Acquisition of fixed assets through two sources of financing. Acquisition of a fixed asset through two sources of financing Accounting for fixed assets through other subsidies

2. ACCORDING TO THE BIDDING, A CONTRACT WAS CONCLUDED FOR THE PURCHASE OF MOBILE BUILDINGS. PAYMENT WAS MADE WITH A SUBSIDIATION FOR OTHER PURPOSE KFO 5 AND INCLUDED IN ACCOUNTING FOR KFO 5. OUR INSTITUTION IS LOCATED IN NORILSK AND DELIVERY IS CARRIED OUT BY WATER. THE CONTRACT WAS NOT PROVIDED FOR DELIVERY TO NORILSK AND WE HAD TO CONDUCT BIDDING FOR THE DELIVERY OF THESE BUILDINGS. THE COST OF THE DELIVERY SERVICE WAS 300,000.00 RUBLES. PAYMENT WAS MADE WITH A SUBSIDIARY FOR THE PERFORMANCE OF THE STATE TASK KFO 4. WE SHOULD ASCRIBE THESE COSTS TO THE COST OF MOBILE BUILDINGS. QUESTION: HOW TO LINK KFO 5 AND KFO 4???

Answer

Fixed assets and intangible assets acquired using targeted subsidies (KFO 5) should be taken into account according to KFO 4 “Subsidies for the implementation of state (municipal) tasks.” That is, in accounting there is no need to link the costs of purchasing and delivering buildings, since first all costs are accumulated in account 4.106.11.310, and then are charged to the formation of the initial cost of the fixed assets. More details on how to record the acquisition of fixed assets at the expense of KFO 5 and transfer to KFO 4 are described in situation 1.

Budgetary institutions, in addition to subsidies for reimbursement of regulatory costs associated with the provision of state (municipal) services (performance of work) to individuals and (or) legal entities, are provided with subsidies for other purposes (Article 78.1 of the Budget Code of the Russian Federation). We will discuss in our article what accounting records reflect the operations for accounting for fixed assets acquired through this source of financing.

General provisions on the provision of subsidies for other purposes

The procedure for providing subsidies to budgetary institutions for other purposes is approved:

- in relation to federal budget funds - a government body performing the functions of the founder. As an example, we can cite the orders of the Ministry of Culture of the Russian Federation dated January 16, 2012 No. 3 “On approval of the Procedure for providing subsidies from the federal budget to the State Hermitage”, the Federal Tax Service of the Russian Federation dated April 27, 2012 No. MMV-7-5/281@ “On approval of the Rules for the provision in 2012 - 2014 from the federal budget to federal budgetary institutions, in respect of which the Federal Tax Service exercises the functions and powers of the founder, subsidies for purposes not related to the reimbursement of standard costs for the provision of public services,” the Ministry of Agriculture of the Russian Federation dated January 17, 2012 No. 70 “On approval of the Rules for the provision The Ministry of Agriculture of the Russian Federation in 2012 - 2014 from the federal budget provided subsidies to subordinate federal educational budgetary and autonomous institutions for other purposes";

- in relation to budget funds of subjects RF - authority of a constituent entity of the Russian Federation. An example of such a regulatory act is the Decree of the Government of the Moscow Region dated April 17, 2012 No. 507/14 “On approval of the Procedure for determining the volume and conditions for providing subsidies for other purposes to state budgetary and autonomous institutions of the Moscow region”;

- in relation to municipal budget funds - municipal government body (see, for example, the resolution of the administration of the Chekhov municipal district of the Moscow Region dated April 10, 2012 No. 421/10-1 “On approval of the Procedure for determining the volume and conditions for the provision of subsidies for other purposes to municipal budgetary healthcare institutions of the Chekhov municipal district”, administration of the city N. Novgorod dated February 13, 2012 No. 505 “On approval of the procedure for determining the volume and conditions for providing subsidies from the budget of the city of Nizhny Novgorod to municipal budgetary and municipal autonomous institutions of the city of Nizhny Novgorod for other purposes”).

The normative act establishing the rules for providing subsidies to budgetary institutions for other purposes (hereinafter referred to as the Procedure for providing subsidies for other purposes) states that the subsidy is provided to the institution within the limits of budgetary allocations provided for by the budget law for the corresponding financial year and planning period, and limits of budget obligations approved in accordance with the established procedure by the budgetary institution. The provision of a subsidy to an institution is carried out on the basis of an agreement on the provision of a subsidy concluded between the body exercising the functions and powers of the founder and the institution. The need for an agreement and the list of conditions that must be contained in it are prescribed in the Procedure for providing subsidies for other purposes. Typically the agreement provides for the following terms:

- volume, timing (frequency) of subsidy transfer (including by month), purpose of providing the subsidy;

- obligations of the institution for the intended use of the subsidy;

- list of documents required to provide a subsidy;

- the right of the body exercising the functions and powers of the founder to conduct inspections of the institution’s compliance with the conditions established by the agreement;

- obligations of the institution to return subsidies used for other purposes;

- the procedure, timing and form for the institution to submit reports on the use of the subsidy;

- the procedure and conditions for terminating the agreement, introducing amendments and additions to it;

- liability for failure of the parties to comply with the terms of the agreement.

The institution submits reports on the use of subsidies for other purposes (not for reimbursement of standard costs for fulfilling the founder’s assignment) to the body exercising the functions and powers of the founder within the time limits established by the agreement. Any remaining subsidy funds not used in the current financial year must be returned to the budget. In accordance with the decision of the body exercising the functions and powers of the founder about the need for a subsidy that was not used at the beginning of the current financial year, the remainder of the said subsidy can be used by the institution in the current financial year to financially support expenses corresponding to the purposes of providing the subsidy. In case of violation of the conditions for providing a subsidy, its transfer is suspended. If the subsidy is used for purposes that do not comply with the conditions for its allocation, it is subject to collection as budget revenue.

We examined general issues of providing subsidies to budgetary institutions for other purposes. However, within the framework of the article, we are primarily interested in the issues of accounting for fixed assets acquired through these subsidies. Let's look at this in more detail below.

Is it possible to purchase fixed assets using subsidies?

The procedure for providing subsidies for other purposes necessarily establishes the directions for spending subsidies (it indicates what the institution has the right to spend subsidies on). In particular, the Procedure for providing subsidies for other purposes, approved By Order of the Ministry of Culture of the Russian Federation dated January 16, 2012 No. 3 , it is determined that the subsidy is provided for:

a) incentive payments based on the results of the reporting period;

b) activities related to the material and technical equipment of a budget institution, namely:

- acquisition of equipment and development of design documentation ;

- acquisition of fixed assets, with the exception of those acquired for the purpose of providing public services (performing work), provided for by the constituent document of a budgetary institution ;

c) major repairs and repair and restoration work at the facilities of the property complex of a budgetary institution;

d) development of design and estimate documentation for facilities subject to major repairs and restoration;

e) implementation of activities provided for by the energy efficiency program of a budgetary institution;

f) other measures established by the above order.

An analysis of regulations establishing the Procedure for providing subsidies for other purposes has shown that in some cases such a subsidy is allocated to an institution for the purchase of fixed assets, and in some cases its provision has completely different purposes. In particular, the Procedure for providing subsidies for other purposes, approved By order of the Ministry of Agriculture of the Russian Federation dated January 17, 2012 No. 70 , it is established that the institution is provided with a targeted subsidy for the purchase of equipment, agricultural machinery and vehicles in order to ensure the implementation of the main activities of the institution, provided for by its charter. The procedure for providing subsidies for other purposes, approved By order of Roszheldor dated January 25, 2012 No. 17 ,The following is defined. The subsidy is provided to institutions, including for the purchase of equipment that is not directly used in the provision of public services (performance of work). Resolution of the administration of the Kolomna municipal district of the Moscow Region dated December 28, 2011 No. 2725 , approving the Procedure for determining the volume and conditions for the provision of subsidies from the budget of the Kolomna Municipal District to municipal budgetary and autonomous institutions of the Kolomna Municipal District for other purposes, it is established that subsidy funds can be spent on the acquisition of fixed assets that are not included in the standard costs for the provision of municipal services of the Kolomna Municipal district.

Thus, if a subsidy for other purposes is allocated for the acquisition of fixed assets, the institution is obliged to purchase these fixed assets. Here I would like to consider the following question. Does an institution have the right to purchase fixed assets at the expense of the amounts of subsidies allocated to it for reimbursement of regulatory costs, on the instructions of the founder, or can fixed assets be acquired by the institution only at the expense of the amounts of subsidies for other purposes and at the expense of budget investments? After all, if you look at least at those regulations that we mentioned just above, you can see that in some cases fixed assets are acquired through subsidies for other purposes to fulfill the founder’s assignment, and in some cases - for activities not related to fulfillment of the founder’s instructions. Let's try to answer the question posed by referring to the rules of financial support for the fulfillment of the founder's assignment.

According to the norms Art. 9.2 of the Federal Law of January 12, 1996 No.7‑FZ “On Non-Profit Organizations”, clause 10 of the Procedure for the formation of a state task in relation to federal government institutions and financial support for the implementation of the state task approved By Decree of the Government of the Russian Federation dated 02.09.2010 No. 671 , financial support for the implementation of state (municipal) tasks by a budgetary institution is carried out in the form of subsidies from the corresponding budget of the budgetary system of the Russian Federation, taking into account the costs of maintaining real estate and especially valuable movable property assigned to the budgetary institution by the founder or acquired by the budgetary institution from funds allocated to it by the founder for the acquisition of such property, expenses for paying taxes, the object of taxation of which is the corresponding property, including land plots.

In the case of leasing, with the consent of the founder, of real estate and especially valuable movable property assigned to a budgetary institution by the founder or acquired by the budgetary institution at the expense of funds allocated to it by the founder for the acquisition of such property, the founder does not provide financial support for the maintenance of such property.

That is, the founder, based on their methodology for determining the cost standard for one unit of service (work) and the volume of services (work) that the institution must provide in the planned period, determines the amount of subsidies. The institution then distributes the subsidy amount at its discretion.

In relation to budgetary institutions, the government body performing the functions of the founder develops and approves (enshrined in a normative act) the procedure for determining standard costs for the provision of services (performance of work) and maintenance of property. An analysis of such regulations shows that, as a rule, when calculating the standard costs for providing a unit of service (work), the founder does not take into account the cost of fixed assets. For example, the Procedure for determining standard costs for the provision of public services and standard costs for maintaining the property of federal government institutions, in respect of which the functions and powers of the founder are exercised by the Federal Agency for Maritime and River Transport, does not provide for the inclusion of the cost of fixed assets in the calculation of standard costs. Rosmorrechflot suggests that when calculating standard costs, only the costs of maintaining equipment directly used in the provision of public services should be taken into account. In turn, the Procedure for determining standard costs for the provision by educational, research and other institutions in the field of culture, licensed to conduct educational activities, subordinate to the Ministry of Culture of the Russian Federation, public services (works) and standard costs for the maintenance of their property provides for accounting in the calculation standard costs of the cost of fixed assets. There is no regulatory act that would make some kind of “linkage” between the calculation of standard costs for services (work) and the directions of distribution of subsidies. Moreover, officials, giving explanations on this issue, say that the institution does not need to rely on the methodology for calculating standard costs when distributing subsidies. The institution is free to spend these funds. At the same time, officials point out that subsidies allocated by the founder for reimbursement of regulatory costs cannot be spent on the acquisition of fixed assets, even if these fixed assets will be used in the future to fulfill the founder’s assignment. In our opinion, the acquisition of fixed assets using the amounts of subsidies allocated to the institution to fulfill the founder’s assignment is possible if this is provided for by the methodology for calculating standard costs. An institution can justify the completion of this operation (purchase of fixed assets) not only by the need for these fixed assets to fulfill the founder’s assignment (provided that the founder does not allocate funds for the acquisition of these fixed assets with a targeted subsidy), but also by the fact that initially such expenses were included by the founder in the cost of a unit of service (work).

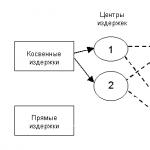

As we said above, expenses for the maintenance of real estate and especially valuable movable property assigned to a budgetary institution by the founder or acquired by a budgetary institution from funds allocated to it by the founder for the acquisition of such property, expenses for paying taxes, the subject of taxation of which is the corresponding property, including land plots, are carried out at the expense of subsidies for the fulfillment of the founder’s assignment. That is, subsidies for other purposes usually do not take into account the costs of maintaining property (repairs, paying property taxes, etc.) acquired through this source of financing. That is why fixed assets acquired by an institution at the expense of subsidies for other purposes and reflected in accounting under activity code 5 “Subsidies for other purposes” are transferred to activity code 4 “Subsidies for the implementation of state (municipal) tasks.”

Before considering the example of the transfer of fixed assets between types of activities, I would like to note that some experts, giving explanations on the issues of transferring fixed assets between types of activities, propose to carry it out not when the value of the object is formed at account 0 101 00 000“Fixed assets”, and when the object is still accounted for account 0 106 01 000"Investments in fixed assets." In our opinion, if the direction of spending the subsidy for other purposes is acquisition of fixed assets , you must first form the cost of the fixed asset in accounting and reflect it on account 0 101 00 000, and then carry out the transfer. In this case, when presenting reports to the founder on the use of subsidies, the institution will show that it acquired fixed assets, and not investments in fixed assets, as the founder demanded. After all, fixed assets and investments in fixed assets are not the same thing, in particular, this follows from the provisions clause 23 Instructions No.157n. It says that the cost of an object reflected in accounting as an object of fixed assets includes the amount of actual investments in its acquisition, construction

or production (creation), taking into account VAT amounts presented to the institution by suppliers and (or) contractors (except for their acquisition, construction and production within the framework of activities subject to VAT, unless otherwise provided by the tax legislation of the Russian Federation).

Accounting

Let's look at an example of the procedure for reflecting in accounting transactions for the acquisition of fixed assets by an institution at the expense of targeted subsidies.

In accordance with Instructions on the procedure for applying the budget classification of the Russian Federation, approved By Order of the Ministry of Finance of the Russian Federation dated December 21, 2011 No.180n, expenses for the acquisition of fixed assets are included in article 310“Increasing the cost of fixed assets” KOSGU.

The founder allocated a subsidy to his subordinate institution for other purposes in the amount of 800,000 rubles. The subsidy is provided within the limits of budgetary allocations provided for in the federal law on the federal budget for the corresponding financial year and planning period, and the limits of budgetary obligations approved in accordance with the established procedure to the founder, including for the purchase of equipment not used directly in the provision of public services (performance work). Using subsidies, the institution purchased equipment worth RUB 590,000. (including VAT - 90,000 rubles). Due to the fact that funds for the maintenance of equipment are provided to the institution in the form of subsidies to reimburse standard costs for fulfilling the founder’s assignment, the institution transferred the equipment from type of activity code 5 to type of activity code 4. The purchased equipment belongs to the category of “particularly valuable movable property.”

In accounting, transactions for the acquisition and transfer of equipment will be reflected as follows:

| Contents of operation | Debit | Credit | Amount, rub. | A document base |

|---|---|---|---|---|

| Accrued income from receipt of targeted subsidy | 5 205 81 560 | 5 401 10 180 | 800 000 | Help (f. 0504833) |

| Received a targeted subsidy for the purchase of equipment | 5 201 11 510 | 5 205 81 660 | 800 000 | Extract from a separate personal account |

| Equipment received from supplier | 5 106 21 310 | 5 302 31 730 | 590 000 | Invoice, Delivery note (f. TORG-12) |

| Funds were transferred to the supplier using targeted subsidies | 5 302 31 830 | 5 201 11 610 | 590 000 | Agreement, invoice, payment order, extract from a separate personal account |

| Equipment received from the supplier at the generated initial cost was accepted for accounting | 5 101 24 310 | 5 106 21 410 | 590 000 | Act on acceptance and transfer of fixed assets (except for buildings, structures) (f. 0306001) |

| At the same time, equipment is transferred from activity type code 5 “Subsidies for other purposes” to activity type code 4 “Subsidies for the implementation of state (municipal) tasks” | 5 401 10 180 | 5 101 24 310 | 590 000 | Help (f. 0504833) |

| Equipment accepted for accounting as part of fixed assets | 4 101 24 310 | 4 210 06 600 | 590 000 |

The amount of VAT presented by the equipment supplier is taken into account in its cost based on pp. 1, 4 p. 2 tbsp. 170 And pp. 4.1 clause 2 art. 146 Tax Code of the Russian Federation. Let us recall that according to pp. 4.1 clause 2 art. 146 Tax Code of the Russian Federation performance of work (provision of services) by state institutions, as well as budgetary and autonomous institutions within the framework of a state (municipal) assignment, the source of financial support of which is a subsidy from the corresponding budget of the budgetary system of the Russian Federation, is not subject to taxation (exempt from VAT).

Equipment purchased by a budgetary institution using targeted subsidy funds for profit tax purposes is not subject to depreciation ( pp. 3 p. 2 art. 256 Tax Code of the Russian Federation). That is, the cost of this property is not included in the expenses of the institution for the purpose of calculating income tax, including in the form of depreciation charges.

____________________________________

In the article we bring to your attention, methodologists from the 1C company explain how to reflect in accounting the acquisition of a fixed asset item from two sources of financing: the budget and business activity. Also in the article you will find answers to questions about how to reflect the calculation of depreciation, whether the cost of one object can be taken into account from several sources.

First of all, we note that one fixed asset item can be accounted for in only one budget accounting account.

As you know, the budget accounting account number includes the source of funding. Accordingly, the capitalization of an object acquired through several sources of financing must be reflected in several budget accounting accounts. However, in the case of reflecting the same fixed asset item on several budget accounting accounts (when capitalizing fixed assets in parts), problems arise when calculating depreciation, conducting inventory and revaluation, during internal movement and write-off of such objects.

According to the explanations given by employees of the Russian Ministry of Finance at seminars on accounting in budgetary institutions, the entire cost of a fixed asset must be attributed to the budget if at least part of it is paid from budget funds. And this is understandable, since the current budget legislation allows the reimbursement of budget expenses from extra-budgetary funds, but the restoration of off-budget cash expenses from budget funds is prohibited. Otherwise, it will be recognized as inappropriate spending of budget funds.

Thus, the cost of one object cannot be taken into account from several sources of financing. How to include in the cost of an object that will be taken into account as part of budgetary funds, expenses incurred at the expense of income-generating activities?

The current Instructions for budget accounting (approved by order of the Ministry of Finance of Russia dated December 30, 2008 No. 148n) do not contain accounting entries to reflect the acquisition of fixed assets from two sources of financing. In our opinion, to reflect the acquisition of fixed assets from two sources of financing, you can use records similar to records for the transfer of non-financial assets from extra-budgetary activities to budgetary ones, given in the letter of the Ministry of Finance of Russia dated May 25, 2006 No. 02-14-10a/1354 (hereinafter - Letter).

The said Letter notes that the decision to transfer non-financial assets from extra-budgetary activities to budgetary activities is made by the main manager of budget funds, to whom, in accordance with Decree of the President of the Russian Federation of 03/09/2004 No. 314 “On the system and structure of federal executive bodies”, the specified powers apply , subject to the availability of approved amounts of appropriations necessary to maintain these assets.

According to the Letter, transactions for the transfer of non-financial assets from extra-budgetary activities to budgetary ones, within the framework of which these assets are used, are formalized using accounts 240101241 and 140101180:

a) by the amount of book value:

Debit 2 401 01 241 Credit 2 101 00 410;

Debit 1 101 00 310 Credit 1 401 01 180;

b) for the amount of previously accrued depreciation on an object of fixed assets:

Debit 2 104 00 410 Credit 2 401 01 241;

Debit 1,401 01,180 Credit 1,104 00,410.

Despite the fact that the Letter has lost force, since it was developed in accordance with the expired order of the Ministry of Finance of Russia dated February 10, 2006 No. 25n “On approval of the Instructions on budget accounting”, the current Instructions on budget accounting provide for the acceptance of fixed assets and capital investments for accounting using account 040101180 "Other income" (correspondence No. 3, 4 of Appendix 1 "Correspondence of budget accounting accounts" to the Budget Accounting Instructions), and disposal (gratuitous transfer within the framework of income-generating activities) - using account 040101241 "Expenses for gratuitous transfers state and municipal organizations" (in accordance with clauses 22, 78 of the Instructions on Budget Accounting).

The decision to use funds for the acquisition of fixed assets or for the construction of an object from two or more sources, transfer from “extra-budget to budget” is made by the main manager. At the same time, limits on budgetary obligations for the maintenance of this property must be provided.

When accepting the entire amount paid for a fixed asset to the budget, the institution does not have the right to count on a VAT refund, therefore the fixed asset is accepted for accounting at cost, including the corresponding amounts of VAT.

Let us consider the accounting records reflected in the accounting of the institution in the situation under consideration using a specific example.

Example

A budgetary institution purchased fixed assets for 354,000 rubles. At the same time, 174,000 rubles. paid from budget funds, 180,000 rubles. - from funds from income-generating activities.

The procedure for reflecting transactions in budget accounting is presented in Table 1.

|

Debit |

Credit |

Sum |

||

|

Reflects the costs of purchasing equipment using funds from income-generating activities |

KRB 2 106 01 310 |

KRB 2 302 19 730 |

||

|

The costs of purchasing equipment at the expense of budgetary funds of the KRB are reflected |

KRB 1 302 19 730 |

|||

|

Payment is reflected from funds from income-generating activities |

KRB 2 302 19 830 |

KRB 2 201 01 610 |

||

|

Reflected payment from budget funds |

KRB 1 302 19 830 |

KRB 1 304 05 310 |

||

|

Expenditures were transferred from extra-budgetary activities to budgetary ones |

KRB 2 401 01 241 |

KRB 2 106 01 410 |

||

|

The costs of receipt of fixed assets from extra-budgetary funds and budget revenues are reflected |

KRB 1 106 01 310 |

KDB 1 401 01 180 |

||

|

Equipment has been capitalized |

KRB 1 101 04 310 |

KRB 1 106 01 410 |

In the program "1C: Accounting of a budgetary institution 8" the operations indicated in the table are formalized using the following documents.

Operations 1 and 2 are documented with the documents Purchase of fixed assets, intangible assets.

In both the first and second document Purchase of OS, intangible assets the same directory element must be specified Fixed assets, against which costs are collected.

In the program "1C: Accounting of a budgetary institution 8" quantitative accounting of fixed assets is carried out, therefore in the first document Purchase of OS, intangible assets, with KVD = 1 (budget), you should indicate the number of received fixed assets - 1 (see Fig. 1).

Rice. 1

In the second document Purchase of OS, intangible assets, with KVD = 2 (extra-budget), which must be registered for the same fixed asset object (same directory element Fixed assets), you should indicate the number of received fixed assets - 0 (only cost is taken into account) - see fig. 2.

Rice. 2

Operations 3 and 4 are documented Application for cash expense (Application for cash expense (abbreviated), Payment order or Cash disposal) in the usual way.

Operations 5 and 6 are non-standard, so they should be documented Operation (accounting). Entries can be entered in one document - see fig. 3.

Rice. 3

Capitalization of equipment is completed in the usual manner - by entering a document Acceptance for accounting of fixed assets and intangible assets at the press of a button Accept for accounting in the document Purchase of OS, intangible assets, which formalizes the receipt of an asset according to the budget.

Pay attention to the date and time of the document Operation (accounting). In order for the document Acceptance for accounting of fixed assets and intangible assets the cost of the object took into account expenses transferred from extra-budgetary activities, the date (time) of the document Operation (accounting) must be earlier than the date (time) of the document Acceptance for accounting of fixed assets and intangible assets.

At the click of a button Accept for accounting processing opens to generate a document Acceptance for accounting of fixed assets and intangible assets, which indicates the amount of the document - the basis (174,000 rubles). The same amount will be shown in the generated by button Form document Acceptance for accounting of fixed assets and intangible assets.

To capitalize fixed assets, taking into account all expenses collected on account 1 106 01 310 (RUB 354,000), press the button Calculate initial cost(Fig. 4).

Rice. 4

For tax accounting purposes, according to the letter of the Department of Taxation in Moscow dated February 18, 2004 No. 26-08/10738, property acquired (created) using budgetary funds of targeted financing is not subject to depreciation, only in part of the cost attributable to the amount of these funds (letter of the Ministry of Taxation Russia dated July 25, 2002 No. 02-5-10/E964).

Thus, if a fixed asset accounted for in budget accounting by type of activity 1 “Budget activity” is used to carry out business activities, for the purposes of tax accounting and depreciation calculations, only that part of the cost of the object that is paid from income from business activities is taken into account. In this case, the conditions for accepting the object as part of depreciable property according to the cost criterion must be observed.

T. Silvestrova, Editor in Chief

Budgetary institutions, in addition to subsidies for reimbursement of regulatory costs associated with the provision of state (municipal) services (performance of work) to individuals and (or) legal entities, are provided with subsidies for other purposes (Article 78.1 of the Budget Code of the Russian Federation). We will discuss in our article what accounting records reflect the operations for accounting for fixed assets acquired through this source of financing.

General provisions on the provision of subsidies for other purposes

The procedure for providing subsidies to budgetary institutions for other purposes is approved:

- in relation to federal budget funds – a government body performing the functions of the founder. As an example, we can cite the orders of the Ministry of Culture of the Russian Federation dated January 16, 2012 No. 3 “On approval of the Procedure for providing subsidies from the federal budget to the State Hermitage”, the Federal Tax Service of the Russian Federation dated April 27, 2012 No. ММВ-7-5/281@ “On approval of the Rules for the provision in 2012 - 2014 from the federal budget to federal budgetary institutions, in respect of which the Federal Tax Service exercises the functions and powers of the founder, subsidies for purposes not related to the reimbursement of standard costs for the provision of public services,” the Ministry of Agriculture of the Russian Federation dated January 17, 2012 No. 70 “On approval of the Rules for the provision The Ministry of Agriculture of the Russian Federation in 2012 - 2014 from the federal budget provided subsidies to subordinate federal educational budgetary and autonomous institutions for other purposes";

- in relation to budget funds of subjects RF – authority of a constituent entity of the Russian Federation. An example of such a regulatory act is the Decree of the Government of the Moscow Region dated April 17, 2012 No. 507/14 “On approval of the Procedure for determining the volume and conditions for providing subsidies for other purposes to state budgetary and autonomous institutions of the Moscow region”;

- in relation to municipal budget funds – a municipal government body (see, for example, the resolution of the administration of the Chekhov municipal district of the Moscow Region dated April 10, 2012 No. 421/10-1 “On approval of the Procedure for determining the volume and conditions for the provision of subsidies for other purposes to municipal budgetary healthcare institutions of the Chekhov municipal district”, administration of the city N. Novgorod dated February 13, 2012 No. 505 “On approval of the procedure for determining the volume and conditions for providing subsidies from the budget of the city of Nizhny Novgorod to municipal budgetary and municipal autonomous institutions of the city of Nizhny Novgorod for other purposes”).

The normative act establishing the rules for providing subsidies to budgetary institutions for other purposes (hereinafter referred to as the Procedure for providing subsidies for other purposes) states that the subsidy is provided to the institution within the limits of budgetary allocations provided for by the budget law for the corresponding financial year and planning period, and budget limits obligations approved in accordance with the established procedure by the budgetary institution. The provision of a subsidy to an institution is carried out on the basis of an agreement on the provision of a subsidy concluded between the body exercising the functions and powers of the founder and the institution. The need for an agreement and the list of conditions that must be contained in it are prescribed in the Procedure for providing subsidies for other purposes. Typically the agreement provides for the following terms:

- volume, timing (frequency) of subsidy transfer (including by month), purpose of providing the subsidy;

- obligations of the institution for the intended use of the subsidy;

- list of documents required to provide a subsidy;

- the right of the body exercising the functions and powers of the founder to conduct inspections of the institution’s compliance with the conditions established by the agreement;

- obligations of the institution to return subsidies used for other purposes;

- the procedure, timing and form for the institution to submit reports on the use of the subsidy;

- the procedure and conditions for terminating the agreement, introducing amendments and additions to it;

- liability for failure of the parties to comply with the terms of the agreement.

Transfer of subsidies for other purposes is carried out to a separate personal account of the institution. Authorization of payment of monetary obligations for these subsidies is carried out in the manner established By order of the Ministry of Finance of the Russian Federation dated July 16, 2010 No. 72n “On authorization of expenses of federal government institutions, the source of financial support for which are subsidies received in accordance with paragraph two of paragraph 1 of Article 78.1 of the Budget Code of the Russian Federation.”

The institution submits reports on the use of subsidies for other purposes (not for reimbursement of standard costs for fulfilling the founder’s assignment) to the body exercising the functions and powers of the founder within the time limits established by the agreement. Any remaining subsidy funds not used in the current financial year must be returned to the budget. In accordance with the decision of the body exercising the functions and powers of the founder about the need for a subsidy that was not used at the beginning of the current financial year, the remainder of the said subsidy can be used by the institution in the current financial year to financially support expenses corresponding to the purposes of providing the subsidy. In case of violation of the conditions for providing a subsidy, its transfer is suspended. If the subsidy is used for purposes that do not comply with the conditions for its allocation, it is subject to collection as budget revenue.

We examined general issues of providing subsidies to budgetary institutions for other purposes. However, within the framework of the article, we are primarily interested in the issues of accounting for fixed assets acquired through these subsidies. Let's look at this in more detail below.

Can I purchase using subsidies?

The procedure for providing subsidies for other purposes necessarily establishes the directions for spending subsidies (it indicates what the institution has the right to spend subsidies on). In particular, the Procedure for providing subsidies for other purposes, approved By Order of the Ministry of Culture of the Russian Federation dated January 16, 2012 No. 3 , it is determined that the subsidy is provided for:

a) incentive payments based on the results of the reporting period;

b) activities related to the material and technical equipment of a budget institution, namely:

- acquisition of equipment and development of design documentation ;

- acquisition of fixed assets, with the exception of those acquired for the purpose of providing public services (performing work), provided for by the constituent document of a budgetary institution ;

c) major repairs and repair and restoration work at the facilities of the property complex of a budgetary institution;

d) development of design and estimate documentation for facilities subject to major repairs and restoration;

e) implementation of activities provided for by the energy efficiency program of a budgetary institution;

f) other measures established by the above order.

An analysis of regulations establishing the Procedure for providing subsidies for other purposes has shown that in some cases such a subsidy is allocated to an institution for the purchase of fixed assets, and in some cases its provision has completely different purposes. In particular, the Procedure for providing subsidies for other purposes, approved By order of the Ministry of Agriculture of the Russian Federation dated January 17, 2012 No. 70 , it is established that the institution is provided with a targeted subsidy for the purchase of equipment, agricultural machinery and vehicles in order to ensure the implementation of the main activities of the institution, provided for by its charter. The procedure for providing subsidies for other purposes, approved By order of Roszheldor dated January 25, 2012 No. 17 ,The following is defined. The subsidy is provided to institutions, including for the purchase of equipment that is not directly used in the provision of public services (performance of work). Resolution of the administration of the Kolomna municipal district of the Moscow Region dated December 28, 2011 No. 2725 , approving the Procedure for determining the volume and conditions for the provision of subsidies from the budget of the Kolomna Municipal District to municipal budgetary and autonomous institutions of the Kolomna Municipal District for other purposes, it is established that subsidy funds can be spent on the acquisition of fixed assets that are not included in the standard costs for the provision of municipal services of the Kolomna Municipal district.

Thus, if a subsidy for other purposes is allocated for the acquisition of fixed assets, the institution is obliged to purchase these fixed assets. Here I would like to consider the following question. Does an institution have the right to purchase fixed assets at the expense of the amounts of subsidies allocated to it for reimbursement of regulatory costs, on the instructions of the founder, or can fixed assets be acquired by the institution only at the expense of the amounts of subsidies for other purposes and at the expense of budget investments? After all, if you look at least at those regulations that we mentioned just above, you can see that in some cases fixed assets are acquired through subsidies for other purposes to fulfill the founder’s assignment, and in some cases - for activities not related to fulfillment of the founder’s instructions. Let's try to answer the question posed by referring to the rules of financial support for the fulfillment of the founder's assignment.

According to the norms Art. 9.2 of the Federal Law of January 12, 1996 No.7-FZ “On Non-Profit Organizations”, clause 10 of the Procedure for the formation of a state task in relation to federal government institutions and financial support for the implementation of the state task approved By Decree of the Government of the Russian Federation dated 02.09.2010 No. 671 , financial support for the implementation of state (municipal) tasks by a budgetary institution is carried out in the form of subsidies from the corresponding budget of the budgetary system of the Russian Federation, taking into account the costs of maintaining real estate and especially valuable movable property assigned to the budgetary institution by the founder or acquired by the budgetary institution from funds allocated to it by the founder for the acquisition of such property, expenses for paying taxes, the object of taxation of which is the corresponding property, including land plots.

In the case of leasing, with the consent of the founder, of real estate and especially valuable movable property assigned to a budgetary institution by the founder or acquired by the budgetary institution at the expense of funds allocated to it by the founder for the acquisition of such property, the founder does not provide financial support for the maintenance of such property.

That is, the founder, based on their methodology for determining the cost standard for one unit of service (work) and the volume of services (work) that the institution must provide in the planned period, determines the amount of subsidies. The institution then distributes the subsidy amount at its discretion.

In relation to budgetary institutions, the government body performing the functions of the founder develops and approves (enshrined in a normative act) the procedure for determining standard costs for the provision of services (performance of work) and maintenance of property. An analysis of such regulations shows that, as a rule, when calculating the standard costs for providing a unit of service (work), the founder does not take into account the cost of fixed assets. For example, the Procedure for determining standard costs for the provision of public services and standard costs for maintaining the property of federal government institutions, in respect of which the functions and powers of the founder are exercised by the Federal Agency for Maritime and River Transport, does not provide for the inclusion of the cost of fixed assets in the calculation of standard costs. Rosmorrechflot suggests that when calculating standard costs, only the costs of maintaining equipment directly used in the provision of public services should be taken into account. In turn, the Procedure for determining standard costs for the provision by educational, research and other institutions in the field of culture, licensed to conduct educational activities, subordinate to the Ministry of Culture of the Russian Federation, public services (works) and standard costs for the maintenance of their property provides for accounting in the calculation standard costs of the cost of fixed assets. There is no regulatory act that would make some kind of “linkage” between the calculation of standard costs for services (work) and the directions of distribution of subsidies. Moreover, officials, giving explanations on this issue, say that the institution does not need to rely on the methodology for calculating standard costs when distributing subsidies. The institution is free to spend these funds. At the same time, officials point out that subsidies allocated by the founder for reimbursement of regulatory costs cannot be spent on the acquisition of fixed assets, even if these fixed assets will be used in the future to fulfill the founder’s assignment. In our opinion, the acquisition of fixed assets using the amounts of subsidies allocated to the institution to fulfill the founder’s assignment is possible if this is provided for by the methodology for calculating standard costs. An institution can justify the completion of this operation (purchase of fixed assets) not only by the need for these fixed assets to fulfill the founder’s assignment (provided that the founder does not allocate funds for the acquisition of these fixed assets with a targeted subsidy), but also by the fact that initially such expenses were included by the founder in units of service (work).

As we said above, expenses for the maintenance of real estate and especially valuable movable property assigned to a budgetary institution by the founder or acquired by a budgetary institution from funds allocated to it by the founder for the acquisition of such property, expenses for paying taxes, the subject of taxation of which is the corresponding property, including land plots, are carried out at the expense of subsidies for the fulfillment of the founder’s assignment. That is, subsidies for other purposes usually do not take into account the costs of maintaining property (repairs, paying property taxes, etc.) acquired through this source of financing. That is why fixed assets acquired by an institution at the expense of subsidies for other purposes and reflected in accounting under activity code 5 “Subsidies for other purposes” are transferred to activity code 4 “Subsidies for the implementation of state (municipal) tasks.”

Before considering the example of the transfer of fixed assets between types of activities, I would like to note that some experts, giving explanations on the issues of transferring fixed assets between types of activities, propose to carry it out not when the value of the object is formed at account 0 101 00 000“Fixed assets”, and when the object is still accounted for account 0 106 01 000"Investments in fixed assets." In our opinion, if the direction of spending the subsidy for other purposes is acquisition of fixed assets

, you must first form the cost of the fixed asset in accounting and reflect it on account 0 101 00 000, and then carry out the transfer. In this case, when presenting reports to the founder on the use of subsidies, the institution will show that it acquired fixed assets, and not investments in fixed assets, as the founder demanded. After all, fixed assets and investments in fixed assets are not the same thing, in particular, this follows from the provisions clause 23 Instructions No.157n. It says that the cost of an object reflected in accounting as an object of fixed assets includes the amount of actual investments in its acquisition, construction

or production (creation), taking into account VAT amounts presented to the institution by suppliers and (or) contractors (except for their acquisition, construction and production within the framework of activities subject to VAT, unless otherwise provided by the tax legislation of the Russian Federation).

Accounting

Let's look at an example of the procedure for reflecting in accounting transactions for the acquisition of fixed assets by an institution at the expense of targeted subsidies.

In accordance with Instructions on the procedure for applying the budget classification of the Russian Federation, approved By Order of the Ministry of Finance of the Russian Federation dated December 21, 2011 No.180n, expenses for the acquisition of fixed assets are included in article 310“Increasing the cost of fixed assets” KOSGU.

The founder allocated a subsidy to his subordinate institution for other purposes in the amount of 800,000 rubles. The subsidy is provided within the limits of budgetary allocations provided for in the federal law on the federal budget for the corresponding financial year and planning period, and the limits of budgetary obligations approved in accordance with the established procedure to the founder, including for the purchase of equipment not used directly in the provision of public services (performance work). Using subsidies, the institution purchased equipment worth RUB 590,000. (including VAT – 90,000 rubles). Due to the fact that funds for the maintenance of equipment are provided to the institution in the form of subsidies to reimburse standard costs for fulfilling the founder’s assignment, the institution transferred the equipment from type of activity code 5 to type of activity code 4. The purchased equipment belongs to the category of “particularly valuable movable property.”

In accounting, transactions for the acquisition and transfer of equipment will be reflected as follows:

Debit |

Credit |

Amount, rub. |

A document base |

|

Accrued income from receipt of targeted subsidy |

Help (f. 0504833) |

|||

Received a targeted subsidy for the purchase of equipment |

Extract from a separate personal account |

|||

Equipment received from supplier |

Invoice, Delivery note |

|||

Funds were transferred to the supplier using targeted subsidies |

Agreement, invoice, extract from a separate personal account |

|||

Equipment received from the supplier at the generated initial cost was accepted for accounting |

Act on acceptance and transfer of fixed assets (except for buildings, structures) (f. 0306001) |

|||

At the same time, equipment is transferred from activity type code 5 “Subsidies for other purposes” to activity type code 4 “Subsidies for the implementation of state (municipal) tasks” |

Help (f. 0504833) |

|||

Equipment accepted for accounting as part of fixed assets |

The amount of VAT presented by the equipment supplier is taken into account in its cost based on pp. 1, 4 p. 2 tbsp. 170 And pp. 4.1 clause 2 art. 146 Tax Code of the Russian Federation. Let us recall that according to pp. 4.1 clause 2 art. 146 Tax Code of the Russian Federation performance of work (provision of services) by state institutions, as well as budgetary and autonomous institutions within the framework of a state (municipal) assignment, the source of financial support of which is a subsidy from the corresponding budget of the budgetary system of the Russian Federation, is not subject to taxation (exempt from VAT).

Equipment purchased by a budgetary institution using targeted subsidy funds for profit tax purposes is not subject to depreciation ( pp. 3 p. 2 art. 256 Tax Code of the Russian Federation). That is, the cost of this property is not included in the expenses of the institution for the purpose of calculating income tax, including in the form of depreciation charges.

Order of Rosmorrechflot dated December 2, 2011 No. 244.

Approved by Order of the Ministry of Culture of the Russian Federation dated December 29, 2011 No. 1259.

Order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n “On approval of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions and Instructions for its application "

5.1. Accounting for fixed assets acquired through subsidies for other purposes

In addition to subsidies to fulfill the founder’s assignment, budgetary institutions are often allocated targeted subsidies in accordance with the standards para. 2 p. 1 art. 78.1 BC RF called "subsidies for other purposes". A subsidy for other purposes is allocated to cover certain expenses, the list of which is approved by the regulatory act.

The normative act establishing the procedure for providing subsidies to budgetary institutions for other purposes is approved:

In relation to federal budget funds - by the government body performing the functions of the founder. As an example, we can cite the orders of the Ministry of Culture of the Russian Federation dated January 16, 2012 N 3"On approval of the Procedure for providing subsidies from the federal budget to the State Hermitage", Federal Tax Service of the Russian Federation dated 04/27/2012 N ММВ-7-5/281@"On approval of the Rules for the provision in 2012-2014 from the federal budget to federal budgetary institutions in respect of which the Federal Tax Service exercises the functions and powers of the founder, subsidies for purposes not related to the reimbursement of standard costs for the provision of public services", Ministry of Agriculture of the Russian Federation dated January 17, 2012 N 70“On approval of the Rules for the provision by the Ministry of Agriculture of the Russian Federation in 2012-2014 from the federal budget of subsidies to subordinate federal educational budgetary and autonomous institutions for other purposes”;

In relation to funds from the budgets of the constituent entities of the Russian Federation - by the government authority of the constituent entity of the Russian Federation. An example of such a normative act is Resolution Government of the Nizhny Novgorod Region dated December 30, 2011 N 1133 “On approval of the Procedure for determining the volume and conditions for providing subsidies from the regional budget to state budgetary and autonomous institutions of the Nizhny Novgorod Region for other purposes”;

In relation to funds from the budgets of municipalities - by the municipal governing body (see, for example, resolutions administration of the city of Nizhny Novgorod dated 02.13.2012 N 505 "On approval of the procedure for determining the volume and conditions for providing subsidies from the budget of the city of Nizhny Novgorod to municipal budgetary and municipal autonomous institutions of the city of Nizhny Novgorod for other purposes", administration of the Rasskazovsky district of the Tambov region dated 04.10.2011 N 1135 “On the Procedure for providing subsidies to municipal budgetary and autonomous institutions for other purposes”, administration of the ZATO of Zelenogorsk dated 08.18.2011 N 304-p “On approval of the Procedure for determining the volume and conditions for providing subsidies from the local budget to municipal budgetary and autonomous institutions for the purposes , not related to financial support for the fulfillment of the municipal task for the provision of municipal services (performance of work)").

The regulations establishing the rules for providing subsidies to budgetary institutions for other purposes stipulate that subsidies for other purposes are provided to reimburse expenses of budgetary institutions not related to the provision of services (performing work) in accordance with the founder’s instructions. The following is a list of expenses that the institution must make using these funds. An analysis of regulations establishing the rules for providing subsidies to budgetary institutions for other purposes has shown that one of the areas of their spending is the acquisition of fixed assets.

For example, Decree of the administration of the ZATO of Zelenogorsk N 304-p established that subsidies for other purposes are provided to reimburse expenses of budgetary institutions not related to the provision by them of municipal services (performance of work) in accordance with the municipal assignment, including expenses:

For the acquisition of fixed assets and (or) inventories for the implementation of activities of budgetary institutions provided for by the constituent documents;

To carry out work on the development of design and estimate documentation, conducting a state examination of design and estimate documentation, major repairs of property assigned to a budgetary or autonomous institution with the right of operational management;

For the implementation of activities provided for by long-term target and (or) departmental target programs;

Not related to budget investments.

The provision of subsidies for other purposes during the financial year is carried out on the basis of an agreement on the procedure and conditions for the provision of subsidies for other purposes, concluded between a budgetary or autonomous institution and the founder (hereinafter referred to as the agreement). The regulations establishing the rules for providing subsidies to budgetary institutions for other purposes also stipulate that the founder has the right, if the budgetary institution violates the terms of the agreement, to suspend the transfer of the subsidy to it until the violations are eliminated. If a budgetary institution has not ensured (does not ensure) the implementation of the agreement or uses the subsidy for purposes not provided for by the agreement, the founder is obliged to take measures to ensure the intended use of the subsidy or its return to the budget. Subsidy funds are transferred to a separate personal account of a budget institution. Authorization of payment of monetary obligations for these subsidies is carried out in the manner established By order Ministry of Finance of the Russian Federation dated July 16, 2010 N 72n “On authorization of expenses of federal government institutions, the source of financial support for which are subsidies received in accordance with paragraph two of paragraph 1 of Article 78.1 of the Budget Code of the Russian Federation.”

Of course, the spending of targeted subsidies must be monitored. Usually it is made by the founder, about which a corresponding entry is made in the normative act establishing the rules for providing subsidies to budgetary institutions for other purposes. This document also usually states that budgetary institutions submit a quarterly report to the founder on the use of the subsidy for other purposes in the form given in the regulatory document establishing the rules for the provision of such subsidies. Remaining subsidies not used for other purposes in the current financial year are transferred to the budget. In the next financial year, they can be returned to the budgetary institution if there is a need to direct them for the same purposes for which they were originally allocated, in accordance with the decision of the founder and with the introduction of appropriate changes to the consolidated budget list.

As we have already said, one of the areas for spending subsidies for other purposes is the acquisition of fixed assets. An analysis of regulations establishing the rules for providing budgetary institutions with subsidies for other purposes showed that such a subsidy is allocated to an institution for the purchase of:

Fixed assets in order to ensure the implementation of the main activities of the institution provided for by its charter ( Order Ministry of Agriculture of the Russian Federation dated January 17, 2012 N 70 “On approval of the Rules for the provision by the Ministry of Agriculture of the Russian Federation in 2012-2014 from the federal budget of subsidies to subordinate federal educational budgetary and autonomous institutions for other purposes”);

Fixed assets that will not be used directly in the provision of public services (performance of work) ( Order Roszheldor dated January 25, 2012 N 17 "On approval of the Procedure for providing from the federal budget to the federal state budgetary cultural institution "Central Museum of Railway Transport of the Russian Federation", which is under the jurisdiction of the Federal Agency for Railway Transport, subsidies for other purposes (with the exception of subsidies for financial support of state assignments for the provision of public services (performance of work))");

Fixed assets, the purchase costs of which are not included in the standard costs for the provision of municipal services (Resolution of the administration of the Kolomensky municipal district of the Moscow Region dated December 28, 2011 N 2725 “On approval of the Procedure for determining the volume and conditions for the provision from the budget of the Kolomensky municipal district to municipal budgetary and autonomous institutions of the Kolomensky municipal area of subsidies for other purposes").

Subsidies for other purposes are reflected according to activity code 5. At the same time, according to the Ministry of Finance, set out in Letter dated 07/11/2012 N 02-06-10/2682, when accepting for accounting property acquired from subsidies allocated for other purposes, financial support code 4 should be used - subsidies for the implementation of a state (municipal) task. The need to keep records of such property using activity code 4 rather than 5 is due to the following.

In accordance with standards Art. 9.2 Law on Non-Profit Organizations, clause 10 The procedure for the formation of a state task in relation to federal government institutions and financial support for the implementation of a state task approved Resolution Government of the Russian Federation dated 02.09.2010 N 671, financial support for the implementation of state (municipal) tasks by a budgetary institution is carried out in the form of subsidies from the corresponding budget of the budgetary system of the Russian Federation, taking into account the costs of maintaining real estate and especially valuable movable property assigned to the budgetary institution by the founder or acquired by the budgetary institution at the expense of the funds allocated to him by the founder for the acquisition of such property, expenses for paying taxes, the relevant property, including land plots, is recognized as an object of taxation.

In the case of leasing, with the consent of the founder, of real estate and especially valuable movable property assigned to a budgetary institution by the founder or acquired by the budgetary institution at the expense of funds allocated to it by the founder for the acquisition of such property, the founder does not provide financial support for the maintenance of such property.

That is, expenses for the maintenance of real estate and especially valuable movable property assigned to a budgetary institution by the founder or acquired by a budgetary institution at the expense of funds allocated to it by the founder for the acquisition of such property, expenses for paying taxes, the subject of taxation of which is the corresponding property, including land plots are carried out at the expense of subsidies for the fulfillment of the founder’s assignment. Subsidies for other purposes usually do not take into account the costs of maintaining the property (repairs, payment of property taxes, etc.). Therefore, fixed assets acquired by an institution using subsidies for other purposes are accounted for under activity code 4 “Subsidies for the implementation of state (municipal) tasks.”

This raises the question: is the transfer of fixed assets from activity type code 5 to activity type code 4 carried out when the property is included in investments or when it is included in fixed assets?

In our opinion, it is more logical when first the cost of a fixed asset is formed in accounting and reflected in account 0 101 00 000, and then the translation is carried out. In this case, by submitting reports to the founder on the use of subsidies, the institution will show that it acquired fixed assets, as required by the founder, and did not simply make investments in fixed assets. After all, fixed assets and investments in fixed assets are not the same thing. If we look at the norms paragraph 38 Instructions N 157n, then fixed assets include tangible property, regardless of their cost, with a useful life of more than 12 months, intended for repeated or permanent use with the right of operational management in the course of the activities of the institution when it performs work, provides services, for the exercise of state powers (functions) or for management needs of institutions that are in operation, in reserve, on conservation, leased, leased (subleasing). Such objects are accepted for accounting as fixed assets. The cost of an object reflected in accounting as an object of fixed assets includes the amount of actual investments in its acquisition, construction or production (creation), taking into account the amounts of VAT presented to the institution by suppliers and (or) contractors (except for their acquisition, construction and production within the framework of activities subject to VAT, unless otherwise provided by the tax legislation of the Russian Federation). In turn, investments in non-financial assets refer to the actual costs of an institution for objects of non-financial assets during their acquisition, construction (creation), modernization (reconstruction, completion, additional equipment), manufacturing, as well as costs associated with the implementation of research, development and development , technological work, which will subsequently be accepted for accounting as objects of non-financial assets ( paragraph 127 Instructions No. 157n).

However, in Letter The Ministry of Finance of the Russian Federation dated July 11, 2012 N 02-06-10/2682 states that property acquired using subsidies for other purposes is reflected according to activity type code 4 when accepted for accounting. That is, the transfer of property from the activity type code 5 to activity code 4 is carried out when it is still accounted for as capital investments in fixed assets and is reflected in account 0 106 01 000 “Investments in fixed assets”. We propose, using an example, to consider the procedure for reflecting in accounting transactions for the acquisition of fixed assets by an institution at the expense of a targeted subsidy, guided by By letter Ministry of Finance of the Russian Federation dated September 18, 2012 N 02-06-07/3798.

Example

The founder allocated a subsidy to the institution subordinate to him for other purposes in the amount of 1,200,000 rubles. The subsidy is provided within the limits of budgetary allocations provided for in the law on the regional budget for the corresponding financial year and planning period, and the limits of budgetary obligations approved in the prescribed manner to the founder, including for the acquisition of fixed assets not taken into account in the standard costs associated with the implementation municipal task, not related to real estate or especially valuable movable property, in the amount of 600,000 rubles. Using subsidies, the institution purchased equipment worth RUB 129,800. (including VAT - 19,800 rubles).

In accounting, transactions for the acquisition and transfer of equipment will be reflected as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| The planned assignments of the budgetary institution by income are reflected | 5 507 10 180 | 5 504 10 180 | 1 200 000 |

| Reflects planned indicators for expenses regarding the acquisition of fixed assets | 5 504 10 310 | 5 506 10 310 | 600 000 |

| The receipt of funds within the framework of the subsidy for other purposes is reflected | 5 508 10 180 | 5 507 10 180 | 1 200 000 |

| Income accrued in relation to allocated targeted subsidies | 5 205 81 560 | 5 401 10 180 | 1 200 000 |

| A targeted subsidy has been received into the institution’s personal account | 5 201 11 510 17

| 5 205 81 660 | 1 200 000 |

| Obligations have been accepted to pay for the equipment supplied by the supplier | 5 506 10 310 | 5 501 11 310 | 120 000 |

| Equipment received from supplier | 5 106 31 310 | 5 302 31 730 | 120 000 |

| Monetary obligations accepted | 5 502 11 310 | 5 502 12 310 | 120 000 |

| Funds were transferred to the supplier in payment for the supplied equipment | 5 302 31 830 | 5 201 11 610 18

| 120 000 |

| Transfer of equipment from activity type code 5 "Subsidies for other purposes" to activity type code 4 "Subsidies for the implementation of state (municipal) assignments" | 5 304 06 830 | 5 106 31 310 | 120 000 |

| Equipment accepted for accounting as part of fixed assets | 4 101 34 310 | 4 304 06 730 | 120 000 |