes; significant price controls; entry to the market for other enterprises is blocked. | Communications, utilities |

Tutoring

Need help learning a topic?

Our experts will advise or provide tutoring services on topics of interest to you.

Submit an application indicating the topic right now to find out about the possibility of obtaining a consultation.

Most modern markets are characterized as competitive. Hence the urgent need to study competition, its level and intensity, in knowledge of the forces and market factors that have the greatest influence on competition and its prospects. A preliminary but obligatory stage in the study of competition in the market is the collection and analysis of information necessary, ultimately, to select competitive strategies. The completeness and quality of the information collected largely determine the effectiveness of further analysis.

The main stage in the analysis of competition in the market is the assessment of the degree of exposure of the market to competition processes based on the analysis of the main factors that determine the intensity of competition.

Since the competitive environment is formed not only under the influence of the struggle of intra-industry competitors, the following groups of factors are taken into account to analyze competition in the market in accordance with the M. Porter model:

· rivalry among the sellers competing in this market ("central ring") - the situation in the industry;

• competition from goods that are substitutes - the impact of substitute goods;

Threat of emergence of new competitors - influence of potential competitors;

Positions of suppliers, their economic opportunities - the influence of suppliers;

· the position of consumers, their economic opportunities - the influence of buyers.

Each of the considered forces of competition can have a different impact on the situation in the industry, both in direction and in significance, and their total impact ultimately determines the characteristics of competition in the industry, the profitability of the industry, the company's place in the market and its success.

The main factors that determine the level of competition in the industry, combined into groups, as well as signs of their manifestation, are presented in Table 1.

Table 1. Factors of competition in the industry market.

| No. p / p | Competition factors | Signs of manifestation of factors in the market |

| 1. Situation in the industry | ||

| 1.1 | Number and power of firms competing in the market | There is a group of firms of equal power, or there is one or more firms that are clearly superior in power to the one being studied. |

| 1.2 | Change in effective demand | Effective demand for goods is falling, the forecast is unfavorable. |

| 1.3 | The degree of standardization of the product offered on the market | Firms-competitors are not specialized in the types of goods. The company's product and competitors' products are practically interchangeable. |

| 1.4 | The cost of switching a customer from one manufacturer to another | The costs of switching a client from one manufacturer to another are minimal; the probability of leaving the company's customers to competitors and vice versa is high. |

| 1.5 | Unification of services for goods in the industry | The set of services provided by firms-competitors of the firm's industry is generally identical in terms of goods. |

| 1.6 | Exit Barriers (Firm Costs of Repurposing) | The costs of leaving the company from the market for this product are high (retraining of personnel, loss of the sales network, liquidation of fixed assets, etc.). |

| 1.7 | Market entry barriers | Initial costs for deployment of works in the market of the given goods are small. The product on the market is standardized. |

| 1.8 | Situation in adjacent commodity markets (markets of goods with similar technologies and areas of application) | The level of competition in related product markets is high (for example, for the furniture market, markets for building materials, housing construction, etc. are related). |

| 1.9 | Strategies of Competing Firms (Behavior) | Some firms carry out or are ready to carry out an aggressive policy of strengthening their positions at the expense of other competitors. |

| 1.10 | Attractiveness of the market for this product | There is clearly expanding demand, great potential, favorable outlook |

| 2. Influence of potential competitors | ||

| 2.1 | Difficulties in entering the industry market | The amount of capital required to enter the industry market is not high. Efficient scale of production can be achieved fairly quickly. Firms in the industry are reluctant to use aggressive strategies against "newcomers" and do not coordinate their activities within the industry to reflect expansion into the industry. |

| 2.2 | Access to distribution channels | There are a large number of resellers in the industry market with little connection to manufacturers. Creating your own distribution network or attracting existing intermediaries to cooperation does not require significant costs for "newbies" |

| 2.3 | Industry Benefits | Industry enterprises do not have significant advantages over new competitors in terms of access to sources of raw materials, patents and know-how, fixed capital, convenient location of the enterprise, etc. |

| 3. Influence of suppliers | ||

| 3.1 | Uniqueness of the supply chain | The degree of product differentiation among suppliers is so high that switching from one supplier to another is difficult or expensive. |

| 3.2 | Importance of the buyer | Industry enterprises are not important (main) customers for supplier firms. |

| 3.3 | Share of an individual supplier | The share of one supplier mainly determines the cost of supply in the production of a product (single supplier). |

| 4. Influence of buyers | ||

| 4.1 | Buyer Status | There are few buyers in the industry. Basically, these are large buyers who buy goods in large quantities. The volume of their consumption is a significant percentage of all sales in the industry. |

| 4.2 | Importance of the product to the customer | Our product and similar products of our competitors are not an important part of the buyer's purchase list. |

| 4.3 | Product standardization | The product is standardized (low degree of differentiation). The cost of switching buyers to a new seller is negligible. |

| 5. Impact of substitute products | ||

| 5.1 | Price | Lower prices and the availability of substitute products create a price ceiling for our industry's products. |

| 5.2 | The cost of "switching" | The cost of "switching" to a substitute product (costs for retraining of personnel, correction of technological processes, etc. for a client when switching from our product to a substitute product) is low. |

| 5.3 | Main product quality | Maintaining the required quality of our product requires higher costs than for a substitute product. |

Thus, it becomes possible to assess the significance of factors by the degree of manifestation of their characteristics in the market of the product under study and to draw a conclusion about the general level of competition in this market.

The assessment of the degree of influence of each of the five forces of competition in the market thus obtained is a weighted average score:

where b ij

- score j

-th expert of the degree of manifestation i

-th factor;

n

- number of experts;

k i

- importance factor i

-th factor,

m

Based on the obtained weighted average score, the following conclusions are drawn (Fig. 1):

Fig.1. Assessment of the degree of influence of the strength of competition in the market

the level of competition is very high

,

,

where b max - weighted average score corresponding to the case of a clear manifestation of competition factors in the market, b cf - weighted average score corresponding to the case of weak manifestation of competition factors in the market;

the level of competition is high if the resulting weighted score falls within the interval

;

;

moderate level of competition if the resulting weighted score falls within the interval

,

,

where b min - weighted average score corresponding to the case of non-manifestation of competition factors in the market;

reduced competition power if the resulting weighted score falls within the interval

.

.

In addition, at the stage of analysis of competition factors, a forecast of the development of competition in the market is carried out on the basis of predictive estimates of changes in the action of each of the factors. The predictive assessment of the change in the effect of the factor corresponds, for example, to the following scores: "+1" - if the effect of the factor will increase, "0" - will remain stable, "-1" - will weaken.

Based on the obtained expert assessments of the forecast for the development of each of the factors, a weighted average estimate of the forecast for the development of competition forces in the market is determined:

where with ij

- score j

-th development forecast expert i

-th factor;

n

- number of experts;

k i

- importance factor i

-th factor,

m

- number of considered factors.

In the case when the weighted average estimate of the forecast falls within the interval (0.25; 1), it is concluded that increasing the level of competition power in the market, (-0.25; 0.25) - the level of competition strength will remain stable, (-1; -0,25) - go down(Fig. 2).

Fig.2. Evaluation of the forecast for the development of the level of competition strength in the market

25. Primary market demand. Demand factors: controlled, uncontrolled.

Primary or unstimulated demand - the total demand for all brands of a given product, sold without the use of marketing. This is the demand that “smolders” in the market even in the absence of marketing activities.

The evolution of demand can be generated by two groups of factors: uncontrollable, or external, and controllable, or internal, factors of the firm.

Controllable factors are essentially operational marketing tools that a firm can use to influence demand. These can be grouped into four broad categories, which McCarthy (1960) labeled the "Four Ps" from the initial letters of the English words Product, Place, in this context selling, Price, and Promotion (promotion, that is, sales promotion). They are the means of marketing pressure, that is, the determinants of demand for the company's products.

It should be noted that this method of determining active marketing variables is focused more on the firm and only to a small extent on the buyer. If viewed from an angle, from the point of view of the buyer, then the "Four R" correspond to:

1) a product, or a “solution” to the problem of the buyer, that is, a set of goods created;

2) price, the total cost incurred by the buyer in order to take advantage of the chosen solution;

3) place, or presentation of goods with the greatest convenience for the buyer;

4) promotion, or communication, informing about the merits of the proposed product.

Uncontrollable factors are constraints that a firm faces in the market. They can be grouped into five broad categories:

1. Constraints on the part of buyers: the firm must understand and anticipate their needs and respond to them with a program adapted to them and attractive to them.

2. Restrictions from competitors: the firm is not alone in the market and must determine its competitive advantage, which it is able to protect.

3. Restrictions on the part of distribution networks: distribution networks are independent intermediaries (wholesalers, distributors, retailers) who have their own goals, but nevertheless are necessary partners of the firm.

4. Constraints on the part of the company itself: the firm must adopt a plan of action consistent with its resources, strengths and weaknesses.

5. Situational restrictions: a set of environmental factors, economic, environmental, climatic, etc., that affect the level of demand.

Assessment of the intensity of competition

The level of intensity of the competitive environment is a determining factor in the construction of the marketing policy of the enterprise, in the choice of means and methods of competition. Its evaluation is a necessary element in the preparation of marketing campaigns.

There are three aggregated factors that determine the intensity of competition: the nature of the distribution of market shares between competitors, the growth rate of the market and its profitability.

1) Distribution of market shares between competitors and the intensity of competition.

For a more complete assessment of the intensity of competition and the distribution of market shares among enterprises, it is extremely important to refer to the experience of competition.

It is known from business practice that there is a certain critical proportion of the shares of two independent competitors, when the desire to change this proportion fades. Usually this proportion is defined as 2 to 1 or more.

The absence of a sharp difference in the values of market shares significantly increases the activity of enterprises in the struggle for competitive advantages. The weaker ones try to attack the closest competitors, who slightly outperform them in terms of market dominance. In turn, more powerful competitors seek to assert their position, which also requires some effort and is the cause of constant conflicts, even for minor reasons.

The greatest competitive activity is observed with an approximate equality of shares. In this case, when the market shares of competitors are equal, their strategies are often identical, which is a sign of an unstable, conflict state in the market. Τᴀᴋᴎᴍ ᴏϬᴩᴀᴈᴏᴍ, in the absence of clear leaders and outsiders, when the entire market of the product (product group) under consideration is represented by competitors owning equal market shares (ceteris paribus) – the intensity of competition is maximum.

An assessment of the intensity of competition in a given product market should be made by measuring the degree of similarity of competitors' market shares using formulas (1) and (2). For this, the student

US=1−s( S)

A, (1) or

(Si− SA)2US=1− × i=1

where US- an indicator of the intensity of competition in the product market under consideration, measured on the basis of an assessment of the degree of similarity of the shares of competitors; (S)– standard deviation of market shares of competitors; SA- arithmetic mean value of the competitor's market share; Si– market share i–of that competitor͵ i= l..... n; n- the number of enterprises (considered competitors, competing trademarks) in the considered product market.

The higher the coefficient of variation, the lower the inverse coefficient of variation and thus the lower the intensity of competition, and vice versa.

To determine the market share of various competitors, it is extremely important for the student to use secondary marketing information published in various sources. If such information cannot be found, proxy indicators can be used. Let's illustrate this with the following example. Suppose, with the help of a survey of consumers in the target market, indicators of the popularity of competing brands of goods are established. To do this, consumers were asked the question: “Which brand of this type of goods can you remember first?”. The share of consumers in the number of respondents who were the first to name this brand is an indication of the popularity of this brand. With a certain degree of assumption, the indicators of brand awareness can be considered equivalent to the market shares of these brands. The survey data are reflected in the table. four.

|

|

| 0,2 |

Product brands

Jasmine tea

Share of brand awareness Number of respondents, Share of brand awareness,

who chose the brand %

Share of fame, fractions of a unit 0,18

Tea "Bergamot" 11 Tea "Wild Berry" 2 Tea "Currant-11"

Fruit tea 13

A total of 45 respondents

24% 0,24 5% 0,05 24% 0,24

The calculation of the indicator of the intensity of competition is carried out according to the share of brands known, reflected in the last column of the table.

Determine the arithmetic mean: SA= 0,18+0,24+0,05+0,24+0,29 = 0,2

Now we calculate the standard deviation of the shares: s( S) = (0,18−0,2)2+(0,24−0,2)2+...+(0,29−0,2)2= 0,083

Then the competition index will be equal to: US=1− 0,083 = 0,586

2) The rate of market growth and the intensity of competition. Accelerated market growth even if competitors are equally powerful

can eliminate many contradictions between enterprises due to their satisfaction with the pace of development. High rates in rapidly developing markets are provided by growing demand and increase the market shares of enterprises not at the expense of competitors, but by increasing the number of consumers or volumes (multiplicity) of purchases by existing consumers. In this situation, the intensity of competition falls.

In a state of stagnation, stagnation, or limited, slow growth, an increase in the sales volume of an enterprise occurs mainly due to poaching consumers from competitors and / or a deterioration in the position of competitors. In this situation, the activity of competitive struggle increases significantly.

This fact is extremely important for the student to take into account in a comprehensive assessment of the intensity of competition. The main difficulty of such accounting

lies in the ambiguity in determining the boundary values of growth rates, beyond which the intensity of competition is minimal (the range of growth rates greater than 100%) or approaches the maximum (values of growth rates less than 100%). Business practice shows that most of the situations describing the dynamics of markets for specific products can be limited to two extreme values of the absolute annual growth rates of sales volumes: 70% and 140%. In this range of market situations, the values of the indicator of the intensity of competition are distributed, taking into account the growth rate of sales in the market under consideration (formula 3).

U = 2− T

where Ut- an indicator of the intensity of competition, taking into account the growth rate of the market; GT- the annual growth rate of sales in the commodity market under consideration, excluding the inflation component, %.

In case when GT more than 140% or less than 70%, Ut will be 0 or 1 respectively.

For values GT below 70%, the intensity of competition is significantly weakened and most often refers to already inactive markets associated with the termination of the sale of goods or with significant economic shocks to the markets.

Suppose that the rate of change in sales is characterized by the data presented in Table. 5.

Table 5 Rate of change in sales

|

|||||||

|

|||||||

| |

|||||||

| |

Time, quarter 1st 2nd 3rd

Sales, % 100 110 125

Inflation, % -11 11

Inflation-adjusted sales, % Growth 100 -

97,9 0,98 111,25 1,14

Then the average increase in sales will be 1.078 or 107.8% (which is more than 70% and less than 140%). Competition intensity indicator Ut will be:

Ut= 2−107,8 = 0,459

3) Market profitability and intensity of competition. Another important economic factor determining in-

The intensity of competition is the profitability ratio of the considered market ( R), determined by the ratio of the total profit received by enterprises in this market ( Pr), to the total sales volume ( Ex) (formula 4).

A market with high profitability is characterized by an excess of demand over supply. This circumstance makes it possible to realize the goals facing enterprises with relatively conflict-free methods and methods that do not affect the interests of competitors. With a decrease in the profitability of the market, the situation changes to the opposite side.

The profitability of the market shows the level of activity of the competitive environment of enterprises and reflects the degree of their "freedom" in the extraction of profit. The higher the profitability, the lower the pressure of the competitive environment and, consequently, the lower the intensity of competition and vice versa. This conclusion can be generalized in the form of formula (5).

UR=1− R, (5)

where UR- an indicator of the intensity of competition, taking into account the level of profitability of the market.

It is important to note that for situations with more than 100% profitability UR tends to 0, and in a loss-making business - to 1.

Indicator score UR can take many forms, in particular, it can be produced using the average trade margin applied in a given market. With an average trade mark of 19.5%, the indicator UR amount to

UR=1−0,195= 0,805

For the convenience of conducting a comparative analysis of the intensity of competition in various markets (market segments) and assessing their attractiveness (in terms of competitive activity), it seems useful to operate with a generalized characteristic of the intensity of competition, which makes it possible to clarify the results of the analysis of individual elements of the competitive environment of an enterprise (formula 6).

|

U = 3 US× Ut× UR, (6)

where U is a generalized indicator of competition intensity, 0< U < 1. Чем ближе U to one, the higher the intensity of competition.

Using the examples given, the generalized indicator U can be defined as:

U= 30.586×0.459×0.805 = 0.6

The level of competition is close to average.

Τᴀᴋᴎᴍ ᴏϬᴩᴀᴈᴏᴍ, the student, having completed the three stages of the analysis of the intensity of competition in the industry, will receive a general assessment of the activity of the competitive environment of the enterprise.

Topic: EVALUATION OF THE INTENSITY OF COMPETITION IN THE MARKET

The intensity of competition is inversely proportional to the degree of monopolization. The main indicators of the degree of market monopolization are: market concentration coefficient, Herfindahl-Hirschman index.

Market concentration ratio (CR). It is the ratio of sales (deliveries) of products by a certain number of the largest sellers to the total volume of sales (deliveries) in this product market for the corresponding period:

where CRn is the market concentration ratio

Si - the share of each specific market participant

After the letters CR, a number is added that shows the number of the largest enterprises on the market: CR3 (three-part), CR4 (four-part), CR6 (six-part), CR10 (ten-part).

Si \u003d Y Vi / Vm,

where Vi is the volume of sales (delivery) of goods by a specific i-th CS, thousand rubles (units);

Vm - the total volume of sales (supply) of goods, thousand rubles (units).

Solution example. Five companies compete in the city's consumer market. The market shares of these manufacturers are equal in %, respectively: 34, 21, 18, 15, 12.

Define CR3 = 0.34+0.21+0.18= 0.73

Define CR4 = 0.34+0.21+0.18+0.15 = 0.88

Both coefficients show low intensity in the market, the market is highly concentrated (monopolized).

The Herfindahl-Hirschman Index (HHI) characterizes the level of monopolization, the uniform distribution of market shares of firms in the analyzed market.

If the index is greater than 0.2 (0.18 for 4 or more firms), we are talking about a high concentration of the market. If there is only one firm present and operating on the market (pure monopoly), then the index reaches its maximum value, i.e. 1 (10,000 if the market share is measured in %). In this situation, state intervention is required to normalize the competitive environment.

In many countries, the HHI index is used as an indicator that determines the need for approval for mergers and acquisitions by the antimonopoly service.

Solution example. Five dairies compete in the city's consumer market. The market shares of these manufacturers are equal in %, respectively: 34, 21, 18, 15, 12. Let us define the state of competition using the index ННI = (0.34)І + (0.21)І + (0.18)І + (0 .12)I + (0.12)I = 0.229.

The index is more than 0.18, its value indicates a low intensity of competition, a high level of market monopolization.

There are three types of markets according to the intensity of competition:

Type I - highly concentrated (monopolistic), low intensity of competition:

70% < CR3 < 100% 0,7 ˂ CR3 ˂ 1,0 0,8 ˂ CR4 ˂ 1,0

2000< HНI < 10000 0,20 ˂ ННI ˂1,0 0,18 ˂ ННI ˂ 1,0

Type II - moderately concentrated (oligopolistic), moderate intensity:

45% < CR3 < 70% 0,45 ˂ CR3 ˂ 0,7 0,45 ˂ CR4 ˂ 0,8

1000< HНI < 2000 0,10 ˂ ННI ˂ 0,20 0,10 ˂ ННI ˂ 0,18

Type III - weakly concentrated (competitive markets), high intensity of competition:

CR3, CR4< 45% CR3, CR4 ˂ 0,45

HHI< 1000 ННI ˂ 0,10

Situation 1. Assess the degree of monopolization of the ferrochromium market (data from the FAS Report on the state of competition in the Russian Federation for 2014) in terms of concentration and the Herfindahl-Hirschman index.

Situation 2. The shares of the main economic entities operating in the market of tungsten concentrate in the territory of the Russian Federation (in terms of production volume) are given in the table. Determine concentration levels in terms of CR3, CR5 and HHI.

Situation 3. Based on the data in the table, use the HHI index to calculate in which industry it is more difficult for an organization to enter the market.

Situation 4. In industry A and in industry B, there are 10 firms each. At the same time, in industry A, the market share of the largest form is 49%, and the three subsequent ones, respectively, 7% each, and the remaining firms - 5% each.

In Industry B, each of the four large firms has a 19% share, and the next largest firm has a 14% share. The remaining 5 small firms equally divided 10% of the market.

Situation 5. Four major diamond producers compete on the Russian market: ALROSA, PO Kristall, Polyus, and Yakutalmaz. Their shares are respectively 0, 32; 0.28; 0.25; 0.15. Determine the state of competition using CR3, CR4, Herfindahl-Hirschman index.

Situation 6. There are 12 organizations represented in the building design market of city A. Determine the level of intensity of competition using CR4.

organization number | The volume of sales of services in comparable prices, thousand rubles. |

|

base period | reporting period |

|

Competition is rivalry between market participants (see 5.3). Studying it, we will first answer the question why the intensity of competition is different in different markets.

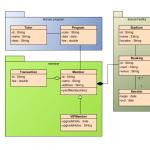

The most famous answer is five forces model of competition developed by an American Michael Porter(b. 1947). It analyzes the intensity of competition along its main lines (forces, as Porter calls them; there are five of them, hence the name of the model). Graphically, this model can be represented in Fig. 12.3.

The strength of rivalry between competing sellers of the same product is central to competition. Each company strives to take the best position in the market and gain an advantage over competitors. The following factors influence the intensity of rivalry between firms:

The number of firms operating in the market and the similarity of their sizes. The more similar firms in the market, the more intense the competition between them;

Rice. 12.3.

- the growth rate of demand in the market, as competition intensifies in slow-growing markets, and weakens in fast-growing ones (“there is enough pie for everyone”);