Accounting for car rental in 1C 8.3. Renting an employee's car without a crew - how to reflect it in accounting? Tax accounting for renting a car without a crew

In accordance with Art. 632 of the Civil Code of the Russian Federation, under a lease agreement for a vehicle with a crew, the lessor provides the lessee with a vehicle for a fee for temporary possession and use and provides its own services for its management and technical operation. The procedure, conditions and terms of payment of lease payments are determined by the lease agreement.

In this article, using a specific example, we will look in detail at what operations a tenant must perform to account for the rental of a vehicle with a crew in the 1C: Accounting 8 edition 3.0 program.

Let's look at an example.

The organization "Rassvet" applies the general tax regime - the accrual method and PBU 18/02 "Accounting for calculations of corporate income tax."

The organization rents a vehicle with a crew from its employee, who is not registered as an individual entrepreneur. The services provided under the contract are not part of the employee’s job responsibilities under the employment contract and are provided during non-working hours. In accordance with the lease agreement, the monthly fee is 50,000 rubles, including the rental fee for providing a car for temporary possession and use - 20,000 rubles, remuneration for the provision of services for driving the car and its technical operation - 30,000 rubles. Funds are transferred to the employee’s bank account monthly on the last day of the month based on a signed act. A rented car is used for the management needs of the organization.

In accordance with paragraphs 5 and 7 of PBU 10/99 “Expenses of the organization”, the organization’s costs associated with renting a car with a crew, which is used for management needs, in accounting are classified as expenses for ordinary activities and, accordingly, can be taken into account on account 26 “General business expenses”. These expenses are recognized monthly on the date of signing the act of providing the car for rent. For settlements under an agreement with a lessor who is an employee of an organization, the program can use account 76 “Settlements with other suppliers and contractors,” and more specifically, subaccount 76.10 “Other settlements with individuals.”

For profit tax purposes, rent paid under a lease agreement for a vehicle with a crew is included in other expenses associated with production and sales (clause 10, clause 1, article 264 of the Tax Code of the Russian Federation), and is recognized in the same way as in accounting for date of signing the act (clause 3, clause 7, article 272 of the Tax Code of the Russian Federation).

Now let's deal with personal income tax.

Income received by an individual from leasing property, as well as in the form of remuneration for services for the management and technical operation of a car, are subject to taxation and form the tax base for personal income tax (clauses 4, 6, clause 1, article 208, clause 1 Article 209 of the Tax Code of the Russian Federation).

An organization that pays income to an individual is recognized as a tax agent for personal income tax and is obliged to calculate, withhold from the individual and transfer to the budget the appropriate amount of tax (clauses 1, 2 of Article 226 of the Tax Code of the Russian Federation).

The personal income tax amount is calculated at the rate provided for in paragraph 1 of Art. 224 of the Tax Code of the Russian Federation (13%), as of the date of actual receipt of income, determined in this case in accordance with paragraphs. 1 clause 1 art. 223 of the Tax Code of the Russian Federation, as the day of payment of income (the day the payment under the lease agreement is transferred to the bank account of the lessor) (clause 3 of Article 226 of the Tax Code of the Russian Federation).

The calculated amount of personal income tax is withheld by the tax agent directly from the taxpayer’s income upon actual payment (Clause 4 of Article 226 of the Tax Code of the Russian Federation).

When paying income in non-cash form, the organization transfers to the budget the amount of calculated and withheld personal income tax no later than the day following the day of transfer of funds to the lessor's bank account (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Now let's see how such a payment is subject to insurance premiums.

Rent paid to an individual (lessor) for the temporary possession and use of a vehicle under a lease agreement for a vehicle with a crew is not subject to insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance (clause 4 of article 420 of the Tax Code of the Russian Federation). It is also not classified as an object of taxation with insurance premiums provided for in paragraph 1 of Art. 20.1 of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases.”

At the same time, remuneration to an individual for the provision of services for driving a car and its technical operation is subject to insurance contributions for compulsory pension insurance and compulsory medical insurance, but is not subject to insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (paragraph 1 clause 4 article 420, clause 2 clause 3 article 422 of the Tax Code of the Russian Federation). The remuneration is subject to insurance contributions for compulsory social insurance against industrial accidents and occupational diseases only if, in accordance with the concluded agreement, the tenant is obliged to pay insurance premiums to the insurer (clause 1 of Article 20.1 of Law No. 125-FZ). In the example we are considering, such a requirement is not specified in the lease agreement.

Insurance premiums accrued on the amount of remuneration are classified as expenses for ordinary activities in accounting and are recognized in the period of accrual of contributions.

Let's return to our example. To charge an employee (individual) rent and remuneration for the provision of services for driving a car and its technical operation, we will use the Operation document in the program. In the same document, you can also accrue (withhold) personal income tax and calculate insurance premiums. Insurance premiums are calculated only from the amount of remuneration for the provision of services for driving a car and its technical operation (30,000 rubles). Therefore, the personal income tax amount is 6,500 rubles. (50,000 rubles * 13%), the amount of the Pension Fund is 6,600 rubles. (RUB 30,000 * 22%), FFOMS amount - RUB 1,530. (RUB 30,000 * 5.1%).

The entries generated by the accountant in the Transaction document are shown in Fig. 1.

To pay rent and remuneration for the provision of services for driving a car and its technical operation in the program, you can use the document Write-off from a current account with the transaction type Transfer to an employee under a contract. The amount payable minus personal income tax is 43,600 rubles. (RUB 50,000 − RUB 6,500).

The document Write-off from the current account and the result of its execution are shown in Fig. 2.

Entries have been made for accounting and profit tax purposes. Further, the date of transfer of payment under the lease agreement to the landlord’s bank account must reflect the fact of calculation and withholding of personal income tax in the program in special registers for accounting for personal income tax. To do this, we need the document Personal Income Tax Accounting Transaction.

In the above document, in our case, three bookmarks are filled in.

First, on the Income tab, you must indicate that an employee of the organization has recognized income with code 2400 “Income from the use of any vehicles in connection with transportation ...” for the cost of rent (20,000 rubles) and recognized income with code 2010 “Payments under civil law contracts” for the amount of remuneration for the provision of services for driving a car and its technical operation (30,000 rubles).

Secondly, on the Calculated tab at 13% (30%), in addition to dividends, you must indicate the amount of calculated personal income tax for each type of income (2,600 rubles and 3,900 rubles, respectively).

Thirdly, on the Withheld for all rates tab, you must indicate the tax rate, the amount of personal income tax withheld, the deadline for transferring the tax to the budget and the amount of income paid for each income code.

An example of filling out the Personal Income Tax Accounting Transaction document is shown in Fig. 3.

When posted, the document does not generate any accounting entries. The document makes movements only in the personal income tax registers.

The Income Accounting register for calculating personal income tax will reflect the income amounts registered by us with codes 2400 and 2010.

In the register Calculations of taxpayers with the budget for personal income tax, entries with the type of movement “Incoming” show that personal income tax has been calculated. Records with the type of movement “Expense” show that personal income tax is withheld from the taxpayer’s income.

In the register Calculations of tax agents with the budget for personal income tax, the records generated by the document show that now the organization, as a tax agent, must pay the amounts of tax withheld from the income of an individual to the budget.

The result of the document Transaction of personal income tax accounting is shown in Fig. 4.

Now it’s time to reflect the fact of accrual of insurance premiums in the special registers of the program. To do this, we need the Contribution Accounting Transaction document.

In the above document, in our case, we will have to fill out two bookmarks.

On the Calculated contributions tab, you must indicate the amounts of calculated and accrued insurance contributions for compulsory pension insurance (RUB 6,600) and compulsory medical insurance (RUB 1,500).

On the Income information tab, you must indicate the type of income - Civil contracts and the amount of income - 20,000 rubles.

When carried out, the document will generate entries in the registers for accounting for insurance premiums: Calculated insurance premiums, Insurance premiums for individuals and Income accounting for calculating insurance premiums.

An example of filling out the document Contribution accounting operation and the result of its implementation are presented in Fig. 5.

In accordance with the law, when paying income in non-cash form, the organization transfers to the budget the amount of calculated and withheld personal income tax no later than the day following the day the funds are transferred to the lessor's bank account.

To reflect in the program the operation of transferring a tax amount to the budget, we will use the document Write-off from a current account with the transaction type Tax payment.

When carrying out, in addition to the accounting entries for the debit of account 68.01 and the credit of account 51, the document will make movements in the registers for personal income tax accounting.

In the register Payment of personal income tax by tax agents (for distribution), the amount of personal income tax paid to the budget will be registered (income) and immediately written off (expense). This means that the transferred amount of tax is fully paid for a specific individual - for the lessor.

In the register Calculations of taxpayers with the budget for personal income tax, a record will be created with the type of movement “Expense”, which means that personal income tax for an individual (lessor) is transferred to the budget.

The document Write-off from the current account and the result of its execution are shown in Fig. 6.

Now all that remains is to check the result of our actions. First, let's create a tax accounting register for personal income tax for one employee we are interested in.

From this register we see that the employee’s income in the amount of 30,000 rubles was registered in January. with code 2010 and income in the amount of 20,000 rubles. with code 2400. Accordingly, the taxable amount of income is 50,000 rubles, the accrual tax is 6,500 rubles.

On January 31, 2018, the tax amount was calculated and withheld from the taxpayer’s income. The next day, in accordance with the law, the tax amount is transferred to the budget. Everything we saw fully corresponds to the example we completed.

A fragment of the Personal Income Tax Register for an employee leasing a vehicle with a crew is presented in Fig. 7.

To be completely sure, let’s create a 6-NDFL declaration for the first quarter of 2018 and see what we got there.

The amount of income actually received is 50,000 rubles, the amount of tax withheld is 6,500 rubles.

The date of actual receipt of income and the date of tax withholding is 01/31/2018, the deadline for transferring tax is 02/01/2018.

Let's see what we have achieved in the program with insurance premiums. To do this, we will generate a declaration Calculation of insurance premiums. Section 1 of this calculation is presented in Fig. 9.

And finally, let’s check how the program generates a 2-NDFL certificate.

The certificate issued to the employee is generated in the program using a document of the same name.

In the header of the document, the tax period is indicated and a specific employee is selected.

The table part is filled in automatically using the “Fill” button. As we can see, the employee received income in the amount of 50,000 rubles in January. From this income, NDL was calculated and withheld in the amount of 6,500 rubles. Personal income tax was fully transferred to the budget.

Document 2-NDFL for employees is shown in Fig. 10.

All the checks we performed showed that we performed this operation correctly in the 1C: Accounting 8 edition 3.0 program.

Liked? Share with your friends

Consultations on working with the 1C program

The service is open specifically for clients working with the 1C program of various configurations or who are under information and technical support (ITS). Ask your question and we will be happy to answer it! A prerequisite for obtaining consultation is the presence of a valid ITS Prof. agreement. The exception is the Basic versions of PP 1C (version 8). For them, a contract is not necessary.

Vehicle rental can be provided in two options: with or without a crew. Accounting for both the tenant and the lessor, if the latter is a legal entity, depends on these two factors. Most often, temporary use of transport is provided by company employees.

Providing a vehicle for rent with a crew is a transfer of transport for temporary use, in which the responsibilities for management and maintenance in good condition (on the move, not requiring repairs) are assigned to the owner.

When renting without a crew, the vehicle is handed over to the lessor, he bears full responsibility for its safety and bears the costs of its operation.

Lease – accounting with the tenant

When an organization rents a vehicle, a fee for its temporary use is charged:

- on the debit of account 20 (,44...) and credit 60 (73, 76).

If the lessor is a legal entity or individual entrepreneur applying the basic taxation regime, then VAT can be deducted on issued invoices.

When a vehicle is taken for temporary use from an individual, including an employee, the organization must withhold income tax from the payment amount, and transfer it to the budget on the day the rental is paid.

If costs arise for maintenance (repair) and operation (fuels and lubricants) of the vehicle (when renting without a crew), they are taken into account in the general manner and written off as expenses.

The rented vehicle is accounted for in accounting on account 001. The amount that needs to be reflected is equal to that specified in the lease agreement.

Rental example:

The organization rented a car (cost 370,000 rubles) from its employee. The fee for using a vehicle is 7,000 rubles. A bareboat lease agreement was concluded with the employee. The car is used by the company's management. Costs for fuel and lubricants amounted to 522 rubles. (VAT 9690 rub.).

Postings:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 001 | The car has been registered | 370 000 | Acceptance/transfer certificate Lease agreement | |

| 73 | Rent accrued | 7000 | Accounting information | |

| 73 | 68 personal income tax | Personal income tax accrued on employee income received as rent | 910 | Accounting information |

| 73 | 50 | The amount of payment for vehicle rental was issued from the cash register | 6090 | Account cash warrant |

| 10 | 60 | Accepted for fuel and lubricants accounting | 53 832 | Packing list |

| 19 | 60 | VAT on fuel and lubricants included | 9560 | Packing list |

| 68 VAT | 19 | VAT is accepted for deduction | 9560 | Invoice |

| 10 | Decommissioned fuel and lubricants | 53 832 | Waybill | |

| 90 | Costs for renting a car and fuel are included in expenses | 60 832 | Accounting information | |

| 001 | At the end of the rental period, the car is returned to the owner | 370 000 | Act of Handover |

Rent – accounting with the lessor

If for an organization the provision of a vehicle for rent is the main activity, then such an operation is reflected as the sale of:

- Debit 62 Credit 90.1.1.

In other cases, money received from renting vehicles is included in non-operating income:

- Debit 62 Credit 91.1.

Our company is going to enter into a bareboat rental agreement with an employee who has a personal car. What documents, besides the contract, must be drawn up? How can an organization account for expenses?

Tax accounting

According to the regulatory authorities (letter of the Ministry of Finance of Russia dated October 6, 2008 No. 03-03-06/1/559, Federal Tax Service of Russia for Moscow dated April 30, 2008 No. 20-12/041966.1), to confirm expenses in the form of rent under the contract Renting a vehicle (vehicle) is necessary, including:

- act of acceptance and transfer of leased property,

- other documents confirming the use of the rented vehicle in the production activities of the lessee organization.

Such documents, in particular, include an order from the head of the organization to assign the rented vehicle to employees and applications for the use of the rented car. Copies of waybills must also be attached to these documents, which will allow you to determine the regularity and time of use, as well as the route of the rented vehicles.

Expenses for fuels and lubricants (fuels and lubricants) and vehicle repairs incurred by your organization during the operation of a rented vehicle are confirmed by documents on the purchase and consumption of fuel and on repair work.

Documents confirming the purchase of fuel and lubricants are payment documents for payment for fuel (for example, cash receipts). The amount of fuel consumed is confirmed by waybills.

Documents confirming the costs of repairing a vehicle are, for example, certificates of repair work performed (there is no unified form of the report, so the executor can draw up a report in any form in compliance with the requirements for the necessary details established by Part 2 of Article 9 of the Federal Law of 06.12. 2011 No. 402-FZ “On Accounting”).

When renting a car without a crew, your renting organization does not have:

- VAT calculations related to this operation;

- any tax consequences regarding payment of income tax;

- obligations to pay property tax (since the property (car) received by your tenant organization under a lease agreement remains the property of the lessor);

- obligations to pay transport tax (since the car is registered in the name of the lessor (Article 357 of the Tax Code of the Russian Federation), and if your organization registers the car temporarily with the State Traffic Safety Inspectorate, the payer of the transport tax will still be the lessor (letter from the Ministry of Finance of Russia dated 04.03 .2011 No. 03-05-05-04/04)).

When renting a car from an individual who is not an entrepreneur, your tenant organization acts as a tax agent (clause 2 of Article 226 of the Tax Code of the Russian Federation) and must withhold personal income tax from the rental amount at a rate of 13% and transfer the withheld tax amount to the budget at the place of registration of your organization-tenant with the tax authority no later than the day of actual receipt of money from the bank for payment of rent or the day of its transfer to the account of an individual (clauses 4 and 6 of Article 226 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated 01.06.2011 No. 03-04-06/3-127, dated December 6, 2010 No. 03-04-06/3-290 and dated August 16, 2010 No. 03-04-05/3-462).

Insurance premiums

The amount of rent paid to an individual for the use of a car is not subject to insurance contributions to extra-budgetary funds (Part 3 of Article 7 of Federal Law No. 212-FZ dated July 24, 2009, letter of the Ministry of Health and Social Development of Russia dated March 12, 2010 No. 550-19).

Contributions for accident insurance from the rent are paid only if such an obligation is established by the lease agreement (clause 1, article 5, clause 1, article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ).

Accounting

In the accounting records of the tenant organization, entries are generated (Instructions for the use of the Chart of Accounts for accounting of financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n):

Debit 001- the rented car is reflected on the balance sheet;

Debit 20 (26, 44 or other cost account) Credit 73 (76)- rent accrued;

Debit 20 (26, 44 or other cost account) Credit 60 (76)- car maintenance costs are taken into account;

Debit 19 Credit 60 (76)- the amount of VAT claimed by counterparties in relation to vehicle expenses is taken into account;

Debit 68 Credit 19- the amount of VAT presented by counterparties regarding expenses for the car is accepted for deduction;

Debit 73 (76) Credit 68.01- personal income tax is withheld from the amount of rent accrued to the lessor;

Debit 73 (76) Credit 51- rent has been paid minus the withheld personal income tax.

The most complete information on the procedure for concluding a lease agreement for a vehicle without a crew, and on the tax consequences that arise for the parties to the agreement, can be found in the reference book “Agreements: conditions, forms, taxes” in the “Legal support” section in IS 1C:ITS.

The 1C:ITS information system is updated every day and contains ready-made advice on accounting, tax and personnel records. It is quite possible that the answers to the specific practical questions that you are currently looking for are already in the “Auditor Answers” section of the 1C:ITS Information System.

On the Internet I have seen advice to enter into a civil law contract for an individual who is not an employee, but I believe that this method is incorrect, because the program will automatically charge this individual insurance premiums to the Pension Fund and the Compulsory Medical Insurance Fund, which is incorrect. It is more correct to introduce the calculation and withholding of personal income tax using the document “Adjustment of accounting for personal income tax, insurance premiums and unified social tax.” In order to open the list of documents, you must select the menu item “Payroll calculation by organizations” - “Taxes and contributions” - “Adjustment of accounting for personal income tax, insurance contributions and unified social tax”. Another way to enter this document is through the general journal of documents for accounting for personal income tax and insurance premiums.

Car rental in 1s 8.3

Sometimes the tax agent uses code 4800 “Other income,” but this may raise questions among tax authorities. Enter the amount of income and go to the “Personal Income Tax at a rate of 13%” tab.

Here you need to select an employee in the “Tax Calculated” tabular section and manually enter the calculated tax amount. Go to the “Personal Tax Withheld” tab. For the document “Adjustment of accounting for personal income tax, insurance premiums and unified social tax”, the established settings for the parameters of salary calculation are not valid, and even if the flag “When calculating personal income tax, accept the calculated tax as withheld” is checked, they do not apply to this document - this is a document for input manual corrections.

Therefore, on the “NDFL withheld” tab, we manually enter the tax rate and the withheld amount. We post the document and close it. 2. Transfer of personal income tax to the budget.

Now it is necessary to reflect the payment of personal income tax to the budget.

1c lessons for beginners and practicing accountants

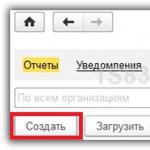

In order to reflect in the program the payment to an employee of an organization for renting a car, we will use the document “Accrual of other income”. This document becomes available after we enable the checkbox “Other income of individuals not related to wages is registered” in the “Settings” - Payroll section.

Attention

Next, go to the “Payments” section - “Non-salary income” - create “Accrual of other income”. In the document we set the type of income “Transport rental”, the income code for personal income tax 2400 is entered automatically.

In the tabular section, select the employee/individual and the accrued amount. As you know, there are no postings in ZUP 3.1. The reflection method, which is specified in the “Account, subconto” field, is responsible for the formation of transactions in the Accounting program.

But the reflection method allows you to select only a debit account.

Renting premises in 1C 8 “accounting” edition 3.0

In the program “1C: Salaries and Personnel Management 8” version 3.0, how can you charge third-party individuals the cost of car rental and take this income into account for personal income tax purposes? The video was made in the program “1C: Salaries and Personnel Management 8” release 3.0.23.128. In the 1C: Salary and Personnel Management 8 program, edition 3.0, the ability to charge car rental payments to third-party individuals should be enabled in the Settings menu - Payroll calculation - checkbox Other income of individuals not related to wages is registered. When the flag is checked, the Other Income item is active in the Salary menu. The document must indicate the type of income. The Personal Income Tax Code and Insurance Contributions fields are filled in automatically in accordance with the Types of Other Income of Individuals directory.

In the list part of the document, you must indicate the Recipients of income on the appointed payment day.

Zup 8.3 payment of vehicle rental

Info

If necessary, you should also indicate the separate unit from which the transfer was made.

- Next, you should fill out the deductions tab. It also needs to reflect the date of receipt of income, the personal income tax rate (it is 13%, and if the employee is not a resident, then 30%), the amount of tax paid.

The date of transfer of the withheld amount must be no later than the next day after the rent was transferred. The revenue code is 1400, since they are received from the provision of property for rent. If necessary, you should indicate a branch or representative office if the payment was made from its accounts.

Reflection of personal income tax on rental income in 1c accounting

You can find it either through the main menu, the item “Payroll calculation by organizations” - “Taxes and contributions” - “Journal of personal income tax and unified social tax accounting documents”, or on the desktop, “Taxes” tab, link “Journal of personal income tax and insurance contributions accounting documents” to the Pension Fund, Social Insurance Fund, and Compulsory Medical Insurance Fund.” We enter a new document. On the “Personal Income Tax: Income and Taxes” tab, add a new line.

The employee is selected from the “Individuals” directory, and this means that we may not hire him. The “Individuals” directory in the Salary and Personnel Management program stores all individuals with whom the organization has ever had relationships, including those who have never been its employees (for example, job candidates).

We also enter an individual there - the tenant, if he is not an employee. If the landlord is an employee of an organization, then we find him in the “Individuals” directory and select him.

An enterprise, being a legal entity, can have contractual relations with both legal entities and individuals. In particular, renting premises, equipment or vehicles. Renting an employee’s car in 1C is reflected as a planned accrual, which is subject to personal income tax only (if the vehicle is rented without a crew).

To pay a car rental to an employee in 1C, you need to conclude a lease agreement, capitalize the car, calculate the rent and withhold personal income tax. The contract is concluded only with the owner of the vehicle. The contract specifies the procedure and terms of payment, and the terms may also contain clauses on compensation for fuel and lubricants, the procedure for obtaining insurance, payments for depreciation and other details. Another important document is the vehicle acceptance certificate.

In order to correctly calculate rent for a car in 1C, you need to create the document “Entering information about planned accruals for employees of the organization.” The employee is selected from the directory and the “Car Rental” accrual is indicated:

The rental of an employee’s car in 1C 8 3 is reflected through the organization’s main accruals with the creation of the “Car rental” calculation type:

Select the method of reflecting expenses in accounting and tax accounting:

If this method of reflecting expenses for renting a car from an employee in 1C 8 3 has not been created in advance, it must be added indicating the accounts and subaccounts:

Insurance premiums are not charged from the rent; this must be reflected on the appropriate tab:

After entering information about the organization’s accruals, you can accrue car rental in 1C 8 3 through the “Payroll” document. In the tabular section, use the “Add” button to enter an employee. The accrual is made for renting a car in a fixed amount:

The accrual of car rental in 1C 8 3 is reflected in regulated accounting:

Payment can be made according to the statement:

On its basis, a RKO is created:

Renting an employee’s car in 1C 8 2 is done in a similar way.

If the owner of the vehicle is not an employee of the organization, then renting a car of an individual in 1C 8 3 requires an entry in the directory of counterparties of this individual. At the same time, personal income tax is also withheld from rental payments.

Accrual of car rental in 1C 8 3 ZUP is made through the accrual of other income that is not wages. Thus, accruals are established in accordance with the data from the directory “Types of other income of individuals,” where the necessary type of income is created. Personal income tax is calculated and withheld automatically, the data is included in the 2-NDFL certificate for the employee. The car rental agreement in 1C ZUP is also registered in the program for making payments.