Introduction, the essence of chain trading and the dynamics of the development of retail chains - the organization of supply chain stores

Introduction

Currently, in the regions of the Russian Federation, such a sector of the economy as retail trade is in a stage of rapid growth. In recent years, dozens of retail chains have appeared on the domestic retail market. Developing since 1994, network trading has covered a significant geographical area and has become almost the driving force behind the increase in the turnover of consumer goods throughout the country.

Analysts call the period 2007-2009 the most active period in the development of Russian network retail. It was during these years that the greatest revitalization of the activity of food companies in the Russian market was observed, a system of network economic ties was formed.

By the end of 2009, the formation of the main formats of Russian trade was completed, multi-format (operating in several formats at once) networks appeared. Initially trading only in Moscow and St. Petersburg, large retailers began active regional expansion, developing, improving their supply system, and by the beginning of the second decade of the 21st century, retail had become one of the most developed Russian trade industries.

Analysts attribute such a rapid development of food chains in Russia primarily to the growth of the country's economy: high prices for crude oil and natural gas, the main export commodities, as well as high demand for them in the country. The growing economy is supported by the growth in the level of income and expenses of Russians. Now in Russia all chain grocery stores are divided into six formats according to the type of trade in them:

1. Supermarkets

2. Hypermarkets

3. Cash and Carry

4. Discounters

5. Convenience stores

6. Premium and super premium gastronomes

According to RBC estimates, in mid-2011 there were about 140 grocery chains of all formats operating in Russia with various supply systems. And now the number of networks continues to grow steadily. In addition, in addition to significant federal players in the industry, their intention to enter the Russian retail market in 2005-2009. announced several world leaders in retail http://inpit.ru/.

In other words, the Russian retail market today is in a state of dynamic development, there is high competition between retail chains. Rationally using the existing systems of commodity supply, they offer the widest range of goods for every taste, more and more winning the loyalty of consumers.

> The essence of network trading and the dynamics of the development of retail networks

As you know, a trading network is a set of trading enterprises located in a certain territory under common management. It is not surprising that networks have gained such popularity among buyers, because they provide the opportunity to make purchases of goods and receive services as quickly and conveniently as possible. This is achieved by providing a wide range of goods presented in the distribution network, as well as the proximity of the location of retail outlets included in the distribution network to the place of work or residence of consumers. A retail trade network is created to purchase, transport, store and sell goods, as well as to conduct financial and informational activities, including those related to advertising.

Merchants that are part of the network can carry out sales in the traditional form - through the counters, as well as in the form of self-service, sales by samples, sales with an open display, by phone, using vending machines, through catalogs, via the Internet.

A retail chain may include stores of various formats. In the Russian Federation, as noted above, the following formats are developed:

1) Supermarkets - large self-service department stores offering up to 35,000 items. Supermarkets sell mainly food products (virtually a full range of food and beverages) and a limited range of non-food products (usually household paper products, soaps, laundry and dish washing powders, sanitation and hygiene items, paperback books, indoor flowers and plants, etc.).

2) Hypermarkets - retail stores that combine the principles of a self-service store and a store divided into sales departments. A hypermarket differs from a supermarket by a large trading area (from 10,000 m 2) and a significantly expanded assortment (from 40,000 to 150,000 items). Hypermarkets sell non-food products along with food products: non-food products in hypermarkets make up 35-50% of the total assortment.

3) "Cash and Carry" - self-service stores that provide customers with the opportunity to purchase various goods wholesale and retail, for cash. "Cash & Carry" offer customers a wide range of household goods. Stores operate on several price lists, depending on the volume of the purchase. The main customers of stores of this format are wholesale and small wholesale buyers, so making a purchase involves the conclusion of contracts.

4) Discounters - shops with a narrow assortment and a minimum set of services for customers, with fairly low prices. Discounters - economy class stores; the management of such a store is aimed at reducing costs due to the minimalist design of the trading floor, simplified display of goods, reducing the number of employees and limiting the assortment, which should be sold in large enough lots due to low prices.

5) Convenience stores - small stores designed to meet the current needs of nearby customers. Often they are located directly in the house itself, on its ground floor. The assortment of such a store should be as balanced as possible and consist of consumer goods, since purchases "near the house" are made daily and include the main goods of the consumer basket.

6) "Premium" and "Super-premium" class stores - stores with an expanded range of high quality goods, including gourmet and exotic goods sold at high prices. Stores of this format are distinguished by elite trade equipment, a trading floor with special design solutions, and sometimes contain their own cafes, bars and stands for sampling products Bragin L.A. Retail trade: current trends and development prospects. - M .: GOU VPO "REA im. G.V. Plekhanov", 2009. - S. 100.

For 2006, the situation with store formats in the Russian Federation was as follows:

Rice. 1. The share of stores of various formats in the retail network market in the Russian Federation in 2006

Figure 1 shows that the most popular formats in 2006 were two formats: "hypermarket" and "discounter", their market shares are 39% and 33%, respectively. Significantly inferior to them "supermarkets", occupying 20% of the network market. And the share of other formats in the market share of network players accounted for only 8%. Convenience stores had a small area, which was very inconvenient for customers, and besides, there was a limited assortment. "Cash & Carry" and "premium and super premium gastronomes" had a very low level of development, because. they are the "youngest" network trading formats in Russia http://inpit.ru/.

It should be said that as of today, the situation has not actually changed.

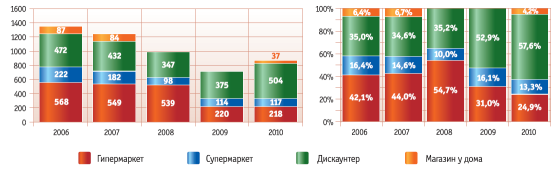

Rice. 2. Dynamics and structure of retail space growth of 90 largest retailers in Russia.

At the end of 2010, discounters and hypermarkets continue to occupy the largest share in the structure of retail space. With regard to the supermarket format, the market is undergoing a process of changing the concept, the main elements of which are an increase in the share of fresh products and a decrease in the share of non-food products. In addition, some retailers refuse to develop this format and close or reformat their supermarkets into discounters. Opportunities for the development of the convenience store format for federal networks are practically absent, and franchising projects are still limited Burmistrov M. Retail trends // Opinion, 2011, No. 1.

Accordingly, the toughest competition unfolded in the field of discounters, supermarkets and hypermarkets, and its main participants are the retail chains presented in Table 1 - the most famous Russian retailers today.

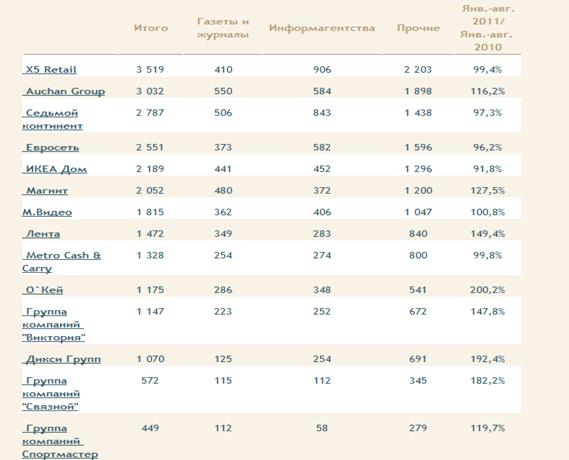

Tab. 1. Ranking of the largest retail chains in Russia by citation in the media in 2010-2011

These companies are today leaders in the field of various economic indicators http://torgrus.com/.

In particular, in terms of the total number of stores, two players are leading in the country: the Krasnodar company Magnit LLC, operating in the format of discounters (Magnit stores) and X5 Retail Group, which develops various retail formats (Pyaterochka, Perekrestok, Mercado-Supercenter ). The same networks are leaders in the field of revenue.

Rice. 4. Revenue of the TOP-10 networks, billion dollars Burmistrov M. Retail trends // Opinion, 2011, No. 1 .

That is, based on the data, we can say that at the top of the list of the largest networks are such market players as X5 Retail Group, Magnit, Auchan Group, Seventh Continent, selling food products. At the same time, according to the Federal State Statistics Service of the Russian Federation, the growth rate of retail sales of food products in 2009 was significantly lower than in previous periods: the turnover of food products increased by only 12.3%, while the turnover of non-food products increased by 17%, 6%.

The fact is that in accordance with the general growth of the Russian consumer market, the structure of the consumer basket of Russians is growing and changing towards Western consumption standards: the share of food products is decreasing, while the share of consumer services and the share of non-food products is growing. The share of food products in the consumer basket of an average Russian has decreased from 45% in 2002 to 35% in 2010. It is no coincidence that almost half of the 14 largest chains in the Russian Federation are retailers in the field of non-food products http://torgrus.com/.

In connection with the acquisition of popularity among buyers, retail chains began active geographical expansion. However, now the main focus of network trade is still Moscow and St. Petersburg.

The capital remains the most important region for the development of network trade. It is from here that the main expansion of national networks is carried out, foreign networks began to work here for the first time, and new formats and technologies are tested here. Today in the capital there are about 60 food and 50 non-food retail chains of various sizes, over 70 shopping centers, more than half of which meet all modern requirements http://inpit.ru/.

St. Petersburg does not lag behind its fellow metropolis: the share of chain grocery stores in the structure of retail retail in it is more than 60% Lobanovsky A. Trading networks: who controls St. Petersburg // Delovoy Petersburg, 2010, No. 7.

As for the regions, according to RosBusinessConsulting analysts, despite the small number of chains so far, the development of food retail in them is faster than it once developed in Moscow and St. Petersburg. Experts explain this for a number of reasons: better business models; cheaper and longer loans; experience in the development of federal companies. This leads to the fact that the increase in the turnover of network trade in the regions is higher than in the capital cities, and the main growth is provided by companies operating in one or several regions of Russia. However, the pace of expansion of the trade "web" is constrained by a number of socio-economic and ethnic factors that are specific to individual regions of Russia and which make the national market extremely heterogeneous in terms of the level of urbanization of the population.

Therefore, in some parts of the country, the market remains discrete, while in cities small stores are quickly giving way to large-format retail, and the buying habits of citizens are becoming more and more “Western”. The trade expansion of chains has just begun, and, taking into account the vast geography of Russia, we can safely say that they have room to grow and where to improve Magomedova A. Retail chains conquer the regional market // Food Promotion. Prod & Prod, 2010, No. 2.