Complex cases of calculating vacation pay. Accounting for vacations and calculating balances of unused vacations Accrual of vacation pay in 1 with 8.2 accounting

According to the provisions of Chapter 19 “Vacation” of the Labor Code of the Russian Federation and the International Labor Organization Convention No. 132 “On Paid Leave,” all employees have the right to leave. In the article, methodologists from the 1C company consider issues related to the reflection of annual paid leaves (main and additional) in 1C: Salary and Personnel Management 8. The procedure for setting up the initial parameters for accounting for vacations by the personnel officer and the accountant is given, as well as for forming estimated obligations for employee benefits in the program.

Every employee working under an employment contract has the right to leave - this is enshrined in paragraph 5 of Article 37 of the Constitution of the Russian Federation and is reflected in Chapter 19 “Vacation” of the Labor Code of the Russian Federation, according to the provisions of which leaves are divided into the following types: annual paid (main and additional), without pay, educational leave, parental leave.

The provisions of the Labor Code of the Russian Federation on annual paid leave do not contradict the International Labor Organization Convention No. 132 “On Paid Leave,” which for the Russian Federation came into force on September 6, 2011, and in some ways provide even broader guarantees for workers.

The task of accounting and calculating vacation essentially consists of several parts.

On the one hand, this is the task of calculating and accounting for the number of allotted vacation days, and on the other hand, this is the task of calculating the amount of vacation pay and calculating average earnings. In addition, this is a task of cost accounting and liability assessment.

An employee is entitled to 2.33 days of vacation for each full month worked.

Why exactly 2.33? If an employee has worked in an organization for 12 months, which includes the vacation itself in accordance with Article 121 of the Labor Code of the Russian Federation, then he is entitled to an annual vacation of 28 calendar days. Therefore, one month has 28 days: 12 months. When calculating the terms of work that give the right to compensation for leave upon dismissal, surpluses amounting to less than half a month are excluded from the calculation, and surpluses amounting to more than half a month are rounded up to a full month (clause 35 of the Rules “On Regular and Additional Leaves” , approved by the NKT of the USSR dated April 30, 1930 No. 169).

Let's see how you can solve the problems of accounting for annual paid leave using the 1C: Salary and Personnel Management 8 program.

Initial settings

Parameter for accounting for vacation balances

First you need to decide on the accounting settings. It is necessary to decide which document - a personnel order for leave or a settlement document for accruing leave - will register the fact of using leave in the system. Actual vacations are written off when conducting personnel or payroll documents. The write-off procedure is determined for each organization in the accounting parameters. Vacation compensation, regardless of the chosen order of writing off actual vacations, is always recorded in vacation balances using settlement documents. By setting the accounting option in the program settings Vacation balances will be reduced when actual vacations are registered - by personnel orders or Payment documents- When generating reports, you should ensure that documents of the specified type are posted.

Vacation income code

It is important to decide what policy you will follow when calculating personal income tax on vacation pay amounts. Will vacation, as in the standard setting, be considered payment for labor or will it be other income in cash. This is important for calculating personal income tax on transferable holidays. Vacation income code for calculating personal income tax - 2012. Let us recall that the date of receipt of income is determined by Article 223 of the Tax Code of the Russian Federation. The date of receipt of income for income in the form of wages is considered to be the last day of the month for which the income is accrued, and for other income in cash - the day the income is paid (or accrued). That is, the whole question is about what period the personal income tax will apply to - to the month in which the vacation was accrued or for which. The standard setting can be changed by adding your own code, for example, 2012 in the directory Income codes for personal income tax, saving Reporting code - 2012(Fig. 1). And then the personal income tax will apply to the same period in which the vacation was accrued.

Rice. 1

In the directory Income code for calculating personal income tax it is possible to specify The procedure for accounting for income when calculating personal income tax.

Example

Vacation in September is accrued for October and November.

Using order By month for which accrual is made (1)

With the specified procedure for accounting for income, personal income tax will be registered in two parts, in the months for which vacation is accrued - October and November, respectively. Tax deductions will be applied for both October and November.

Those. It does not take into account when the income was accrued, but it is important for what months.

Using order By month of accrual

With this procedure for accounting for income, personal income tax will be registered at a time in the month in which the vacation is accrued - September. Tax deductions will be applied only for September.

Those. it is taken into account only when income was accrued, no matter for which months.

Currently, for vacation (income code 2012), the law corresponds to the procedure By month of accrual.

How to change the setting if the order was previously used By month for which the accrual is made?

By changing the setting in the directory Income code for calculating personal income tax for code 2012, we will get that all newly created documents will be registered in accordance with these settings, but previously entered ones will remain unchanged. To obtain a reliable calculation and report on personal income tax, it is desirable that throughout the year personal income tax is calculated in accordance with the same procedure.

To do this, you will need to repost the documents after completing the setup. Payroll payments to employees of organizations.

Particular attention should be paid to vacations moving into January from December. They were not included in the report last year because, in accordance with order (1), they belonged to January. And this year it is necessary either not to transfer the documents related to them Payroll payments to employees of organizations, or after re-conducting, generate a corrective report for the previous year.

Types of main and additional leaves

The default duration of vacation is 28 days. But there are certain categories of workers who have different vacation durations. So, for example, for teaching staff, on the basis of Decree of the Government of the Russian Federation dated October 1, 2002 No. 724, the duration of vacation is from 42 to 56 calendar days, for candidates of science - 36 calendar days (Resolution of the Government of the Russian Federation dated August 12, 1994 No. 949), for some employees healthcare - 36 calendar days (Resolution of the Government of the Russian Federation dated 04/03/1996 No. 391), etc.

In the 1C: Salary and Personnel Management 8 program, types of annual leave are stored in the directory of the same name Types of annual leave.

For each type of annual leave entered into the directory, it is necessary to indicate in which days the number of vacation days allotted for the year should be counted: in calendar days or working days. The handbook should also indicate whether this annual leave will be granted to all employees (activate the checkbox Provide leave to all employees).

Directory of Organization Positions

If a certain type of annual leave is not provided to all employees, this must be indicated in the handbook Organization positions on the bookmark Annual holidays(Fig. 2).

Rice. 2

Calculation type plans for additional holidays

An accrual for calculating additional leave or several accruals, if the organization uses different types of additional leave, must be configured in terms of calculation types Basic charges. On the bookmark Calculations indicate the name, install Calculation method, usually - Average for vacation by calendar days.

On the bookmark Time the checkbox must be checked Type of time - Unworked full shifts and business trips, and select the appropriate type from the working time use classifier. Exactly the type of time according to the classifier Additional leave determines the visibility and availability of this accrual in the vacation order in the column - Type of additional leave.

In order for balances by type of annual leave to be correctly calculated when posting a settlement document, it is necessary to indicate the type of annual leave in Main or Additional charges on the bookmark Usage.

On the bookmark Taxes in accordance with the previously selected policy for accounting for personal income tax on vacation pay, we indicate either a standard code 2012 , or defined by us earlier 2012.

Bookmark Contributions filled out as usual. This is income that is entirely subject to insurance premiums.

When filling out a bookmark Other We can advise you to take the standard type of accrual as a sample - Vacation by calendar days and fill in the same way.

Accounting for vacations by personnel officer

Let's consider what tasks an employee of the HR department faces in accounting for employee vacations.

In addition to taking into account the terms of work that give the right to vacation or monetary compensation for it, the personnel officer should, in accordance with Article 123 of the Labor Code of the Russian Federation, maintain a vacation schedule. The vacation schedule is mandatory for both the employer and the employee.

Vacation schedule

The organization's vacation schedule can be entered based on the management vacation schedule if management accounting is maintained (menu Personnel accounting - Accounting for absenteeism - Entering the vacation schedule of organizations), or you can simply fill it with a list of employees. When filling in the start and end dates of vacation in the column Note the program will tell you for what period the vacation is planned (Fig. 3).

Rice. 3

From this document you can obtain a report in form T-7 and a convenient diagram that allows you to visualize the intersections of vacations (Fig. 4).

Rice. 4

In the shape of Remaining vacations(menu Personnel accounting - Absenteeism accounting) you can edit your vacation balances, get a vacation certificate, and you can also set an individual vacation duration by clicking the button Change the number of vacation days per year. Here you can change your vacation balances by clicking the button Edit vacation balance. Based on this information, a report is generated Vacation information.

If the accounting settings indicate that the fact of using leave will be recorded in a personnel document, then posting the leave order itself, as well as corrections to it in case of any changes, is mandatory.

From the document Vacations of the organization You can print an order to grant leave to employees using forms T-6 and T-6a.

Additional leave

In addition to the regular annual paid leave, some categories of employees also have the right to additional paid leave. Additional leave may be provided for by the Labor Code of the Russian Federation, other regulations, in accordance with the labor (collective) agreement. Additional leaves, including for employees engaged in work with harmful and (or) dangerous working conditions, for the special nature of the work, for employees with irregular working hours, are provided for by , , , 321 of the Labor Code of the Russian Federation. When determining the right to additional leave for hazardous professions, one should be guided by the list approved. Resolution of the State Labor Committee of the USSR and the Presidium of the All-Union Central Council of Trade Unions dated November 21, 1975 No. 273/P-20.

Initially, in the field settings of the personnel leave order, fields for entering additional leave are not visible. To make them available in document form Vacations of organizations right-click to bring up the menu and select List setup. Mark fields Type of additional leave, start of additional vacation, days and press the button OK.

These fields are now available for viewing and editing. The start and end dates of vacation are entered taking into account additional vacation, while additional vacation is indicated “including”.

Can an order be issued only for additional leave? Yes. And then both fields: Start of vacation And Start of additional leave filled out equally - vacation and additional vacation coincide.

Is it possible to apply several additional holidays to one employee with one order? Yes. But for each additional vacation there is a separate entry.

Example

|

Annual paid leave for employee of Taon JSC G.A. Illarionova from March 1 to March 30, 2012, including 3 days of additional leave for harmful activities and 2 days for irregular working hours. If in the field Remind If you put a flag on a vacation order in an organization, this will mean that the employee will be listed as on vacation until the HR department employee submits the document Return to work organizations. In our example, the return date is April 1, 2012. If the props Remind If the vacation order in the organization is empty, then the fact of returning to work occurs automatically from the date following the end date of the vacation. Installing and removing the flag Release/Occupy bid important when Setting up HR parameters flag set Control the number of rates according to the staffing schedule during personnel changes. |

When issuing a dismissal order, the number of vacation days subject to compensation, as well as the days for which previously accrued vacation should be withheld, are entered automatically.

Accounting for vacations by the settlement department

Based on the entered personnel documents, the accountant generates settlement documents.

Please note that if for some reason personnel records are not maintained in the 1C: Salaries and Personnel Management 8 program, then you can immediately enter the payment document .

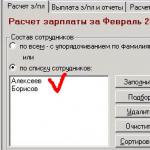

Using Processing No-show analysis significantly increases the efficiency of interaction between the HR and accounting departments. It is convenient for a payroll clerk to do the following, for example. Generate a list of all personnel leaves in the specified processing for the month. And then, going through the primary signed documents, check the box for those electronic documents that have corresponding orders signed by management. And then immediately create all settlement documents, calculate and process them by pressing the corresponding buttons in processing in sequence (Fig. 5).

Rice. 5

In some cases, processing cannot be fully automated. For example, in our example with two additional holidays. In the settlement document Accrual of vacation to employees of organizations corresponding to the second additional leave should be edited Vacation start date. This date must be set the same as in the first document (03/01/2012) so that the calculation of average earnings is the same.

To do this you can Open settlement document directly from the processing form (Fig. 6).

Rice. 6

In the form of a settlement document Accrual of vacation to employees of organizations main leave, additional leave and compensation for leave are calculated.

Cash compensation can replace part of the vacation.

To calculate compensation for unused vacation upon dismissal in accordance with Article 127 of the Labor Code of the Russian Federation, another document is intended - Calculation upon dismissal of an employee of an organization(menu Payroll calculation by organization - Primary documents).

Please note that after completing the “calculation upon dismissal”, you should make a “salary calculation”, i.e. enter a document Payroll for employees of organizations for the person being dismissed (or recalculate if such a document already existed) in order to take into account personal income tax.

Provisions for employee benefits

Starting from reporting for 2011 in accordance with PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets”, all organizations, with the exception of credit institutions and state (municipal) institutions, are required to reflect estimated liabilities in their reports. Small businesses, except for small businesses - issuers of publicly offered securities, may not apply this PBU (clause 3 of PBU 8/2010).

Estimated liabilities in accounting, subject to the conditions of paragraph 5 of PBU 8/2010, are expenses for payment of upcoming vacations and remunerations at the end of the year.

In order for accounting to reflect estimated liabilities and generate postings, in the 1C: Salary and Personnel Management 8 program you need to Setting up accounting parameters on the bookmark Estimated liabilities check the box Formation of estimated liabilities in accounting.

At the request of the organization, estimated liabilities for wages recognized in accounting can also be recognized in tax accounting in accordance with Article 324.1 of the Tax Code of the Russian Federation.

A detailed example of accounting for estimated obligations for employee benefits in “1C: Salary and personnel management 8” can be found in the ITS PROF information system in the “Personnel and remuneration” section - Directory “Personnel accounting and settlements with personnel in 1C programs” - "Accounting setup"

The issue of calculating employee leave and accruing vacation pay becomes especially relevant for accounting during the holiday season. A special configuration - 1C Accounting 8.2 - will help the accountant in this matter. Let's look at an example of calculating vacation pay in it.

To perform certain actions in this version, you need to fill out some directories by entering the data necessary for calculations. To calculate vacation pay, you need to check the reference book, which is called “Plans for types of calculations”. It stores data on accruals and deductions of organizations. It is important to identify the presence in the directory of an element corresponding to a vacation.

When opening 1C in the “1C: Enterprise” mode, you need to select the “Operations” main menu item, then click on the “Plans for calculation types” button. A new window will open in which we select “Basic accruals of organizations.”

In the open directory, in addition to other accruals, there are elements that are responsible for vacation. We need an element called “Vacation Pay (A3)”.

It is necessary to fill out several options on this card, which are necessary for calculating vacation pay. You should start by filling out the data on the “Basic” tab, then go to the “Base for calculations” tab. The figures show an example showing the parameters of the most general case.

After completing the steps described above, we will proceed with the accrual. We propose to consider in detail the operation of adding leave for employees.

You need to open a new payroll document. Depending on personal need, we fill it out and calculate it either as a list or one employee at a time. The picture shows the accrual for one employee.

Having carried out an automatic calculation, we will see that the program did not display vacation pay in our document. This type of accrual will have to be added manually separately. To do this, press the button with the “+” sign or the “Insert” key in the tabular part of the calculation. Next, you need to add an accrual type. This can be done by successively pressing the “…” buttons in the “Accrual” column, and then in the window with accruals by selecting the “Vacation Pay (AZ)” item.

Then we set the start and end dates of the vacation in the appropriate columns. It is necessary to pay attention to the fact that the base period, which will switch automatically, must be selected corresponding to the accrued month. After that, we will set the amount. For example, it will be equal to 500 rubles

Please note that the salary remained unchanged, but the total amount payable increased. To prevent overpayment, we eliminate the resulting discrepancy by changing the number of days worked for a specific employee in the salary line. The days spent on vacation must be subtracted from the total number of days worked. Having completed this operation, click the “Calculate” button and the “Calculate by employee” menu item.

After completing the above steps, the salary will be calculated again, as a result of which the numbers will take the desired form.

Then, to correctly calculate accruals and deductions, it is worth re-filling and calculating manually in all tabs of the table. This is necessary because the accrual amount has changed, and now contributions need to be recalculated. Thus, we select an employee, click on the “Fill” - “Fill by employee” button, and after that “Calculate” - “Calculate by employee”.

After the amount has been verified and clarified, you need to go to the “Transactions” tab and generate them by clicking the corresponding button.

To complete the accrual of vacation pay, press the “Record” and “OK” buttons in sequence. Let us note once again that we considered the most general case, for which the described actions are sufficient. Depending on the situation, you may have to resort to additional automation methods within the calculation itself.

If it doesn’t work out for you, then our specialist can come and.

Let's set it up. Let's connect. We'll fix it. Let's find error 1c.

Which were discussed in most of the latest articles, and talk about the very useful and long-awaited salary accounting documents that appeared in Enterprise Accounting 3.0. We're talking about documents. "Sick leave" And "Vacation". They appeared in BUKH 3.0, starting with release 3.0.35, which was released in September 2014. However, I would like to immediately note that such an opportunity exists only for organizations that employ less than 60 people. But for small organizations that do not have the opportunity or desire to buy even the cheapest basic version of 1C ZUP (*only 2,550 rubles), this is a very useful update. It will make life easier for many people. accrual of vacation and sick leave in 1C Accounting enterprise edition 3.0.

Let me remind you that there are a number of articles on the site devoted to payroll calculation in ACCOUNTING 3.0:

Setting up the calculation of vacation and sick pay in 1C Enterprise Accounting 3.0

In order for it to be possible to enter a “Vacation” document in ACCOUNTING 3.0, you must open the “Accounting Policy” of the program (section of the main menu “Main”) and check the box on the “Salaries and Personnel” tab “Keep records of sick leave, vacations and executive documents” workers. Here you can see the restriction on the use of these documents, which I spoke about in the introduction: “Available if the information base does not contain organizations with more than 60 employees”.

Document “Vacation” in 1C Enterprise Accounting 3.0

As for the “Vacation” document itself, it is quite simple. You must select the accrual month, employee, and indicate the vacation period. As for the period in the field “Provided for the period of work from: ... to ...”, then in this field you must indicate the working year for which the leave is granted. Let me remind you that the first working year for each employee begins from the date of admission and lasts exactly a calendar year ( Exceptions: for example, vacation days at your own expense fall outside this period, so the calendar year may be extended). During this year he has the right to 28 calendar days. My employee was hired on 01/01/2014. Therefore, in this field the period from 01/01/2014 to 12/31/2014 is entered. Average earnings and accrual amount are calculated automatically when you enter all the necessary data.

It may happen that you do not have enough data in your database about an employee’s earnings to calculate vacation pay. For example, the database began to be maintained on January 1, 2014, and vacation is calculated in December. As in my example. This means that the employee’s salary for December 2013 should be included in the calculation base. This information is not in the database, so we must manually enter the missing information. This is done using the window that opens when you click the “Edit” button.

In addition to the amount of income, you also need to enter number of calendar days. Separately, I would like to note that it is worth considering the feature calculating calendar days in months which employee did not work completely. You can read how this indicator is calculated in the theoretical part of this article.

There is another bookmark in the “Vacation” document - "Accruals". It generates accrual by type of accrual "Primary vacation" with the calculated amount and period. If absolutely necessary, you can edit the amount here, but this is not recommended. It is better to ensure that the required amount is calculated automatically. And please also note that personal income tax is not calculated here; it will be taken into account in the “Payroll” document.

In our example, the employee has the right to a salary calculated in proportion to three days worked from December 1 to December 3. The program will do this during the final calculation in the document "Payroll". The program itself will recalculate the salary. Previously, 1C Enterprise Accounting did not support this feature.

Pay attention to the composition of the bookmarks in this document. The first tab contains summary data on the employee’s main accruals (including vacation pay), as well as information on withheld personal income tax and accrued contributions. This seems to me a very convenient and visual solution.

Calculation of sick leave in 1C BUKH 3.0

- Number of certificate of incapacity for work;

- Indicate whether it is a continuation of another sick leave (you should select the primary document);

- Cause of disability - please note that this document can be used to calculate not only standard cases of disability, but also many others. In particular, "Maternity leave". Read more about the theoretical features of calculating this benefit. From a practical point of view, there is no difference in the calculation of regular sick leave and “Maternity Leave” in ACCOUNT 3.0, so I will analyze the document “Sick Leave” within the framework of regular sick leave;

- Exemption from work from ... to ... - period of incapacity for work;

- Reduce benefits for violating the regime - indicated if such a fact occurred, officially reflected in the certificate of incapacity for work;

- The percentage of payment is entered depending on the length of service of the employee. Unfortunately, 1C BUKH 3.0 does not yet support accounting for length of service and therefore this indicator will have to be entered manually;

- Accrued - the program calculates automatically, based on the entered data and the employee’s earnings. You can read more about how, from the legal point of view, sick leave should be calculated.

Now note that the average salary of the employee in the example is very small, calculated from the minimum wage. The thing is that the employee was hired in November 2014 and there is no information about his earnings in the database. Unfortunately, Bukh 3.0 does not provide a document for entering such information, so you will have to use the “Change” button and enter this data manually.

By the way, in this window there is a rather convenient button in the form of a question mark, when clicked, a transcript of the calculated average earnings opens. After entering, click OK and the document should be recalculated.

And now I'll tell you how do not enter this information every time. If this employee again needs to create a “Sick Leave” document, enter it by copying. Copy the previous document, which already contains information about earnings, and simply change the period and month of accrual.

Go ahead. There are two more bookmarks in the document. In chapter "Additionally" we will see the benefit limit setting. This parameter is set automatically when you select the type of benefit. Here you can also select a benefit if the employee is entitled to one. On the bookmark "Accruals" the accruals themselves are formed. In this case, the entire sick leave is divided into two types of accrual: “Sick leave at the expense of the employer” (for the first three days) and “Sick leave”.

In addition to sick leave, the employee must also receive a salary calculated in proportion to the days worked. The program will make this calculation automatically when filling out the “Payroll” document.

That's all I wanted to talk about today!

How to calculate vacation pay in 1C 8.2?

At the height of the vacation season, it is natural for accounting to calculate the vacation of employees and accrue vacation pay. Examining such common 1C 8.2 configurations as “Trade Enterprise Management” and “Accounting”, we can note that if in the first the accrual of vacation pay is provided by the developer, then in the second, in “Accounting” there are no separate documents for this action. But there is a company, employees go on vacation and it is necessary to accrue it.

Therefore, we will consider the example in a configuration less prepared for our purpose, namely in 1C Accounting for Ukraine 8.2.

Those who have been using the program for some time have already found out for themselves that 1C version 8.2, in order to perform actions, requires filling out a certain number of directories and entering into them the data necessary for calculations. Likewise, to calculate vacation, you need to check the directory called “Plans for types of calculations,” which stores data on accruals and deductions of organizations. Namely, the presence in it of an element corresponding to the release.

Open 1C in mode 1:Enterprise and select the main menu item “Operations”, the button “Plans for types of calculations”. In the window that opens, select “Basic accruals of organizations.”

In the directory that opens, along with other types of accruals, there should be elements responsible for vacation. Let’s open the “Vacation Pay (AZ)” element.

The vacation pay card contains a number of options that must be filled out to accrue vacation pay. First, we fill in the data on the “Basic” tab in a similar way, then the parameters on the “Base for calculations” tab. For the most general case, the parameters of the vacation card are shown in the figures. If the data is displayed small, just click on the picture, it will be displayed in a larger format.

After checking the presence or creating/filling in the data of the vacation accrual accounting element, let’s turn to the accrual itself. The payroll process was ours, so now we will focus on a detailed examination of the operation of entering leave for an employee.

Open a new payroll document. We fill it out and calculate it either as a list or one employee at a time, depending on how we need it. In our example, for greater clarity, we make calculations for one employee.

After the automatic calculation, we will notice that the program did not display vacation pay in our document. This type of accrual must be added manually. Press the button with the green “+” sign or the “Insert” key while in the tabular part of the calculation.

By successively pressing the keys, first in the “Accrual” column, the button marked “…”, then in the window with accruals, the item “Vacation Pay (AZ)”, add the type of accrual.

Next, set the beginning and end of the vacation in the appropriate columns. Please note that the automatically switched base period in the next two columns must be selected equal to the accrued month, that is, reset it from the beginning to the end of the month. Set the amount. For example 500 UAH.

Please note that the salary remained unchanged, the total amount payable increased. To prevent overpayment, we will eliminate the discrepancy by changing the number of days worked for this employee in the salary line. Subtract the number of days spent on vacation from the total number of days worked. After that, to put the salary in order, click the “Calculate” button and the “Calculate by employee” menu item.

As a result, the salary will be calculated again, the numbers will take on the desired appearance and size.

Next, to correctly calculate accruals and deductions, we re-fill and calculate manually in all the necessary tabs of the table for the employee. This must be done due to the need to recalculate contributions due to a changed accrual amount. Those. select an employee, click “Fill”, then “Fill by employee”, then “Calculate” - “Calculate by employee”.

After reconciliation and complete clarification of the amounts, go to the “Transactions” tab and generate accounting entries by clicking the appropriate button.

Click “Record” and “OK”. The accrual of vacation pay is now complete. Naturally, additional automation methods are possible within the calculation itself, but for the most general case the method is sufficient.

Download illustrated instructions:

Rate this article:

The accounting program 1C 8.3 allows you to accrue vacation pay to employees, although previously this was possible only in the 1C: ZUP configuration, and vacation accrual in 1C: Accounting was carried out by creating a separate type of accrual.

Setting up accounting parameters

In order for accrual to be available, in the form of accounting parameters, you need to set a note about the accrual of sick leave, vacations and executive documents - the menu item “Administration-Accounting Parameters-Salary Settings”.

Fig.1 Go to the accounting parameters section

Fig.2 Go to the settings menu

Fig.3 Direct settings

This setting is available for small companies; if up to 60 employees are kept in the database, then use the “Salary Accounting Procedure” hyperlink, and if necessary, set up the formation of a leave reserve – the “Vacation Reserves” tab.

Fig.4 Window for setting up the formation of vacation reserves

Accrual of vacation pay in 1C

Once the settings are completed, the document “Vacation-Salary and Personnel-Salary” will be available in the accrual journal.

Fig.5 Salaries and personnel

By clicking the “Create” button in the “All accruals” document journal, we see the “Vacation” document.

Fig.6 Creating a document

We fill out the form that opens - the date of the document, select an employee, indicate the start and end date of the vacation. The period for which leave is granted is indicated below. At the same time, based on the data on the accrued salary in the program, the amount of accrued vacation and personal income tax is automatically calculated.

Fig.7 Filling out the document

You can check the calculation of average earnings and the accrued amount of vacation pay by clicking on the “Accrual” hyperlink.

Fig.8 Calculation of vacation pay in 1C 8.3 based on average earnings

The table reflects the amounts accrued for the previous 12 months of salary, time worked and calculation of average earnings. If there is no data in the program, it can be corrected here manually.

The table below shows accruals based on the established vacation days. It is clear that part of the vacation falls in the month of October, the remaining days in November. Accordingly, in the program the amount of vacation pay is divided into two parts - from 10/15/18 to 10/31/18 and 11/01/18 to 11/12/18.

Fig.9 “Personal Income Tax” calculation window in the “Vacation” document

Next we carry out the document. In some cases, when posting a document, an error may appear: “The document date cannot be greater than the planned payment date.” What to do? After all, the “Payment date” field is not in the document. What's the catch?

Fig. 10 Error when posting the “Vacation” document

It would be more correct to change the date of the document (vacation accrual), because Payment for vacation must be made by the employer no later than three days before it starts. This provision is enshrined in the Labor Code, where the period for payment of vacation pay is specified in Article 136, Part 9. When the payment date falls on a non-working day or holiday, the transfer or issuance of funds to the employee must be made the day before. Thus, payment of vacation pay must be made before it begins.

And if you still need to correct the date of payment of income, but by default the “Payment date” field is hidden, you need to go to the “More” button, click “Change form”, add a checkbox “Payment date” in the “Main” subsection, and then this field will be available in the document form when filled out.

Fig. 11 Document menu “Vacation” for editing the form

Fig. 12 Document form settings window

Fig. 13 “Vacation” document form with the “Payment date” field

In printed forms of the document, the “Order for granting leave (T-6)” and the “Calculation of average earnings” form are available - the “Print” button.

Fig. 14 Selecting the printed form of the “Vacation” document

Fig. 15 Printed form of order T-6

Fig. 16 Printable form for calculating average earnings

By pressing the button

“Show postings and other movements of the document”, we see that the postings for accruing vacation and for deducting the amount of accrued personal income tax from it are reflected. The accrual account debit is set depending on your organization's setup.

Fig. 17 Accounting entries generated by the “Vacation” document

By clicking the “Pay” button from the document, the program will prepare documents for the payment of vacation pay - “Statement to the Bank” or “Statement to the Cashier”, documents “Payment Order” for the payment of vacation pay and payment of taxes. If you do not need to generate all these documents, then you can arrange the payment of vacation pay yourself in the journals “Vedomosti to the Bank” or “Vedomosti to the Cashier” - menu item “Salaries and Personnel”.

Fig. 18 “Pay” button for generating payments according to the “Vacation” document

Fig. 19 Generating payment documents from the “Vacation” document

Fig. 20 The document “Statement to the Bank” generated through the “Payment” button from the document “Vacation”

Fig. 21 Transition to journals of documents on payments to employees through a cash desk or bank

Go to the menu item “Salaries and personnel - Salary reports - Payslip”.

Fig. 22 Reports from the “Salary” section

Fig. 23 Reflection of vacation accrual on the employee’s pay slip

The formation of a payslip shows how the accrual of vacation for the employee was reflected.