The share of the top 10 players in Russian retail grew due to a slowdown in the market

The revenue growth rates of the largest Russian retailers continued to decline in 2016, but their market share increased. This happened due to the washing out of smaller networks and the reduction in the dynamics of the market as a whole.

Photo: Ekaterina Kuzmina / RBC

Growth through small

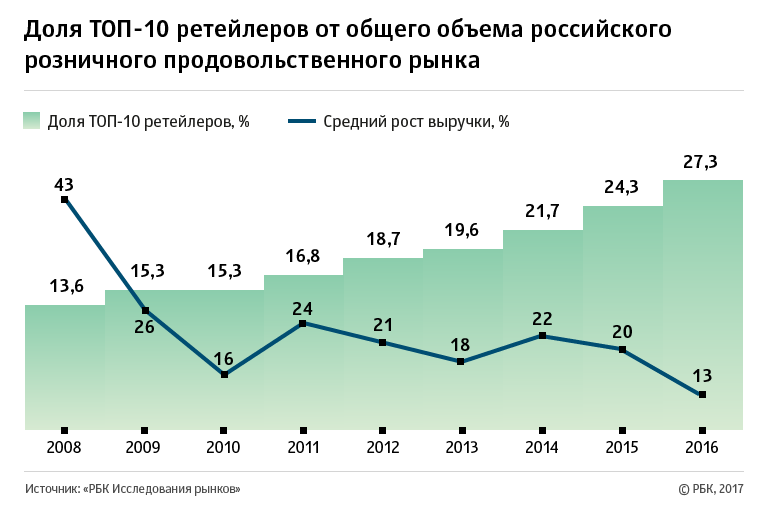

The share of the ten largest Russian grocery retail chains increased by 3 p.p. in 2016 compared to 2015. At the same time, the average growth of their revenue, on the contrary, decreased by 7 p.p. and amounted to 13%, follows RBC Market Research. Thus, the increase in the share of federal retailers is due not so much to their operational achievements, but to the washing out of smaller players and the slowdown in the market as a whole (according to the results of 2016, it added only 2.9%, and, taking into account inflation, decreased by 5.2%), summarize study authors.

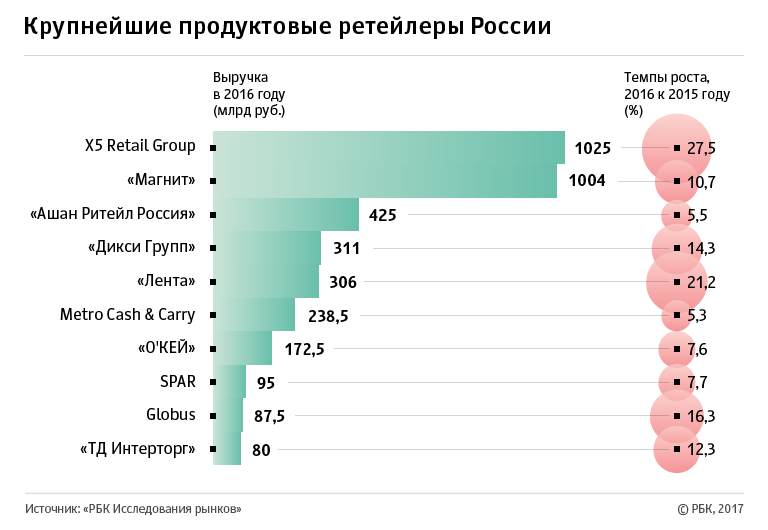

The dynamics of the average revenue of the largest retailers has been falling since 2014, while the growth of their share remains stable. In total, in 2016, the share of the top 10 chains reached 27.3% of the market, or RUB 3.7 trillion. At the same time, more than half of this amount fell on two companies - X5 Retail Group and Magnit. The volume of the entire food retail market amounted to 13.702 trillion rubles.

The share of small players has indeed been washed away in recent years and the growth of the entire market has slowed down, confirms Mikhail Burmistrov, general director of the INFOLine-Analytics agency. According to him, the largest players continue to grow due to lower prices: federal chains have an advantage in purchase volumes when negotiating with suppliers. Earlier, the authors of the study UBS Evidence Lab, that for 80% of Russians the determining factor when choosing a store is the price.

Change of leaders

The leader has changed in the top 10 largest retailers, according to RBC Market Research data. Excluding drogerie stores, Magnit lost its leadership to X5 Retail Group (manages the Pyaterochka, Perekrestok, and Karusel chains). The total revenue of Magnit in 2016 exceeded the threshold of 1 trillion rubles. But the annual turnover growth over the past 11 years, while the growth of X5 Retail Group, on the contrary, the entire history of the company. As a result, X5 Retail Group earned 1.026 trillion against 1.005 trillion rubles. at a competitor.

After the loss of leadership, Magnit revised its plans for the year in favor of a more aggressive strategy: the chain intends to open at least 2.75 thousand stores, of which about 1.7 thousand will be in the neighborhood format. In addition, it is planned to update the appearance of about 2,000 stores. The cumulative effect of the opening and renewal should increase the growth rate of Magnit's revenue to 12-15%, analysts at RBC Market Research predict. The main owner of Magnit, Sergei Galitsky, previously voiced a figure of 9-13%. In order to maintain leadership and reach the declared market share of 15% by 2020, X5 Retail Group will have to open about 2,000 stores in 2017. This is the same as last year, the study notes.

Changes may occur among retailers ranked fourth and fifth, respectively. Already in the first quarter of 2017, Dixy Group (manages the Dixy, Victoria and Megamart networks) may yield in revenue to Lenta, which has more ambitious development plans, analysts at RBC Market Research calculated. During the year, Dixy plans to open 180 stores, and Lenta - 80, but 30 of them will be hypermarkets, the researchers cite chain data. In total, Lenta intends to invest about 40 billion rubles in the opening of new outlets. and increase its retail space by 200,000 sq. m. m. The long-term strategy of the company until 2020 is to become one of the three largest grocery retailers in Russia. So far, the third place is traditionally occupied by Auchan, whose revenue in 2016 amounted to 425.2 billion rubles.