Basic methods of market analysis

Market sizing is one of the most common marketing research tasks. When talking about market size, marketers and marketing managers most often use the term "market capacity".

In marketing, there are two levels of market capacity: potential and real capacity.

Potential market capacity is the highest possible volume of sales in a market situation, when all potential consumers purchase based on the maximum possible level of consumption. Potential capacity in most cases is an unattainable (hypothetical) value, since not all potential consumers purchase goods, and those who purchase them have real financial limitations (limited solvency).

The real market capacity is estimated as the achievable actual volume of sales of the analyzed product (that is, the volume of effective demand for the product) under certain conditions. Most often, marketers are trying to determine the value of the real market capacity. The real market capacity, as a rule, is determined in a short retrospective, that is, for past periods of time (usually for the past year). In this case, the actual volume of consumption of goods or services is measured. Another option for assessing the real capacity of the market is to determine the forecast values of this indicator for a certain perspective (until the end of the current year, for a year, two, three years ahead).

It should be remembered that the longer the horizon for forecasting the real market capacity, the more inaccurate your forecasts will be. The main reason for this is the uncertainty of the future, the impossibility of accurately assessing the future value of the factors that determine the real capacity of the market. Another reason for the inaccuracy of forecasts is the vulnerability of most markets to the possibility of new factors that can cause both growth and contraction of the market.

For example, which ice cream manufacturer 10 years ago could have imagined that the volume of the Russian market for this sweet delicacy would fall to values significantly lower than in Soviet times? Currently, the average Russian eats 40% less ice cream than in 1985, and the purchasing power of Russians for this product is much higher than in Soviet times. In other words, the rate of consumption of ice cream by Russians has significantly decreased. What is it connected with? Mainly, with the action of the factor of species competition between snacks (ready-to-eat impulse purchase food products). Currently, if a person wants a quick and tasty snack, he can choose between hundreds of generic alternatives to such a purchase: nuts, chips, chocolate bars, ice cream, corn flakes, croutons, juice and much more, and generic competition in this market continues to grow. However, on the other hand, the main target group of ice cream consumers - teenagers and young people, who at one time provided up to 70% of ice cream consumption, began to consume this product significantly less for another reason: it is now considered not cool among young people to eat portioned ice cream on street. Walking down the street with a can of beer or a bottle of Coca-Cola is cool, but ice cream is not. At the same time, in Russia the consumption of ice cream is still associated mainly with the consumption of portioned ice cream on the street; The consumption of ice cream at home or in cafes is relatively low, and, accordingly, the demand for ice cream in large and industrial packaging is very low.

The effect of both factors could be predicted in time, just as it was possible to predict the reduction in the real market capacity, but for this it was necessary to constantly monitor the market. Unfortunately, not all Russian ice cream producers did this.

Why is it necessary to know the value of the real market capacity? By and large, the absolute values of the real market capacity in themselves do not have much value for marketing. But these values are necessary for the following reasons:

Drawing up forecasts of own sales and development of a sales plan. Very often, the reason for the failure to fulfill the sales plan is not the poor performance of the sales department, but bright forecasts for the future size of the market: the market began to slow down in its growth, and the marketing specialists of the enterprise did not notice this.

Determining your own market share and the market share of the main competitors, as well as tracking the dynamics of these indicators. The market share is one of the few indicators that objectively and often impartially reflect the real market position of the enterprise. Very often, company managers rest on their laurels, seeing an increase year and year in the company's sales and profit figures. However, in a situation where the growth rate of the market volume exceeds the growth rate of the company's sales, the latter gradually loses the market.

Evaluation of the commodity and geographical structure of the sales market. For example, if a company decides for itself the problem of choosing target geographic sales markets, then the company's marketers need to evaluate the contribution of individual regions to the total sales volume, that is, to the total capacity of the product market.

If the need to determine the real market capacity is more or less clear, then why does an enterprise need to know the potential market capacity? As a rule, this is due to the need to estimate the ceiling, that is, the upper limit for the growth of the market size, above which the market size will never grow. This is the task facing marketers in the strategic planning of marketing activities. For example, when assessing the prospects for entering a new market for an enterprise. Unfortunately, I have seen real examples of how Russian enterprises, without properly assessing either the real or potential market capacity, invested huge capital in the construction of enterprises whose production capabilities exceeded the potential capacity of the Russian market several times over for many years to come. Often this is a completely illiquid business, which is very difficult to sell without significant economic damage to the enterprise.

Potential market capacity is calculated for a certain period of time, usually for a year. An assessment of the potential market capacity is always based on marketing research, which boils down to the following algorithm of actions:

Step 1. Determining the number of potential consumers of a product or service. In this case, we are talking about determining the number of individuals, households or enterprises that:

- they are aware of the need (neediness) for this product (service) - they really need it;

- experience a moral and psychological readiness to acquire it under certain circumstances (for example, when the financial situation of the household improves).

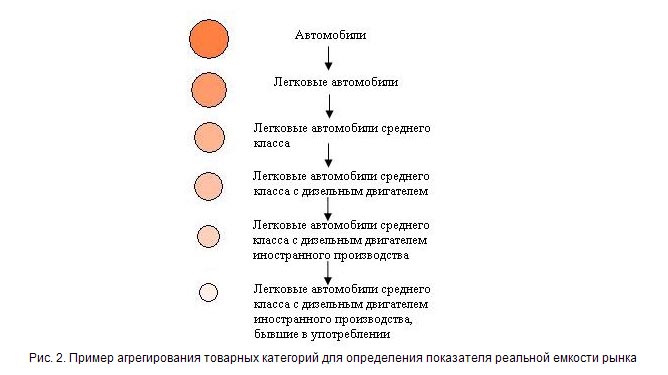

Step 2 Determination of the volumes of consumption of goods or services desired by potential consumers. The difference between potential and actual market capacity in marketing is called market potential (see Fig. 1).

This indicator reflects the backlog of the market, the degree of its residual attractiveness. It is very important to periodically assess the potential of the market in which the company operates. This gives marketing managers the opportunity to make timely strategic decisions about diversifying or even converting a business.

Consider an example. The victorious march of cellular communications across Russia in a few years will end with the fact that almost every adult Russian will have a mobile phone. Already, the penetration rate, that is, the provision of mobile communications for the adult population in capital cities, is approaching 90%, that is, the market has reached the level of rational consumption (saturation), and sales of mobile telephones are supported mainly by replacement sales. In this regard, large retail operators (Svyaznoy, Euroset), in order to maintain an acceptable level of sales, some time ago began to include additional categories of goods in their range: digital cameras, MP3 players, accessories and headsets for digital equipment, and more.

Unfortunately, a universal method for assessing the real capacity of the market has not yet been invented.

| Name of the seminar, training, course | Dec | Jan | Feb | Mar | Apr | May | Price, rub. |

| - | - | - | - | - |

17-18 |

28 200 | |

| - |

31-02 |

- | - | - | - | 34 600 |